Ever wonder who’s behind the magic powering your iPhone or MacBook? It’s a complex story, but the short answer for who makes Apple’s chips, especially their cutting-edge A-series and M-series processors, is Taiwan Semiconductor Manufacturing Company, or TSMC. This partnership has been a huge deal for both companies, shaping the tech landscape. But things are starting to shift, and it’s worth taking a look at how this all works and what might happen next.

Key Takeaways

- TSMC is the primary manufacturer of Apple’s custom-designed chips, a relationship that has driven innovation and growth for both companies.

- Apple’s significant investment and early adoption of TSMC’s advanced manufacturing nodes have been crucial for TSMC’s development and dominance.

- Advanced packaging techniques, like TSMC’s InFO, are vital for Apple’s device designs, enabling thinner and more powerful products.

- The rise of AI demand is changing the chip manufacturing landscape, creating new priorities for TSMC and potentially shifting power dynamics with customers like Apple and NVIDIA.

- While TSMC remains Apple’s main chip partner, Apple is exploring diversification strategies with potential alternatives like Intel and Samsung for certain components to mitigate supply chain risks.

Understanding Who Makes Apple’s Chips: The TSMC Partnership

The Genesis of Apple’s Chip Design Ambitions

It’s easy to forget that Apple didn’t always design its own chips. Back in the day, they relied on others. But around 2010, Apple started getting serious about custom silicon. They bought a small company called Intrinsity, which was really good at making low-power chips. This was the first big step towards what we see today with their A-series and M-series processors. The goal was clear: more control over performance and features, especially for the iPhone. They wanted chips that were fast, efficient, and unique to their devices. This internal design capability became a huge advantage.

TSMC’s Pivotal Role in Apple’s Silicon Journey

So, Apple designs the chips, but who actually makes them? For the most part, it’s Taiwan Semiconductor Manufacturing Company, or TSMC. This partnership is pretty massive. Back in 2013, TSMC made a huge gamble, investing billions in new manufacturing capacity specifically for Apple’s upcoming 20-nanometer chips. This bet paid off big time. Apple’s A8 chip, released in 2014, was the first major chip made by TSMC for Apple, and it kicked off a decade-long relationship. Without Apple’s massive orders, TSMC might not have been able to invest as heavily in the latest manufacturing technologies, which is why many see Apple as a key player in TSMC’s rise to dominance. It’s a relationship that has really shaped the entire semiconductor industry.

The ‘Anchor Tenant’ Relationship: Funding Innovation

Think of Apple as the main tenant in a giant apartment building. TSMC builds these incredibly complex and expensive factories, and Apple’s consistent, huge orders help pay for them. This arrangement, often called the ‘anchor tenant’ relationship, is how TSMC could afford to constantly upgrade its technology. Apple’s demand for the newest, fastest chips meant TSMC had to push the boundaries of what was possible in chip manufacturing. This allowed TSMC to fund the research and development needed for each new generation of smaller, more powerful chips, like their 3nm process. This steady stream of business from Apple de-risked TSMC’s massive investments in new fabs, allowing them to stay ahead of competitors like Intel, who were also trying to get into the foundry business. You can see this effect when looking at Intel’s new chip fabrication plant in Arizona; they are trying to attract similar anchor customers.

TSMC’s Manufacturing Prowess and Apple’s Dependence

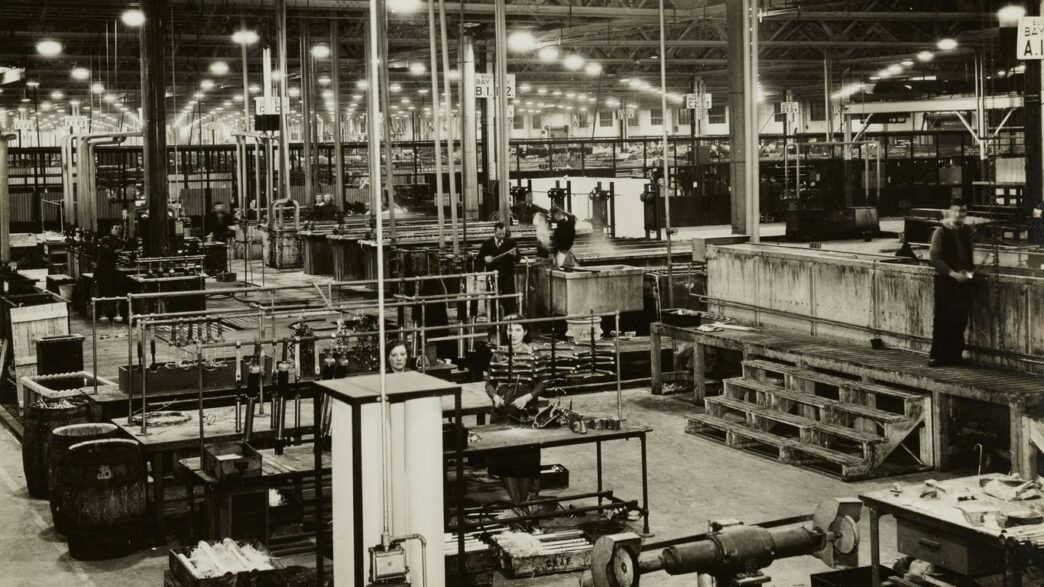

The GigaFab Network: Where Apple’s Silicon is Born

When we talk about Apple’s chips, it’s easy to get caught up in the design side, the clever engineering that goes into making the A-series and M-series processors. But the real magic, the part that makes it all possible, happens in TSMC’s massive factories, or ‘GigaFabs’. These aren’t just any factories; they are the most advanced chip-making facilities on the planet. TSMC operates a sprawling network of these GigaFabs, primarily located in Taiwan, each one a marvel of engineering and precision. Think of them as the engine rooms of the modern digital world, churning out billions of tiny silicon wonders every year. For Apple, this means nearly all of its cutting-edge processors, the brains behind iPhones, iPads, and Macs, are born within these highly specialized Taiwanese facilities. It’s a concentration of manufacturing that’s both impressive and, as we’ll see, carries its own set of risks.

Fab 18: The Heart of Leading-Edge Production

Within TSMC’s network, Fab 18 in Tainan, Taiwan, holds a special place, especially for Apple. This facility is essentially the ground zero for TSMC’s most advanced manufacturing processes. It’s where the latest and greatest chips are brought to life, including Apple’s A19 Pro, A18 Pro, and the M3, M4, and M5 series processors, all produced on TSMC’s 3-nanometer lines. This concentration of Apple’s most critical silicon production in a single location underscores the deep integration between the two companies. It’s a testament to TSMC’s ability to handle the immense scale and complexity required for Apple’s product cycles, but it also highlights a significant point of dependency.

Geographic Concentration: Risks and Realities

Now, let’s talk about the elephant in the room: geography. Almost all of Apple’s leading-edge chip production, from the A-series to the M-series, happens on the island of Taiwan. This geographic concentration, while incredibly efficient for production, presents a notable risk. Taiwan sits just about 100 miles off the coast of mainland China, a fact that can’t be ignored in today’s geopolitical climate. While TSMC is making efforts to diversify, like its facility in Arizona, these are still in early stages and won’t significantly reduce the reliance on Taiwan for leading-edge production for several years. This single-island dependency means that any disruption, whether it’s natural or man-made, could have a massive impact on Apple’s ability to produce its most important products. It’s a reality that both companies are acutely aware of as they plan for the future. The partnership has been incredibly fruitful, driving innovation and growth for both companies, but this deep reliance on a single geographic area is a complex challenge to manage. Apple’s reliance on TSMC’s advanced packaging, like InFO for thinner devices, has been a key part of this integrated manufacturing strategy.

Advanced Packaging: A Key Differentiator for Apple

Integrated Fan-Out (InFO) for Thinner Devices

So, we’ve talked a lot about the actual chips, the brains of the operation, but how they’re put together matters a ton too. For Apple, this is where advanced packaging comes in, and it’s been a pretty big deal for them. Think about how thin iPhones are. A lot of that slimness is thanks to a specific packaging tech called InFO, which stands for Integrated Fan-Out. Basically, it lets them stack memory chips right on top of the main processor chip. This saves a lot of space compared to older methods where chips were placed side-by-side. It’s not just about making things smaller, though; this stacking also helps with heat, which is always a problem when you’re cramming a lot of power into a small space.

The Evolution of Packaging Technologies

Apple was actually one of the first big customers to really push TSMC on this advanced packaging stuff. Their InFO technology has grown quite a bit, with revenues going from under $2 billion a few years back to over $3.5 billion recently. This growth is pretty much all thanks to their A-series and M-series chips powering iPhones, iPads, and Macs. It’s a clear example of how Apple’s needs drive innovation in the manufacturing process. They needed thinner phones, and TSMC helped them get there with InFO.

Competition for Advanced Packaging Resources

Now, here’s where things get interesting. While Apple has been a long-time leader in InFO, other companies, especially those making AI chips like NVIDIA, are using different packaging methods. NVIDIA, for instance, uses something called CoWoS, which is great for putting lots of memory right next to the graphics processor for maximum speed. For a while, Apple and NVIDIA weren’t really competing for the same packaging lines. Apple was all about InFO, and NVIDIA was focused on CoWoS. But as Apple starts making even more complex chips, like their future M-series Ultra models, they’re going to need more of the same advanced 3D packaging resources that NVIDIA is using. This means they might start bumping heads for capacity down the line, which could change how TSMC plans its manufacturing.

Here’s a quick look at how the packaging landscape has shifted:

| Technology | Primary User | Key Benefit |

|---|---|---|

| InFO (Integrated Fan-Out) | Apple | Device Thinness, Thermal Management |

| CoWoS (Chip-on-Wafer-on-Substrate) | NVIDIA, AMD | High Bandwidth Memory Integration |

| SoIC (System on Integrated Chips) | Emerging for Apple/Others | Advanced 3D stacking, higher density |

This competition for advanced packaging is a big deal. It’s not just about making chips smaller anymore; it’s about how you connect them and manage power and heat in increasingly complex ways. And as more companies need these cutting-edge packaging solutions, TSMC has to figure out how to keep everyone happy, which isn’t easy.

The Shifting Power Dynamic in Chip Manufacturing

It feels like for ages, Apple was the undisputed king of the chip world, at least when it came to getting the absolute latest and greatest from TSMC. They were the "anchor tenant," basically paying for TSMC to build out all this cutting-edge tech, and in return, they got first dibs. But things are changing, and it’s not just Apple calling the shots anymore.

From Unipolar to Bipolar: Apple and the Rise of AI Demand

For a long time, Apple was pretty much the only game in town for TSMC’s most advanced manufacturing processes. They’d order the latest A-series and M-series chips, and TSMC would build the fabs to make them happen. This gave Apple a lot of influence, but it also meant their entire high-end chip production was tied to one supplier on one island. Now, though, there’s this massive surge in demand for AI chips. Companies like NVIDIA are ordering chips that, while maybe not the absolute bleeding edge in terms of logic nodes, require incredibly complex packaging. This has created a whole new dynamic.

NVIDIA’s Growing Influence on TSMC’s Capacity

Think about it: Apple needs advanced logic wafers and specific packaging like InFO for thin devices. NVIDIA, on the other hand, needs advanced logic wafers but is heavily reliant on TSMC’s CoWoS packaging for AI accelerators. CoWoS packaging revenue has actually blown past InFO, largely thanks to NVIDIA and AMD. This means TSMC’s investment decisions aren’t just about making the next generation of iPhone chips anymore. They’re also about building out massive capacity for AI-focused packaging.

The Bifurcation of TSMC’s Capacity Planning

So, TSMC’s capacity planning is now split. They’re still investing in the next nanometer nodes, which Apple benefits from, but a huge chunk of their capital expenditure is going into advanced packaging like CoWoS. It’s like they have two major forces pulling their resources: Apple pushing the boundaries of Moore’s Law, and the AI boom pushing the boundaries of chip packaging. This "bipolar" situation means Apple isn’t the sole driver of TSMC’s massive investments anymore. They’re still a huge customer, no doubt, but they now share the stage with the insatiable appetite of the AI industry.

Exploring Alternatives and Diversification Strategies

So, Apple’s been pretty much glued to TSMC for its most important chips, like the A-series for iPhones and M-series for Macs. It’s a relationship built on trust and, let’s be honest, TSMC’s unmatched ability to make the absolute cutting edge of silicon. But, you know, relying on just one supplier, even a great one, can be a bit risky. What if something goes wrong? What if demand just explodes in a way no one predicted? Apple’s been quietly looking around.

Intel’s 18A-P Process: A Potential Alternative

Intel’s been trying to get back in the game, and they’ve got this new process called 18A-P. It’s supposed to be pretty good, maybe not quite TSMC’s absolute best, but close enough for some things. Think about it: if Apple could shift even a portion of its less critical chips, like maybe the base M-series chips for MacBooks, over to Intel, it would be a huge win for Intel and a nice bit of insurance for Apple. It’s not about moving the iPhone’s brain over there, but more about spreading the load for chips where the absolute bleeding edge isn’t the only factor. Intel’s also got fabs in the US, which could be a plus for Apple’s own manufacturing goals.

Re-engagement with Samsung for Specific Components

Remember when Apple used Samsung for some chips and then switched? Well, they’re actually working together again, but not for the main processors. Apple’s now getting advanced image sensors for iPhones made by Samsung, specifically at their US facilities. This is a smart move. It helps Apple diversify its supply chain for these camera components and also aligns with any internal goals about manufacturing in America. It’s a way to get more options without putting the core iPhone performance at risk.

Diversifying Beyond Leading-Edge A-Series and M-Series

Apple’s real diversification play isn’t about ditching TSMC for its flagship chips. That’s a whole different ballgame with massive technical hurdles and costs. Instead, they’re looking at other areas. This includes things like power management chips (PMICs), display drivers, and audio components. These are important, sure, but they don’t require the absolute latest, most expensive manufacturing process. By using other foundries for these parts, Apple can reduce its reliance on TSMC for everything, gain more flexibility, and potentially even save some money. It’s a strategic move to build resilience across their entire product ecosystem, not just the headline-grabbing processors.

The Complexities of Modern Silicon Manufacturing

Challenges at the Nanometer Frontier

The race to make smaller, faster chips pushes physics to its limits. These days, manufacturing sits around 2 nanometers, and every advance means wrangling new problems:

- Quantum tunneling and leakage—what worked at 7nm doesn’t at 2nm, so electrons sneak where they shouldn’t.

- Patterning so fine that manufacturers need exotic tools like extreme ultraviolet (EUV) lithography. It’s literally shining a special kind of light to draw impossibly tiny features!

- New chip designs, like 3D stacking and chiplets, to keep boosting performance when just shrinking everything isn’t enough.

- Heat that’s off the charts—the hottest chips can burn through over 700 watts, so cooling is a whole separate headache.

- Supply chain is fragile; a batch contaminated in any of the 700+ processing steps can ruin months of work.

The Art and Science of Chip Fabrication

Building a chip isn’t just science—it’s part puzzle, part marathon. Here’s what it really takes:

- Raw materials, like ultra-pure silicon, are sliced into wafers.

- Each wafer goes through hundreds of steps including etching, layering, and baking.

- Dozens of different chemical and physical processes must line up perfectly. A tiny hiccup causes massive losses.

- Precision machinery, including EUV lithography tools, cost more than a commercial jet.

- Tight quality checks—yield (good chips per wafer) is everything, since every chip gone wrong is money out the window.

It’s fair to call a modern chip wafer the most complicated thing humans make.

Why Replicating TSMC’s Position is So Difficult

On paper, building a chip factory just means more cash and staff, right? Not even close. Here’s why TSMC is king of the mountain:

- A top-tier fab costs $20 to $40 billion to build and equip. That’s before you even start making chips.

- You need a huge team with skills that, honestly, take decades for most companies to build up.

- Years of fine-tuning are needed to perfect yields. Companies like Samsung and Intel still haven’t caught TSMC on the most advanced nodes.

- TSMC’s supply chain is a fortress—it took decades of trust with suppliers, customers, and talent to reach this level.

| Company | Advanced Node Share (%) | Recent Major Node |

|---|---|---|

| TSMC | 70 | 3 nm |

| Samsung | 15 | 3 nm |

| Intel | 5 | 7 nm |

| GlobalFoundries | <5 | 12 nm+ |

Even government efforts—like the US CHIPS Act—still can’t buy the experience and hidden know-how that make TSMC unique.

In summary: manufacturing leading-edge chips isn’t just a money game or a checklist. It’s a feat of experience, coordination, and patience that few have pulled off, and even fewer can match at the highest level.

Looking Ahead: The Evolving Chip Landscape

So, where does this all leave us? Apple and TSMC have built something pretty incredible together, basically powering the devices we use every single day. But the world of chips isn’t standing still. With AI booming and other companies like Intel trying to get back in the game, things are getting more complicated. Apple is smart to look around for other options, even if TSMC remains their main partner for now. It’s a complex dance of technology, business, and even global politics, and it’s going to be fascinating to see how it all plays out for the future of silicon.

Frequently Asked Questions

Who actually makes the chips for Apple’s iPhones and Macs?

Apple designs its own chips, like the A-series for iPhones and M-series for Macs, but they don’t build them. The company that actually manufactures these advanced chips is a Taiwanese company called TSMC (Taiwan Semiconductor Manufacturing Company). Think of Apple as the architect and TSMC as the builder.

Why does Apple rely so much on TSMC?

TSMC is the world’s leading chip manufacturer, especially for the most advanced chips. They have the most cutting-edge technology and the biggest factories, called ‘fabs.’ Apple needs this advanced tech to make its powerful and energy-efficient chips. For years, Apple has been TSMC’s biggest customer, helping them fund new factories and technologies.

Are Apple’s chips made in the USA?

For a long time, almost all of Apple’s advanced chips were made in Taiwan. Recently, Apple has started working with TSMC to build a factory in Arizona, USA. However, this factory is still getting started, and it will take time before it produces the most advanced chips in large quantities. Most of Apple’s chips are still made in Taiwan.

Could Apple use other companies like Samsung or Intel to make its chips?

Apple used Samsung in the past but moved most production to TSMC because TSMC offered better technology. Intel is also trying to become a major chip maker again and is developing new processes that Apple might consider for some chips in the future. However, switching suppliers for the most important chips is difficult and takes a lot of time and testing.

What is ‘advanced packaging’ and why is it important for Apple?

Advanced packaging is like putting the chip components together in a very smart and compact way. For iPhones, Apple uses a special method called InFO (Integrated Fan-Out) to stack memory chips right on top of the main processor. This makes the devices thinner and helps them run cooler, which is crucial for small gadgets.

Is there a risk because most of Apple’s chips are made in one place (Taiwan)?

Yes, there is a risk. Having almost all of its most important chips made in Taiwan, which is close to China, creates a potential problem if there are political issues or natural disasters. That’s why Apple is investing in factories in places like Arizona to spread out its manufacturing and reduce this risk.