Ever wonder about the people who back the next big thing? You know, the ones who put money into new companies before they become household names? These are the famous VCs, or venture capitalists. They do a lot more than just write checks. They actually help shape the future of a lot of industries. This article will look at how these famous VCs operate, what they look for, and how they change the business world. It’s pretty interesting stuff.

Key Takeaways

- Famous VCs use different ways to invest, like putting money into new companies or helping bigger ones grow. They also sometimes focus on certain kinds of businesses.

- These VCs really help new companies get started and expand. They give advice and connect people, which helps new ideas become real products and services.

- The next group of famous VCs will likely come from new kinds of investments. They will also include more different types of people and look for opportunities in new places.

- Famous VCs have to deal with ups and downs in the economy. They also have to compete with other investors. Plus, they need to make sure their investments are good for society.

- Many well-known companies got their start with money from famous VCs. These investments have led to new technologies and helped companies grow a lot over time.

Pioneering Investment Strategies of Famous VCs

Early Stage Venture Capital

Early stage venture capital is where the magic often begins. It’s about spotting potential before it’s obvious, backing founders with a vision, and providing the resources to turn an idea into a real company. This high-risk, high-reward approach is a hallmark of many famous VCs. It’s not just about the money; it’s about the mentorship, the network, and the strategic guidance that can make or break a young company. Think of it as planting seeds – some will grow into mighty oaks, others might wither, but the potential payoff is huge. For example, venture capital firms often look at the team, the market size, and the uniqueness of the idea.

Growth Equity Investments

Growth equity is like adding fuel to a fire. Once a company has proven its model and is showing real traction, growth equity investments help them scale rapidly. This might involve expanding into new markets, acquiring competitors, or investing heavily in sales and marketing. It’s a different game than early-stage investing; it’s about optimizing operations, building a strong management team, and executing a well-defined plan. The risks are lower, but so are the potential returns, but the impact on the company can be transformative.

Sector-Specific Focus

Some VCs choose to specialize, becoming experts in a particular industry or technology. This sector-specific focus allows them to develop a deep understanding of the market dynamics, the competitive landscape, and the emerging trends. They can identify the most promising companies in their area of expertise and provide them with the specialized knowledge and resources they need to succeed. For example, a VC focused on biotech might have a team of scientists and doctors who can evaluate the potential of new drugs and therapies. Or a VC focused on AI might have engineers and data scientists who can assess the technical feasibility of a new algorithm. This specialization can give them a significant edge over generalist investors.

The Impact of Famous VCs on Startup Ecosystems

Famous VCs do more than just write checks; they actively shape the startup landscape. Their influence extends far beyond individual companies, impacting entire ecosystems. It’s not just about the money, but also the knowledge, connections, and credibility they bring to the table. Let’s take a look at how they do it.

Fostering Innovation and Growth

Famous VCs often act as catalysts for innovation by identifying and funding groundbreaking ideas. They provide the resources necessary for startups to experiment, iterate, and scale their operations. This injection of capital and support can transform a promising concept into a thriving business. They also help to create a culture of innovation by showcasing what’s possible and inspiring other entrepreneurs to pursue their own ventures. The global startup ecosystem is constantly evolving, and these VCs are at the forefront, pushing boundaries and driving progress.

Mentorship and Guidance

Beyond financial backing, famous VCs offer invaluable mentorship and guidance to startup founders. They share their experience, insights, and networks to help entrepreneurs navigate the challenges of building a successful company. This can include advice on product development, market strategy, team building, and fundraising. It’s like having a seasoned coach in your corner, helping you avoid common pitfalls and make informed decisions. This mentorship is especially important for first-time founders who may lack the experience and connections needed to succeed. It’s not just about telling them what to do, but helping them develop their own leadership skills and strategic thinking.

Building Industry Networks

Famous VCs have extensive networks of contacts, including other investors, industry experts, potential customers, and strategic partners. They can leverage these networks to help their portfolio companies connect with the right people and access new opportunities. This can be a game-changer for startups, opening doors that would otherwise remain closed. Think of it as a shortcut to building credibility and gaining traction in the market. These networks also facilitate collaboration and knowledge sharing among startups, creating a more vibrant and interconnected ecosystem. It’s about building a community where everyone can benefit from each other’s expertise and resources. The rise of female titans in the VC world is also helping to diversify these networks, bringing new perspectives and opportunities to the table.

Identifying the Next Generation of Famous VCs

It’s always interesting to think about who the next big names in venture capital will be. The landscape is constantly shifting, and what worked for the previous generation might not be the key to success going forward. So, how do we spot the rising stars? It’s a mix of looking at emerging trends, paying attention to diversity, and seeing where new geographic hubs are developing.

Emerging Investment Trends

The next generation of VCs will likely be defined by their ability to identify and capitalize on emerging trends early on. This means staying ahead of the curve in areas like AI, sustainable technology, and personalized medicine. It’s not just about following the hype, but about understanding the underlying technology and its potential for long-term impact. For example, we’re seeing a lot of interest in sustainable business practices, and VCs who can identify the companies that are truly making a difference will be well-positioned for success.

Here’s a quick look at some areas attracting attention:

- AI-driven healthcare solutions

- Decentralized finance (DeFi) applications

- Sustainable agriculture technologies

Diversity in Venture Capital

The VC world has historically been pretty homogenous, but that’s starting to change. There’s a growing recognition that diverse teams make better investment decisions. Different backgrounds and perspectives can lead to a more nuanced understanding of the market and a greater ability to identify promising startups that might be overlooked by more traditional firms. We’re seeing more women and people of color entering the VC space, and that’s a really positive trend. It’s not just about fairness; it’s about improving the quality of investment decisions. The rise of the female titans is a great example of this.

Geographic Expansion

For a long time, Silicon Valley was the place to be for venture capital. But now, we’re seeing innovation hubs popping up all over the world. Cities like Austin, Miami, and even places in Europe and Asia are becoming major players in the startup ecosystem. This means that the next generation of famous VCs might not be based in the usual locations. They might be the ones who are building networks and making investments in these emerging markets. It’s about recognizing that innovation can happen anywhere, and being willing to look beyond the traditional hotspots.

Challenges and Opportunities for Famous VCs

Navigating Economic Shifts

Let’s be real, the economy is always doing something weird. One minute it’s booming, the next it’s… not. For famous VCs, this means constantly adjusting their strategies. They have to predict where the market is going and make smart moves to protect their investments. It’s like playing chess, but the board keeps changing. Interest rates go up, inflation spikes, and suddenly that hot new startup isn’t looking so hot anymore. They need to be ready to pivot, double down, or even cut their losses. It’s a high-stakes game, and only the most adaptable survive.

Competitive Landscape

The world of venture capital is cutthroat. Everyone wants to find the next big thing, and there’s a ton of money floating around. This means famous VCs are constantly battling each other for the best deals. It’s not just about having the most money; it’s about having the best network, the sharpest insights, and the fastest trigger finger. Plus, new players are always entering the game, disrupting the old order. Think about it:

- Established firms have to compete with up-and-coming funds.

- Corporate venture arms are throwing their weight around.

- Even individual angel investors are getting in on the action.

To stay ahead, famous VCs need to constantly innovate and differentiate themselves. They need to offer more than just capital; they need to provide expertise, connections, and a track record of success. It’s a constant arms race, and the stakes are only getting higher. It’s important to understand the role of a venture capitalist in this environment.

Ethical Investment Practices

More and more, people care about where their money is going. Famous VCs are under pressure to invest in companies that are not only profitable but also ethical and sustainable. This means considering the social and environmental impact of their investments. It’s not enough to just make money; they need to make a positive difference in the world. This can be a challenge, as ethical considerations can sometimes conflict with financial returns. But for many VCs, it’s a matter of principle. They want to invest in companies that are building a better future, not just a richer one. Some examples of ethical considerations include:

- Avoiding investments in industries that harm the environment.

- Promoting diversity and inclusion within portfolio companies.

- Ensuring fair labor practices throughout the supply chain.

It’s a balancing act, but it’s one that famous VCs need to take seriously if they want to maintain their reputation and attract the next generation of investors.

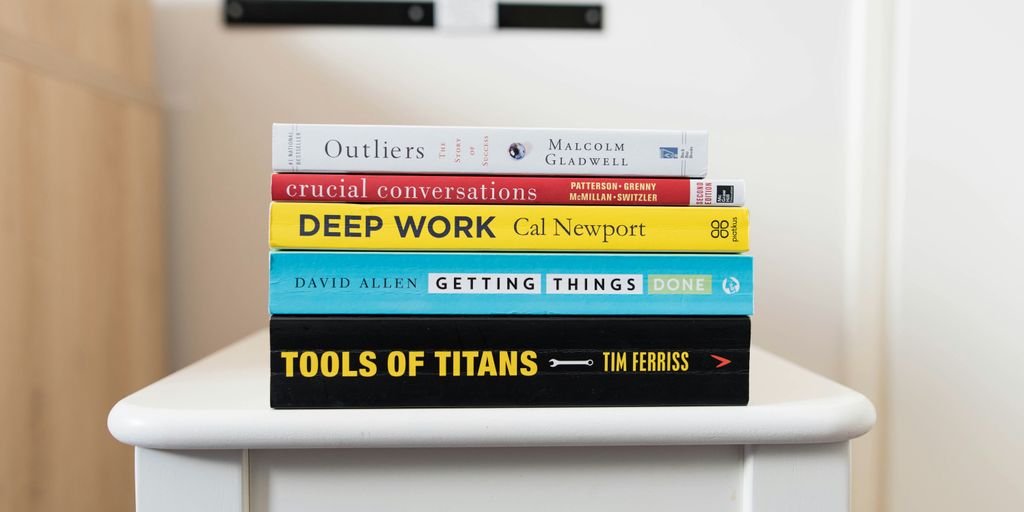

Notable Success Stories from Famous VCs

It’s always interesting to look back and see where famous VCs made their mark. Some investments become legendary, shaping industries and creating massive returns. It’s not just about the money, though; it’s about spotting potential and helping build something amazing. Let’s take a look at some notable wins.

Transformative Company Exits

One of the biggest indicators of a VC’s success is a transformative company exit, usually through an IPO or acquisition. Think about the early days of Google. Sequoia Capital saw something special and invested. Their exit was, well, pretty transformative for everyone involved. Then there’s Accel’s early bet on Facebook. These aren’t just financial wins; they change how we live and interact. It’s about more than just venture capital funding; it’s about shaping the future.

Disruptive Technology Investments

VCs often get behind companies that are shaking things up with new tech. Take CRISPR technology, for example. VCs who invested early in companies like Editas Medicine are not only seeing financial gains but are also supporting advancements that could revolutionize medicine. Or consider the electric vehicle market. Investments in Tesla by firms like Kleiner Perkins helped propel a niche idea into a mainstream reality. These investments show how VCs can fuel disruptive technology and change the world.

Long-Term Portfolio Growth

It’s not always about the quick wins. Some of the best VCs focus on long-term portfolio growth, building a diverse set of companies that can weather economic storms. This means investing in companies with solid fundamentals, strong leadership, and a clear path to profitability. It’s a more patient approach, but it can lead to more sustainable and substantial returns over time. A good example is how some firms have consistently backed software-as-a-service (SaaS) companies, recognizing the long-term value of recurring revenue models. This strategy requires a keen eye for detail and a willingness to stick with companies through thick and thin. It’s about building a portfolio that can grow over time, not just chasing the latest hype.

The Influence of Famous VCs on Market Dynamics

Shaping Industry Standards

Famous VCs often set the tone for entire industries. Their investment choices signal what’s hot and what’s not, influencing other investors and entrepreneurs alike. It’s like they’re the cool kids in school, and everyone wants to dress like them. They don’t just fund companies; they validate business models and technologies. For example, if a well-known VC firm pours money into a new type of AI-powered healthcare solution, suddenly everyone is talking about AI in healthcare. This can lead to a rapid increase in the number of startups in that space, all trying to capitalize on the perceived opportunity. It’s a bit of a self-fulfilling prophecy, but it definitely shapes the direction of the industry. It’s interesting to see how sector-focused venture capital can really drive innovation in specific areas.

Driving Valuation Trends

VCs play a big role in determining how much companies are worth. When a famous VC invests in a startup, it’s not just about the money; it’s also about the stamp of approval. This can lead to a significant increase in the startup’s valuation, even if its revenue or user base hasn’t changed much. This "VC bump" can be both a blessing and a curse. On the one hand, it makes the startup look more attractive to other investors and potential employees. On the other hand, it can create unrealistic expectations and put pressure on the startup to grow at an unsustainable rate. It’s a delicate balancing act, and it’s something that startups and VCs need to be aware of. It’s also worth noting that valuations can be heavily influenced by market sentiment and overall economic conditions. What seems like a reasonable valuation in a bull market might look completely absurd in a downturn.

Catalyzing New Markets

VCs are often at the forefront of creating new markets. They’re willing to take risks on unproven technologies and business models, which can lead to the emergence of entirely new industries. Think about the early days of the internet or the rise of mobile apps. VCs played a crucial role in funding the companies that built those markets. This often involves not just providing capital, but also providing guidance, mentorship, and access to networks. It’s about more than just money; it’s about building an ecosystem. Of course, not every bet pays off. There are plenty of VC-backed startups that fail, but the ones that succeed can have a transformative impact on the world. It’s a high-risk, high-reward game, and it’s one that requires a lot of vision, patience, and a little bit of luck. It’s interesting to see how female founders are increasingly capturing the attention of investors, driving innovation and creating new markets.

Wrapping It Up

So, we’ve looked at some of the big names in venture capital today. It’s pretty clear these folks aren’t just throwing money around; they’re really shaping what’s next. They find new ideas, help them grow, and sometimes, they even change whole industries. It’s a fast-moving world, and these VCs are right there at the front, making things happen. It’ll be interesting to see who pops up next and what new things they bring to the table.

Frequently Asked Questions

What exactly is a famous VC?

Venture capitalists (VCs) are like special investors who put money into new companies that are just starting or growing quickly. They usually invest in businesses they think will become very successful and make a lot of money in the future. Think of them as helping to kickstart innovative ideas.

How do famous VCs help the companies they invest in?

VCs bring more than just money. They offer smart advice, connect startups with important people, and help guide young companies through tough times. They’re like mentors who want their investments to succeed.

What kind of businesses do famous VCs typically invest in?

They look for companies with fresh ideas, strong teams, and a big market to sell to. They also consider if the company can grow fast and make a real difference in its industry.

Why is it important to know about famous VCs?

It’s a big deal because these VCs often pick the next big companies. Their choices can change whole industries, create new jobs, and bring exciting new products or services to everyone.

What are some new trends in the world of famous VCs?

The world of venture capital is always changing. Today, there’s more focus on new tech, companies that help the environment, and making sure different kinds of people get a chance to lead. Also, more VCs are looking beyond just Silicon Valley.

Are there many famous female VCs, and is the field becoming more welcoming to women?

Yes, it’s getting better! More and more women are becoming successful VCs and founders. While there’s still work to do, the industry is seeing more women in leadership roles and investing in women-led businesses, which is a positive change.