Hey everyone, welcome back! Today we’re taking a look at the us share market today, trying to make sense of all the ups and downs. It feels like there’s always something new happening, whether it’s company news, what the Fed is up to, or even stuff happening across the globe. Let’s break down what’s moving things and what we should keep an eye on.

Key Takeaways

- The US share market today saw mixed performance across major indices like the S&P 500, Dow Jones, and Nasdaq.

- Company-specific news, including earnings reports from big names like Apple and tech giants, significantly influenced stock movements.

- Speculation around Federal Reserve policies and interest rate changes continued to be a major factor for investors.

- Global market trends in Europe and Asia also played a role in shaping the day’s trading activity.

- Shifts in commodity prices and currency exchange rates provided additional context for today’s us share market action.

US Share Market Today: Key Indices Performance

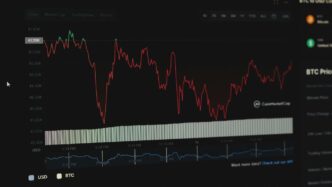

S&P 500 Performance Overview

The S&P 500 saw a bit of a dip today, closing down 0.50% at 6934 points. This comes after a pretty solid run, as the index has climbed 1.29% over the past month. Looking back a year, we’re up a healthy 14.79%. It’s been a bit of a rollercoaster, with the index hitting an all-time high of 7002.58 back in January 2026. Analysts are predicting it might trade around 6759.92 by the end of this quarter, and potentially dip to 6104.41 in about a year. So, while today wasn’t its best day, the broader trend has been positive.

Dow Jones Industrial Average Trends

The Dow Jones Industrial Average had a mixed day. It finished Thursday up a modest 0.11%, adding about 55 points to reach 49071. Some big names helped lift it, like IBM, Honeywell International, and Caterpillar. However, Microsoft took a pretty big hit, dropping over 10%, and Salesforce wasn’t far behind. This kind of movement shows how individual stock performance can really sway the index. Despite today’s slight gain, the Dow has been showing strength, posting a 2.1% rise for the first month of the year.

Nasdaq Composite Movement

The Nasdaq Composite experienced some turbulence today, falling 0.72% in regular trading. This followed a pattern of futures being in the red, with Nasdaq 100 contracts down 0.5%. A big factor seemed to be the mixed signals from tech earnings. While some companies like Apple managed to beat expectations, others, like Microsoft, signaled slower growth, which really spooked investors. The tech sector is always sensitive to these kinds of reports, and today was no exception. Still, for the month, the Nasdaq managed to add 1.9%.

Market Movers and Shakers

Today’s trading session saw a mixed bag of performances across the board, with several stocks making significant moves. Investor attention was keenly focused on corporate earnings reports and shifts in economic sentiment.

Top Gaining Stocks

Several companies managed to buck the broader market trends, posting notable gains. These included:

- Verizon: The telecommunications giant saw a significant jump, rising 2.4% after reporting stronger-than-expected financial results. This positive reaction suggests that their strategic initiatives are paying off.

- IBM: In the software sector, IBM stood out with an upside surprise in its earnings report. This performance is particularly noteworthy given the recent pressures on software stocks.

- Other smaller cap stocks also experienced upward momentum, driven by sector-specific news and positive analyst ratings.

Leading Losing Stocks

Conversely, some prominent names faced selling pressure:

- Apple: Despite strong quarterly results and increased iPhone sales, Apple’s stock dipped 0.5% in pre-market trading. The market’s reaction highlights the high expectations placed on the tech behemoth.

- Visa: The payment processing company dropped 1% even after surpassing earnings and revenue estimates. This indicates a broader market sentiment that may be weighing on even strong performers.

- Energy Stocks: Major players like ExxonMobil and Chevron experienced declines, down 1.4% and 0.3% respectively. This pullback in the energy sector could be linked to shifting commodity prices or broader economic concerns.

Active Trading Volume Stocks

Stocks with high trading volumes often indicate significant investor interest, whether positive or negative. Today, several companies stood out:

- Microsoft: Experienced a sharp sell-off, with trading volume surging as investors reacted to their earnings call. The market’s response was notably negative, despite continued capital expenditure.

- Meta: In contrast to Microsoft, Meta saw solid gains, with high trading volume accompanying its positive earnings report. The market seemed to favor their explanation of investment returns.

- American Express: This financial services company lost 2.3% following an earnings miss, attracting considerable trading activity as investors adjusted their positions.

For a real-time look at the day’s top performers, you can check out the list of top gaining stocks. Understanding these market movers is key to grasping the day’s overall trading narrative.

Economic Factors Influencing Today’s US Share Market

So, what’s really moving the needle in the US stock market today? It’s a mix of things, as usual. We’ve got the Federal Reserve making waves, and of course, everyone’s watching interest rates and how inflation is playing out.

Federal Reserve Policy Impact

The Federal Reserve’s actions, or even just the hints of future actions, can really shake things up. Today, there’s a lot of chatter about the Fed’s stance on monetary policy. Markets are trying to figure out if the Fed is leaning towards keeping things steady or if they’re planning some adjustments. This uncertainty can lead to some choppy trading days. Investors are paying close attention to any statements or reports that might give clues about their next move. It’s like trying to guess the next play in a chess match, but with a lot more money on the line.

Interest Rate Speculation

Speaking of rates, speculation about where interest rates are headed is a constant source of market movement. If rates are expected to go up, it can make borrowing more expensive for companies, potentially slowing down growth. On the flip side, lower rates can encourage borrowing and spending. It’s a delicate balance, and any news that suggests a shift in rates can cause stocks to react.

Inflationary Pressures

And then there’s inflation. When prices for goods and services rise too quickly, it eats into people’s purchasing power and can make it harder for businesses to manage their costs. High inflation often leads the Fed to consider raising interest rates to cool things down. So, today’s market is definitely keeping an eye on the latest inflation numbers and what they might mean for the economy and, by extension, for stock prices. We saw some mixed signals recently, with some companies reporting strong earnings but also warning about rising costs, which is a direct link to these inflationary pressures. For a deeper look at how these economic trends are shaping investment strategies, you might find the Market Compass video series helpful.

Corporate Earnings and Their Market Impact

Major Tech Earnings Reactions

This week, the tech sector has been a real mixed bag when it comes to earnings reports. We saw some big names put out their numbers, and the market’s reaction wasn’t always what you’d expect. For instance, Microsoft’s stock took a pretty big hit, dropping around 10% after they hinted at slower growth in their cloud services. It seems investors are really focused on how these companies are spending money on AI, and whether that spending will actually pay off down the road. It’s not just about the potential, but how management explains the return on that investment. Some companies are doing a better job of convincing the market than others.

Impact of Apple’s Financial Results

Apple also released its latest financial results. While they managed to beat expectations for both earnings and revenue in the first fiscal quarter, thanks in part to strong iPhone sales, the company did put out a warning about rising costs putting pressure on their profit margins. Even with the good news on sales, the stock saw some movement in after-hours trading. It’s a classic example of how even a company as big as Apple can face headwinds. Investors are watching closely to see how they plan to manage these increasing costs.

Analysis of Energy Sector Reports

Looking ahead, the market is keeping a close eye on upcoming earnings from major energy players like ExxonMobil and Chevron. We’ll also be hearing from financial services giant American Express and telecom company Verizon. The performance of these companies can give us a good sense of the broader economic picture. For example, energy sector reports often reflect global demand and supply dynamics, while financial firms can indicate the health of consumer and business spending. It’s these reports that help paint a clearer picture of where the economy is headed.

Global Market Connections

Americas Market Performance

Things are looking a bit mixed across the Americas today. The S&P 500, a big benchmark for the US market, dipped a bit, losing about 0.50% on January 30, 2026. It’s been a decent climb over the last month though, up around 1.29%, and even better when you look back a full year, showing a gain of nearly 15%. Analysts are predicting it might settle around 6760 by the end of this quarter, but they’re also forecasting a dip to about 6100 in the next year. This kind of movement often gets investors watching closely.

European Market Trends

Over in Europe, the markets are also showing some shifts. While specific numbers for today aren’t immediately clear, general sentiment suggests a cautious approach. Investors are keeping an eye on economic data releases and any hints from central banks about future policy. It seems like a lot of the focus is on how global economic health might affect trade and corporate profits across the Atlantic.

Asia-Pacific Market Influence

The Asia-Pacific region has had its own set of movements. Markets there often react quickly to news from the US and Europe, and vice versa. Today, we’re seeing some mixed signals. Some areas are up, while others are down, which is pretty typical when there’s uncertainty about global growth or trade relations. The performance in Asia can often set the tone for how European and American markets open. It’s a constant back-and-forth, with news from one region quickly rippling through the others.

Commodities and Currencies Watch

Energy Market Dynamics

Oil prices saw some movement today, with Brent crude futures hovering around $80 a barrel. It seems like supply concerns are still on traders’ minds, even with some signs of slowing global demand. We’re watching to see if OPEC+ makes any announcements soon, as that could really shake things up. Natural gas prices also took a bit of a dip, probably due to milder weather forecasts in key regions.

Precious Metals Performance

Gold prices are holding steady, which is pretty typical when there’s a bit of uncertainty in the stock market. It’s acting like a safe bet for investors right now. Silver, on the other hand, is showing a bit more volatility, often following gold but with bigger swings. The yellow metal continues to be a go-to asset during these times.

Key Currency Exchange Rates

The US Dollar Index (DXY) is trading slightly higher today. This often happens when US economic data looks okay, or when there’s a bit of global tension. The Euro is a bit weaker against the dollar, and the Japanese Yen is also seeing some pressure. It’s a mixed bag out there for the major currencies.

Here’s a quick look at some key rates:

| Currency Pair | Rate (Approx.) | Change (%) |

|---|---|---|

| EUR/USD | 1.0850 | -0.20% |

| USD/JPY | 148.50 | +0.15% |

| GBP/USD | 1.2600 | -0.10% |

| USD/CAD | 1.3500 | +0.05% |

Wrapping Up Today’s Market Moves

So, the market had a bit of a mixed day. We saw some ups and downs, with certain stocks doing well while others struggled a bit. The big news about the new Fed chair nominee definitely got people talking and seemed to influence how futures were looking. Plus, with earnings season in full swing, companies like Apple and Visa gave us some numbers to chew on, which moved things around too. It’s a lot to keep track of, but that’s the market for you – always something happening. We’ll keep an eye on how these trends play out.

Frequently Asked Questions

What are the main stock market indexes in the US and how did they perform recently?

The main stock market indexes in the US are the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite. Recently, the S&P 500 saw a slight dip, while the Dow Jones and Nasdaq also experienced some movement. For instance, on a particular day, the S&P 500 contracts were down 0.4%, Nasdaq 100 off 0.5%, and Dow Jones futures lost 150 points.

What factors are influencing the US stock market today?

Several things are affecting the market. News about who might lead the Federal Reserve can make investors nervous. Also, companies releasing their financial results, like Apple or Visa, can cause their stock prices to go up or down. Even global events and the prices of things like oil can have an impact.

How do company earnings reports affect the stock market?

When companies share their earnings, it’s a big deal. If a company like Apple reports good sales and profits, its stock might go up. But if they warn about rising costs or slower growth, like Microsoft did, their stock can fall, and this can even affect other similar companies.

What is the Federal Reserve and how does its policy affect stocks?

The Federal Reserve, or the Fed, is like the central bank for the US. It makes decisions about interest rates. When the Fed changes interest rates or hints that it might, it can make borrowing money cheaper or more expensive for companies and people. This can influence how much companies spend and how much people invest, which in turn affects stock prices.

What are ‘market movers’ and ‘shakers’ in the stock market?

‘Market movers’ and ‘shakers’ are terms used to describe stocks that are experiencing significant price changes, either up or down. These movements are often caused by major news, company announcements like earnings reports, or shifts in economic conditions. Investors watch these stocks closely to understand market trends.

How do global markets and commodities affect the US stock market?

The US stock market doesn’t exist in a bubble. What happens in other parts of the world, like in Europe or Asia, can influence US markets. Also, the prices of important goods like oil and gold (commodities) can signal bigger economic trends. If oil prices change a lot, it can affect energy companies and even how much people spend on other things.