Hey there! So, you want to keep an eye on how the big tech companies are doing, right? That’s where the US Tech 100 Index, also known as the Nasdaq 100, comes in. Think of it as a snapshot of the 100 biggest non-financial companies listed on the Nasdaq stock exchange. We’re talking about the heavy hitters in areas like software, hardware, and biotech. This article is all about tracking the us tech 100 index live, so you can see what’s happening with these major players in real-time.

Key Takeaways

- The Nasdaq 100 is an index tracking the 100 largest non-financial companies on the Nasdaq exchange.

- It’s a good way to gauge the performance of major tech and growth companies.

- You can track the us tech 100 index live to see its current value and component stock movements.

- The index is market-capitalization weighted, meaning bigger companies have a larger impact.

- Historical data and future projections give context to current performance trends.

Understanding the US Tech 100 Index Live

What is the Nasdaq 100?

The Nasdaq 100 is a stock market index that tracks the performance of the 100 largest non-financial companies listed on the Nasdaq stock exchange. It’s been around since January 31, 1985, and it’s a pretty big deal in the world of tech and growth stocks. Think of it as a snapshot of some of the most influential companies in the U.S. and internationally, all in one place. It’s not just about size, though; companies have to meet certain requirements to get in, like being listed for at least two years and having a solid market cap and trading volume. The index gets reviewed annually, so it stays current with the market.

Key Characteristics of the Nasdaq 100

So, what makes the Nasdaq 100 stand out?

- Focus on Non-Financials: Unlike some other major indexes, the Nasdaq 100 specifically excludes companies from the financial sector. This means you’re looking at a pure play on technology, biotech, and other growth-oriented industries.

- Market Cap Weighted: The companies with the biggest market values have the most influence on the index’s movement. If Apple or Microsoft does well, it’s going to have a bigger impact on the Nasdaq 100 than a smaller company in the index.

- Global Reach: While it’s a U.S. exchange, the Nasdaq 100 includes both American and international companies, giving it a broader scope.

- Price Index, Not Total Return: It’s important to know that the Nasdaq 100 is a price index. This means it doesn’t account for dividend payments when calculating its value. So, while the companies might be paying out dividends, those aren’t factored into the index’s daily moves.

Historical Performance Overview

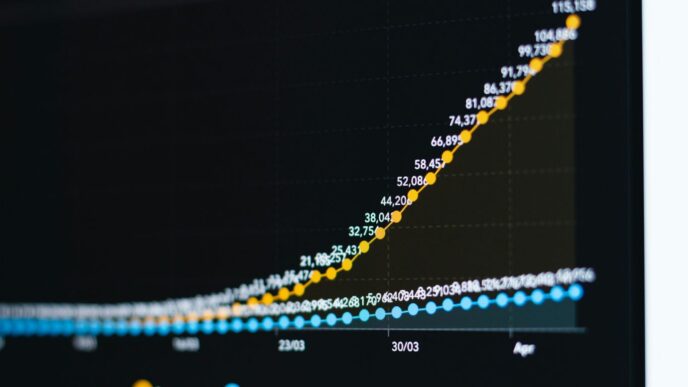

Looking back at the Nasdaq 100’s history shows a pretty interesting story. It started with a baseline value of 250 points back in 1985. By 1994, it was split, and the baseline was halved. Over the years, it’s seen significant ups and downs, mirroring the broader tech landscape. For instance, as of December 4th, 2025, the index was trading around 25,628, showing a modest increase from the previous day. Over the last year, it’s seen a rise of about 19.62 percent. This kind of performance shows its potential for growth, but also its sensitivity to market shifts. It’s a dynamic index, reflecting the fast-paced nature of the tech sector it represents.

Tracking Real-Time Nasdaq 100 Performance

Keeping an eye on the Nasdaq 100 as it moves is pretty important if you’re interested in the big tech players. It’s not just about looking at a single number; it’s about seeing how the biggest non-financial companies listed on the Nasdaq exchange are doing, second by second.

Live Stock Prices for Nasdaq 100 Components

This is where you get the nitty-gritty. The Nasdaq 100 is made up of 100 of the largest companies, and their individual stock prices are constantly changing throughout the trading day. We’re talking about companies like Apple, Microsoft, Amazon, and all those other tech giants. Seeing their prices fluctuate gives you a direct look at what’s happening with the index as a whole. It’s like watching the individual players on a sports team to understand how the team is performing.

Continuous Index Level Calculation

The Nasdaq 100 index level itself is calculated continuously. Think of it as a running average of the stock prices of all 100 companies, weighted by their market size. This calculation happens every second the market is open. This constant updating means the index level you see is a very current snapshot of the market’s sentiment towards these major tech companies. It’s not something that gets updated just once a day; it’s a live feed.

Data Sources and Disclaimers

Where does all this live data come from? It’s usually provided by sources like Nasdaq Data Link, which is a pretty reliable place for financial information. It’s important to know that this data might have a slight delay, often at least a minute, from the absolute real-time trade. This is pretty standard for most public index data. Also, remember that this data is for informational purposes. It’s not financial advice, and you should always do your own research before making any investment decisions. The index itself doesn’t include dividends, which is something to keep in mind when comparing its performance to other investment returns.

Nasdaq 100 Key Figures and Trends

Looking at the numbers can tell you a lot about how the Nasdaq 100 is doing. It’s not just about the day-to-day ups and downs, but also the bigger picture over weeks, months, and even years. Understanding these figures helps paint a clearer picture of the index’s overall health and direction.

Performance Over Different Periods

We can see how the index has performed across various timeframes. This gives us a sense of its recent momentum and longer-term trends. For instance, looking at the 30-day performance shows us what’s been happening lately, while the 250-day performance gives us a view of its progress over most of a trading year.

| Period | Performance |

|---|---|

| 30 Days | 0.67% |

| 90 Days | 8.26% |

| 250 Days | 32.82% |

Index Highs and Lows

Tracking the highest and lowest points the index has reached over different periods is also pretty interesting. It shows us the boundaries of its recent trading range and can sometimes hint at support or resistance levels. The data shows the index has seen significant movement, reaching highs and lows that reflect market conditions.

Volatility Metrics

Volatility is a measure of how much the index’s value tends to fluctuate. Higher volatility means bigger price swings, which can mean more risk but also potentially more reward. Lower volatility suggests a more stable, less dramatic movement. These numbers give us a sense of the market’s current temperament regarding these tech giants.

- 30 Days Volatility: 21.35

- 90 Days Volatility: 17.19

- 250 Days Volatility: 24.82

These metrics are important for anyone trying to get a handle on the market’s mood. You can find more detailed information and charts on the NASDAQ-100 (^NDX) index to see these trends yourself.

Analyzing Nasdaq 100 Components

Looking at the individual companies within the Nasdaq 100 gives you a clearer picture of what’s really moving the index. It’s not just one big blob; it’s made up of 100 different businesses, each with its own story.

Biggest Gainers in the Index

These are the companies that are really shining, showing strong upward momentum. Keep an eye on them, as they often lead the charge. For example, recently, Microchip Technology (MCHP) and ON Semiconductor (ON) have seen significant jumps, showing double-digit percentage gains. Marvell Technology (MRVL) and Vertex Pharmaceuticals (VRTX) have also been strong performers. It’s interesting to see how these tech and biotech firms are doing so well.

Notable Losers in the Index

On the flip side, some companies are experiencing a downturn. While it might seem negative, sometimes these dips can present opportunities, or they might signal broader industry shifts. Lately, Netflix (NFLX) has been among the notable decliners, along with PayPal Holdings (PYPL) and Microsoft (MSFT). Regeneron Pharmaceuticals (REGN) has also seen a drop. Understanding why these companies are falling is just as important as knowing who’s rising.

Market Capitalization Insights

Market capitalization, or ‘market cap’, is basically the total value of a company’s outstanding shares. It’s a key way to gauge a company’s size. In the Nasdaq 100, you’ll find some of the biggest tech giants in the world. While the index itself is focused on non-financial companies, comparing the market caps of its constituents can tell you a lot about the concentration of value within the tech sector. You can explore the list of companies and stocks that make up the Nasdaq 100 to see how their market caps stack up against each other. This helps in understanding which companies have the most influence on the index’s overall movement.

Future Outlook for the US Tech 100 Index

Analyst Expectations

Looking ahead, the tech sector, as represented by the Nasdaq 100, is a mixed bag according to market watchers. While many analysts maintain a positive stance, there’s a general consensus on keeping a ‘Buy’ rating for many of the index’s components. For instance, firms like Telsey Advisory Group, Rosenblatt, BTIG Research, and Needham & Company have recently issued ‘Buy’ recommendations for major players such as Dollar Tree, CrowdStrike, and Marvell Technology. These analysts often set price targets, suggesting potential upside from current levels. It’s worth noting that these are just opinions, and the market can be unpredictable.

Here’s a snapshot of some recent analyst actions:

- CrowdStrike (CRWD): Multiple analysts, including Rosenblatt and BTIG Research, have maintained ‘Buy’ ratings with price targets around $630-$640.

- Microchip Technology (MCHP): Rosenblatt has also kept a ‘Buy’ rating, setting a target of $80.

- Dollar Tree (DLTR): Telsey Advisory Group has a ‘Buy’ rating with a target of $130.

- Marvell Technology (MRVL): The Benchmark Company has a ‘Buy’ rating with a target of $130.

Macroeconomic Model Projections

Beyond individual stock picks, broader economic models offer another perspective on where the Nasdaq 100 might be headed. These models try to factor in various economic indicators to predict index movements. For example, based on current data and projections, some models suggest a potential dip in the index by the end of this quarter, with further declines anticipated over the next year. As of early December 2025, the US 100 Tech Index was trading around 25,628. Projections from models like those from Trading Economics indicate a possible future price of approximately 24,634 by the close of this quarter and a more significant drop to around 22,378 in a year’s time. These projections highlight the inherent volatility and the influence of broader economic forces on the tech-heavy Nasdaq 100. It’s a good reminder that past performance doesn’t guarantee future results, and economic conditions play a big role.

Wrapping Up the Nasdaq 100

So, that’s a look at how the Nasdaq 100 has been doing. It’s a big deal in the tech world, made up of the top 100 companies that aren’t banks or financial firms. We’ve seen some ups and downs, as you’d expect with the stock market. Keeping an eye on this index gives you a pretty good idea of where the tech sector is headed. Remember, past performance doesn’t guarantee future results, but understanding these trends can help you make sense of the market. It’s always a good idea to stay informed, whether you’re a seasoned investor or just curious about what’s happening with big tech.

Frequently Asked Questions

What exactly is the US Tech 100 Index?

The US Tech 100, also known as the Nasdaq 100, is a list of the 100 biggest companies traded on the Nasdaq stock market. These companies are mainly in technology and don’t include banks or financial companies. It’s a way to see how these major tech players are doing overall.

How can I see the US Tech 100’s performance right now?

You can track the US Tech 100’s performance live on financial websites or through trading platforms. These sources show the current value of the index, which changes throughout the day as the stocks within it move.

What makes a company eligible for the Nasdaq 100?

To be part of the Nasdaq 100, a company needs to be among the largest by value on the Nasdaq exchange. They also must not be in the financial industry and usually need to have been listed for at least two years with a good amount of trading activity.

Does the Nasdaq 100 include dividends in its performance?

No, the Nasdaq 100 is a price index. This means it only looks at the stock prices themselves and doesn’t include money paid out to shareholders as dividends when calculating its value.

Where does the data for the US Tech 100 come from?

The live data for the US Tech 100 often comes from sources like Nasdaq Data Link, which provides real-time stock information. It’s important to remember that this data might have a slight delay, usually at least a minute.

What are some of the top companies in the US Tech 100?

Some of the biggest names you’ll find in the US Tech 100 include major tech giants like Apple, Microsoft, Amazon, and Google’s parent company, Alphabet. These companies have a big impact on the index’s overall movement.