Accounting or accountancy is an accounting method that employs various methods to calculate, monitor, understand, and communicate financial information pertaining to organizations including corporations and businesses. The purpose of accounting is to provide information to managers, investors, tax authorities, and other stakeholders in organizations such as companies and organizations. Accountants usually have bachelor’s degrees in accounting or business management. They may also hold other degrees such as Ph.D. or Masters.

There are two general types of accounting, cost accounting, and managerial accounting. Cost accounting, also known as managerial accounting, involves valuing the costs of doing business through a cash-flow perspective. It compares cost with sales, identifying areas of short supply, analyzing market dynamics, and making adjustments where necessary to improve and increase the firm’s profitability.

On the other hand, fundamental accounting focuses on the sequence of financial transactions made during a period. These transactions include purchases, sales, expenses, and payments. Fundamentals are important in determining the value of an entity. A firm’s financial statements are a record of these fundamental concepts. Many people refer to these fundamental concepts as the “baseline” for accountancy practices. Fundamentals are not just a matter of record-keeping, but also include the concepts reflected in pricing, measurement, reporting, and interpretation of the financial records.

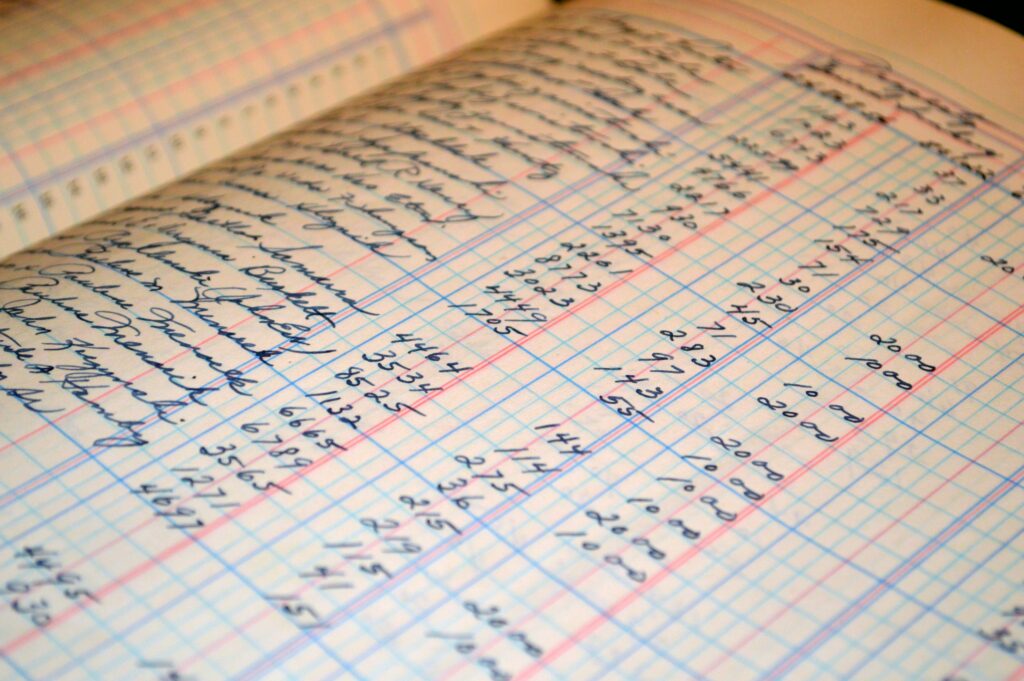

A firm’s accounting system is based on the revenue principle. The revenue principle states that revenue increased with an increase in the firm’s assets, and decreases with the reduction of the firm’s assets. Accounting uses a balance sheet, or journal, to record these transactions and account for the results. An accountant is required to prepare financial statements each year, which reveal the income statement, the balance sheet, and a company statement.

The control risk of an accounting transaction is what concerns most accountants. Control risk occurs when the effects of a planned transaction have an unreasonable effect on the financial statements of a company. A perfect example of control risk is the effect a manager’s order may have on the company’s production. Another example includes the decision to sell a particular stock within a company. A third example is a company that decides to issue stock that will actively trade on a secondary market. In either case, there is a risk that the anticipated increase in stock price will exceed the amount that has actually been issued.

On a related note, an accounting transaction is considered material if it is not necessary and the transaction itself is more work than is necessary. In accounting terms, this is called an insignificant transaction. Examples of insignificant transactions include checks, invoice payments, securities transactions, bank transactions, and loans. A transaction is significant if it is necessary and the transaction is more work than is necessary. These are examples of an accounting period.