So, what’s happening to crypto today? It’s been a bit of a mixed bag out there. Some coins are doing really well, while others are taking a bit of a hit. We’ve seen some interesting moves in the market, and there are definitely some big stories making waves. Let’s break down what’s going on.

Key Takeaways

- Bitcoin spot ETFs have seen some money leaving them lately, which is a notable shift.

- LayerZero is buying the Stargate platform, a pretty big deal in the cross-chain world.

- Hong Kong is rolling out new rules for crypto banking starting in 2026, which could change things there.

- Some traders are making adjustments to their big crypto positions, like one person selling Ethereum for a large profit and another cutting their risk on DOGE.

- Japan is pushing forward with a plan to help startups, with a special focus on Web3 technologies.

Market Overview: What’s Happening to Crypto Today

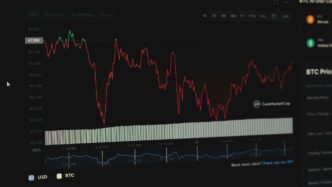

Bitcoin and Ethereum Price Movements

Things are looking pretty interesting in the crypto market today. Bitcoin is trading around $116,364, showing a slight increase of about 1.22% in the last 24 hours. It seems like the market is picking up steam, with some folks thinking the US Federal Reserve’s expected rate cuts might be playing a role. Ethereum isn’t too far behind, currently sitting at $4,486, which is a small dip but still showing signs of recovery. Analysts are watching closely to see if Bitcoin can push towards new highs soon. For a quick look at current prices and trends, you can check out CryptoSlate’s market data.

Top Gainers and Losers in the Market

When we look at who’s up and who’s down, it’s a mixed bag. Some of the top performers today include Aster, which has seen a massive jump of over 424%, and Pudgy Penguins, up by about 14.5%. MemeCore and Avalanche are also making good gains. On the flip side, MYX Finance is down around 4.8%, and Monero has dropped nearly 2%. Tether Gold also saw a small decrease.

Overall Market Capitalization Trends

The total cryptocurrency market capitalization is currently hovering around $4.03 trillion. This figure gives us a broad sense of the entire digital asset space’s value. While specific numbers fluctuate, this overall trend indicates continued interest and investment in the crypto world, even with the day-to-day ups and downs we see in individual assets.

Key Developments Impacting Crypto

Things have been pretty busy in the crypto world lately, with a few big stories making waves. Let’s break down what’s been happening.

Bitcoin Spot ETFs Experience Net Outflows

It looks like the excitement around Bitcoin spot ETFs has cooled off a bit. For the first time in a while, these funds saw more money pulled out than put in. This isn’t necessarily a bad sign for the long term, but it does show that investor sentiment can shift pretty quickly. It’s a reminder that even with new products, the market still has its ups and downs. We’ll have to keep an eye on this to see if it’s just a temporary blip or the start of a trend.

LayerZero Acquires Stargate Platform

In a move that’s got a lot of people talking, LayerZero has officially bought the Stargate platform. This is a pretty big deal in the cross-chain space. Stargate is known for its work in moving assets between different blockchains, and LayerZero is a major player in interoperability. Combining forces like this could really change how we think about moving crypto between networks. It’s all about making things smoother and more connected, which is a big goal for the whole crypto industry. This kind of consolidation often signals a maturing market.

Hong Kong’s New Crypto Banking Rules

Over in Hong Kong, they’re getting ready to roll out some new rules for banks that deal with crypto. Starting January 1, 2026, banks will need to keep their capital reserves at a 1:1 ratio for any crypto exposure. This is a pretty significant step towards clearer regulations in the region. The goal is to make the financial system more stable while still allowing for innovation in digital assets. It’s part of a larger trend we’re seeing globally, where governments are trying to figure out how to handle crypto without stifling its potential. This could make it easier for traditional finance to get more involved in the crypto space in Hong Kong.

Expert Analysis and Predictions

When you look at the crypto market right now, it feels like a bit of a rollercoaster, doesn’t it? Some folks are talking about a bull run, but others are a little more cautious. It’s a mixed bag out there.

Navigating the Crypto Bull Run

So, how do you even start to figure out what’s going on during these upswings? It’s not just about buying the cheapest coin and hoping for the best. Experts suggest a few things to keep in mind:

- Diversification is key: Don’t put all your eggs in one basket. Spreading your investments across different types of crypto can help manage risk.

- Research is non-negotiable: Understand what you’re investing in. What problem does the project solve? Who is the team behind it?

- Have an exit strategy: Know when you plan to sell, both for taking profits and cutting losses. It’s easy to get caught up in the hype and forget this part.

Many analysts are watching how regulatory changes might affect the market. For instance, new rules for technology firms are always on the horizon, and keeping up with these can be a challenge adapting to evolving regulations.

Building a $1000 Crypto Portfolio

Thinking about starting small? Building a $1000 portfolio is totally doable, but it requires a smart approach. Instead of just picking the most popular coins, consider a mix:

- Established players: A portion in Bitcoin and Ethereum makes sense for stability.

- Mid-cap potential: Look for projects with solid tech and growing adoption that aren’t as big as the top two.

- Small-cap risk/reward: A very small part could go into newer, riskier projects with high growth potential, but be prepared to lose that portion.

It’s about balancing the known with the potential.

Insights on Meme Coin Investments

Meme coins are a whole different ballgame. They often move based on social media trends and community sentiment rather than underlying technology. While some have seen massive gains, they are incredibly volatile. Treat meme coin investments as speculative bets rather than core portfolio holdings. It’s easy to get drawn in by quick profits, but the risk of significant loss is very high. Remember, what goes up fast can come down even faster.

Shifts in Investor Behavior

It’s interesting to see how people are actually using their crypto these days. We’re not just talking about big institutions anymore; individual traders are making some pretty big moves, and sometimes, they get caught out.

Take, for example, an Ethereum trader who had a pretty large leveraged position. They decided to trim it down a bit, selling off 2,000 ETH. This wasn’t a full exit, mind you, but a way to lower their liquidation price. It shows they’re still in the game but trying to play it a little safer with the market being so jumpy. It’s a smart move if you want to stay in the trade longer, especially when things get choppy.

Then there’s the flip side. We saw a DOGE trader who got hit with a partial liquidation on their leveraged bet. That’s a tough break. It means the market moved against them enough to wipe out a portion of their collateral. It’s a stark reminder that leverage, while it can amplify gains, can also magnify losses really fast. You have to be super careful with that stuff.

On the other hand, some folks are cashing out with nice profits. One whale, in particular, sold a chunk of Ethereum and walked away with a significant gain. This kind of profit-taking is normal, especially after a good run. It shows that even with all the talk of holding for the long term, people do take profits when they can. It’s a balancing act, really. You want to catch the upside, but you also don’t want to miss the chance to lock in gains. It’s like trying to catch a ride on a new spaceship; you want to get on board, but you also need to know when to enjoy the view and when to prepare for landing Virgin Galactic.

Here’s a quick look at some of these actions:

- Ethereum Trader: Reduced liquidation risk by selling 2,000 ETH from a leveraged long position.

- DOGE Trader: Experienced a partial liquidation on a 10x leveraged long position.

- Whale Investor: Sold Ethereum, realizing substantial profits.

These individual actions paint a picture of a market where people are actively managing their positions, reacting to price swings, and trying to make the most of the current conditions, whether that means cutting losses, reducing risk, or taking profits.

Regulatory and Technological Advancements

It’s been a busy period for regulatory news and tech developments in the crypto space. Japan, for instance, is really pushing forward with its innovation plans. The government announced it’s stepping up its "Five-Year Startup Development Plan," with a big focus on Web3 and AI. This means more support for new tech across different industries. The Finance Minister, Katsunobu Kato, is also keen on making things better for crypto, seeing it as a good way to diversify investments. It’s interesting to see how different countries are approaching this.

On the tech side, LayerZero made a pretty big move by acquiring the Stargate platform for $110 million. This acquisition got a lot of support, with about 95% of the Stargate DAO voting yes. This kind of consolidation could really shape how cross-chain communication works going forward.

Speaking of regulations, Hong Kong is getting ready with new rules for crypto banking. Starting January 1, 2026, banks will need to keep a 1:1 capital ratio for any dealings with permissionless blockchain tech. This is a pretty significant step towards clearer banking guidelines for digital assets.

Vitalik Buterin, one of the Ethereum co-founders, also shared some thoughts on prediction markets. He pointed out that they often lack good incentives for people to participate, which can limit their use for things like hedging. He thinks fixing this could really boost trading volumes and open up new possibilities.

And in a notable financial trend, stablecoins are holding a massive amount of U.S. Treasury assets. Reports show they’ve got close to $200 billion in these securities. This makes stablecoins a pretty big player in the traditional finance world, showing how intertwined crypto and traditional finance are becoming. It’s a good reminder of how the financial landscape is changing, and you can read more about fintech’s impact on the broader market.

Performance of Major Cryptocurrencies

Let’s take a look at how the big players in the crypto world are doing today. It’s been a bit of a mixed bag, with some coins showing solid gains while others are seeing slight dips.

Bitcoin Price Action and Analyst Expectations

Bitcoin has been trading around the $116,000 mark, showing a modest increase of about 1.22% in the last 24 hours. This uptick comes as the market anticipates potential interest rate cuts from the US Federal Reserve, a move that often boosts riskier assets like cryptocurrencies. Analysts are watching closely, with some suggesting that Bitcoin might be on the verge of testing new all-time highs soon. The overall market capitalization for crypto is hovering around $4.03 trillion, with Bitcoin still holding a dominant share. You can check out the latest Bitcoin price action and what experts are saying about its future.

Ethereum’s Surge and Potential Pullback

Ethereum hasn’t been left behind, experiencing a decent surge of 1.71% in the past day, pushing its price to around $4,486. While this is positive movement, some traders are cautious. We’ve seen instances where large traders are adjusting their positions, like one who recently reduced their leveraged long position to lower their liquidation price. This kind of activity can sometimes signal a potential for a short-term pullback, even as the general sentiment remains optimistic.

Solana’s Expected Gains Against ETH and BTC

Solana is showing some impressive strength today, up by a notable 5.12%. This performance has caught the eye of market watchers. There’s a growing sentiment among some analysts, like Chris Burniske, that SOL could continue to outperform both Ethereum and Bitcoin in terms of exchange rates. While it’s still a long way from challenging the top two, its current momentum suggests it might be a coin to keep an eye on for potential future gains relative to its larger counterparts.

Wrapping It Up

So, that’s a look at what’s moving the crypto market today. We saw some big players like Bitcoin and Ethereum making moves, and even some smaller coins catching attention. It’s clear that things can change fast in this space, with news about regulations, tech updates, or even just general market sentiment playing a big role. Remember, keeping up with these trends is key, but it’s also smart to do your own research before jumping into any investments. The crypto world keeps evolving, and staying informed is half the battle.

Frequently Asked Questions

What’s moving the crypto market today?

Today, the crypto world is buzzing with activity. Bitcoin and Ethereum are showing some interesting price changes. We’re also seeing which coins are doing really well and which ones are not. Plus, the total value of all crypto is shifting.

Are there any big news stories affecting crypto?

Yes, there are a few important things happening. Bitcoin’s special investment funds are seeing money leave them. A company called LayerZero is buying a platform called Stargate. Also, Hong Kong is bringing in new rules for banks that deal with crypto.

What do experts think about the crypto market?

Experts are sharing their thoughts on how to do well during the current crypto boom. They’re also talking about how to create a small crypto collection worth $1000 and giving advice on investing in fun meme coins.

How are people investing their money in crypto right now?

We’re seeing some big crypto players making moves. One person trading Ethereum is changing their investment to avoid losing money. Another trader had some of their Dogecoin sold off because of market changes. And a big investor sold a lot of Ethereum for a nice profit.

Are there new rules or tech changes in crypto?

Japan is planning to support new businesses that use Web3 technology. Vitalik Buterin, a co-founder of Ethereum, has ideas about how to make prediction markets more interesting. Also, stablecoins, which are cryptocurrencies tied to real-world money, are holding a lot of government money.

How are Bitcoin and Ethereum performing?

Bitcoin’s price is doing something interesting, and experts have ideas about where it’s headed. Ethereum has seen a big jump, but some think it might pull back a bit. Solana is also expected to do well compared to Ethereum and Bitcoin.