Wolfspeed News Today: Stock Soars on Silicon Carbide Breakthrough. It seems like every day there’s a new company making headlines, and this week, Wolfspeed is definitely one of them. They’ve had a major announcement about their silicon carbide tech, and the market is reacting big time. This news has sent their stock price way up, and people are talking about what this means for the future of semiconductors, especially with the AI boom. Let’s dive into what’s going on.

Key Takeaways

- Wolfspeed has commercialized its new 200mm silicon carbide material, a big step for making electronics more efficient.

- This new material has better specs, which should help factories make things faster and with fewer issues.

- Silicon carbide is seen as the future, better than old silicon chips, especially for electric cars and green energy.

- The company’s financial situation is improving with a plan to cut a lot of debt, which investors seem to like.

- While the stock is up a lot, investing in tech companies like this can be risky due to market swings and competition.

Wolfspeed News Today: Stock Soars on Silicon Carbide Breakthrough

Revolutionary 200mm Silicon Carbide Material Commercialized

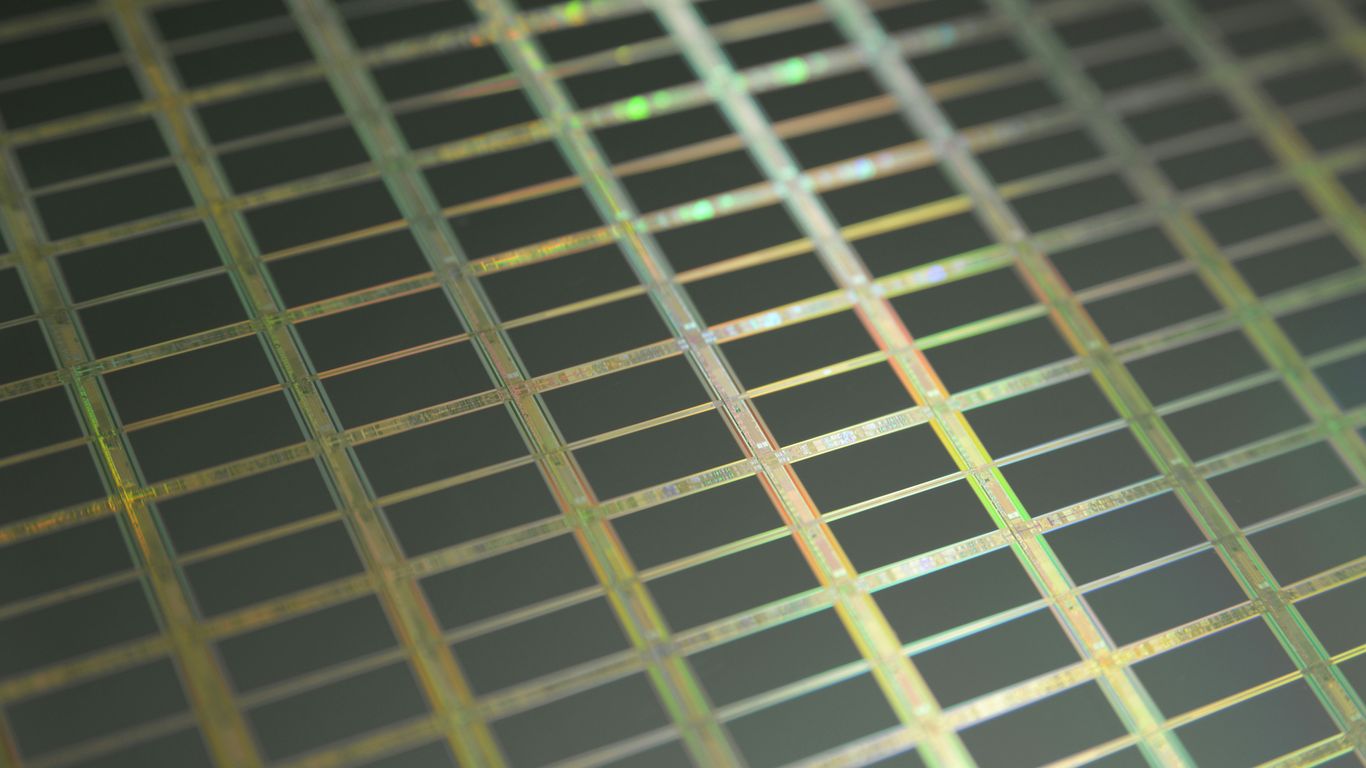

Wolfspeed just announced a pretty big deal: they’ve started selling their new 200mm silicon carbide (SiC) wafers to some customers. This isn’t just a small step; it’s a major move for the whole industry. The company is pushing hard to get everyone to switch from old-school silicon to this newer, better silicon carbide technology. Think of it like upgrading from a flip phone to a smartphone – it just does things a lot better, especially when it comes to handling power. This commercial release of their 200mm SiC materials is a big milestone, showing they can actually make this stuff at scale. You can read more about this Wolfspeed SiC materials launch on their site.

Enhanced Wafer Specifications Drive Manufacturing Efficiency

These new 200mm wafers aren’t just bigger; they’ve got some serious upgrades. They’re thinner, at 350 micrometers, and have better control over how the material is doped and how uniform the thickness is. What does that mean for manufacturers? It means they can make more good parts from each wafer, which cuts down on waste and speeds up how fast they can get new products out the door. It’s all about making the whole production process smoother and more productive. This kind of improvement is exactly what’s needed to make silicon carbide more common.

Transition to Silicon Carbide Technology Accelerates

So, why all the fuss about silicon carbide? Well, it’s way better than traditional silicon for a lot of things. It can handle higher temperatures, higher voltages, and switch on and off much faster. This makes it perfect for demanding jobs like in electric cars, renewable energy systems, and even big industrial machines. Wolfspeed’s new wafers are designed to make it easier and cheaper for companies to use SiC, which is going to speed up how quickly these industries adopt the technology. It feels like we’re on the edge of a big change in how electronics are made.

Silicon Carbide Technology Promises Industry Transformation

Advantages Over Traditional Silicon Semiconductors

So, what’s the big deal with silicon carbide (SiC) anyway? It’s basically a super-material for electronics, especially when you need things to be really efficient and handle a lot of power. Unlike the regular silicon we’ve used for ages, SiC can take the heat – literally. It works well at higher temperatures and can handle much higher voltages. This means devices can be smaller, run cooler, and use less energy. Think of it like upgrading from a regular car engine to a high-performance sports car engine; it’s just built for more demanding tasks.

Applications in Automotive and Renewable Energy

This is where SiC really shines. In the automotive world, it’s a game-changer for electric vehicles (EVs). SiC chips in EV power systems mean better efficiency, which translates directly into longer driving ranges on a single charge. No more range anxiety! Plus, they can handle the high power needed for fast charging. On the renewable energy front, SiC is perfect for solar inverters and wind turbine converters. These systems need to manage large amounts of electricity efficiently, and SiC helps reduce energy loss during conversion. It’s all about making green energy greener and more reliable.

Improved Power Handling and Reliability

When you’re dealing with serious power, you need components that won’t quit. SiC semiconductors offer superior power density, meaning they can handle more watts in a smaller package. This is a big win for designers trying to shrink down electronics. They also tend to be more reliable because they operate at lower temperatures and are less prone to failure under stress. This improved robustness is a major reason why industries are looking to make the switch from traditional silicon. It’s not just about performance; it’s about building systems that last and can be trusted, even in tough conditions.

Investor Interest Fueled by AI Industry Connection

It’s no secret that the artificial intelligence boom is changing everything, and Wolfspeed is finding itself right in the middle of it. The company makes specialized semiconductors, the tiny brains behind all the powerful computers and servers that run AI applications. Think about those massive data centers humming away – Wolfspeed’s chips are key components in their power supplies. They’re designed to be super efficient and handle a lot of power, which is exactly what these AI operations need.

Wolfspeed’s silicon carbide technology is becoming a go-to for enabling the next wave of AI infrastructure. This isn’t just about making things run; it’s about making them run better and cooler. The demand for more powerful and efficient computing is only going to grow as AI gets more advanced, and Wolfspeed seems to be stepping up to meet that need.

Here’s a quick look at why this connection is so important:

- Powering Data Centers: AI requires immense computing power, housed in large data centers. Wolfspeed’s chips help manage the electricity needed for these facilities.

- Efficiency Gains: Their silicon carbide chips use less energy and generate less heat compared to older technologies, which is a big deal when you’re running thousands of servers.

- High-Performance Needs: AI workloads are demanding. Wolfspeed’s components are built to handle these high-performance requirements reliably.

What’s also interesting is that Wolfspeed’s stock price, trading at a lower level, presents a more accessible way for everyday investors to get a piece of the AI action. It’s not always about buying the biggest names; sometimes, the companies providing the foundational technology are where the real opportunity lies. As the AI sector continues its rapid expansion, Wolfspeed’s role in providing these critical semiconductor components is definitely catching the eye of investors looking for growth.

Strategic Financial Restructuring Boosts Wolfspeed

So, Wolfspeed just pulled off a pretty big financial maneuver, and it’s got the stock market buzzing. They’ve gone the Chapter 11 bankruptcy route, but it’s not what you might think. This is a planned restructuring, a way to get their financial house in order and shed a massive amount of debt. Think of it as a strategic reset button.

Chapter 11 Filing to Slash Debt by 70%

This is the headline grabber, right? Wolfspeed is looking to cut its debt load by a huge chunk – around 70%. We’re talking about wiping out roughly $4.6 billion from their books. That’s a serious amount of money. This move is designed to make their annual interest payments much lower too, freeing up cash that can be used for, you know, running the business and developing new tech instead of just paying interest. It’s a pretty bold move, but it seems like they had a solid plan in place before filing.

Securing New Financing and Creditor Support

It’s not just about cutting debt; it’s also about getting new money and making sure the people they owe money to are on board. Wolfspeed has managed to get significant backing from its creditors, with a large majority of senior noteholders and convertible noteholders agreeing to the plan. Plus, they’re bringing in new financing, around $275 million, which is key to keeping operations running smoothly during this restructuring period. This shows that while they had financial trouble, there’s still confidence in their future.

Emergence from Bankruptcy Expected Soon

The whole point of this Chapter 11 filing is to get through it relatively quickly and come out stronger. The company is aiming to be out of bankruptcy proceedings by the end of September 2025. The idea is to emerge leaner, with a much healthier balance sheet, and ready to focus on growth and capitalizing on the demand for their silicon carbide technology. It’s a gamble, sure, but if it works, it could set them up for a much better future.

Market Dynamics and Investment Considerations

So, Wolfspeed’s stock has been doing some wild things lately, right? It’s a bit of a rollercoaster, and understanding what’s going on under the hood is key if you’re thinking about putting any money in. The recent surge, which some reports say was around 92% to 95% in pre-market trading, is definitely eye-catching. This kind of jump is often fueled by a mix of actual company news and what traders call a ‘short squeeze.’ Basically, when a lot of people bet that a stock will go down, and then it starts going up instead, they have to buy it back quickly to limit their losses, which pushes the price up even more. It’s exciting, but also super risky.

Short Squeeze and Momentum Trading Activity

This whole short squeeze situation is a big part of why the stock is moving so fast. When a stock like Wolfspeed, which has had a rough patch, suddenly gets good news – like the restructuring plan – it can catch a lot of short-sellers off guard. They scramble to buy shares, and that sudden demand can cause the price to spike dramatically. For traders who focus on momentum, this is the kind of action they look for. They jump in when they see the price rising fast, hoping to ride the wave for a quick profit. It’s all about timing and being quick on your feet. This kind of trading is not for the faint of heart, though; the same forces that push the price up can also cause it to drop just as quickly.

Volatility and Risks in Emerging Technology Stocks

Investing in companies that are pushing new technology, like Wolfspeed with its silicon carbide chips, always comes with a good dose of volatility. These aren’t your stable, blue-chip companies. They’re often smaller, and their success hinges on whether their new tech really takes off and if they can make it at a price that works. We saw Wolfspeed’s revenue dip in the first nine months of 2025, and they’ve had a net loss. Plus, there’s competition out there, especially from companies in China. So, while the potential is huge if silicon carbide becomes the standard for things like electric cars and renewable energy, there’s also a real chance things don’t go exactly as planned. The market can be unforgiving when expectations aren’t met.

Long-Term Potential Amidst Market Challenges

Despite the current bumps in the road, there’s a reason investors are paying attention. The big picture for silicon carbide is pretty bright. It’s seen as the future for high-power electronics, which are needed in electric vehicles, charging stations, and green energy systems. Wolfspeed’s focus on this area, combined with its U.S.-based manufacturing, could give it an edge, especially if government support for domestic chip production continues. The recent financial restructuring, if approved by the courts, aims to get rid of a lot of debt and bring in new money, which could give the company the breathing room it needs to focus on growth. It’s a classic case of a company trying to get its financial house in order to capitalize on a growing market. The key will be whether they can actually ramp up production and become profitable in the long run.

Wolfspeed’s Scalability and Future Growth Potential

Wolfspeed’s leadership is really talking up how they can make their silicon carbide (SiC) stuff at a big scale. Chief Business Officer Dr. Cengiz Balkas mentioned they’re all about getting quality products out there to meet the demand. It sounds like they’ve got a solid plan to ramp up production, especially with their new 200mm wafer platform. This is pretty important because it means they can actually make enough of their advanced chips for industries that are really starting to need them, like electric vehicles and renewable energy.

Think about it: making these advanced semiconductors isn’t like baking cookies. It takes a lot of specialized equipment and know-how. Wolfspeed’s focus on scaling up means they’re building a foundation for more production capacity. This is key for them to grab more market share as more companies switch over to silicon carbide technology. They’ve commercially launched their 200mm silicon carbide materials portfolio, which is a big step in making this happen.

Here’s a quick look at what makes their scalability a big deal:

- Manufacturing Efficiency: The move to 200mm wafers is designed to boost how many chips they can make and improve the quality. This helps lower costs over time.

- Meeting Demand: Industries like automotive and renewable energy are growing fast. Wolfspeed needs to be able to supply the chips they need without delays.

- Technological Edge: Their automated manufacturing process is supposed to give them an advantage in producing high-performance SiC devices consistently.

Of course, it’s not all smooth sailing. The semiconductor world is pretty competitive, and there are always supply chain headaches. But Wolfspeed’s bet on silicon carbide, especially for high-growth areas like AI and EVs, seems like a smart move. The company’s current financial situation, including a recent restructuring, is aimed at clearing the decks so they can focus on this growth. The idea is that a leaner company can invest more effectively in expanding its production and capitalizing on these expanding market opportunities. It’s a big gamble, but if they pull it off, the potential for growth is definitely there.

What’s Next for Wolfspeed?

So, Wolfspeed’s stock is definitely making waves right now, thanks to that big debt reduction plan. It feels like a fresh start, and the company is really pushing its silicon carbide tech, especially for things like electric cars and AI stuff. They’ve got this new 200mm wafer tech that could be a real game-changer. But, let’s be real, the road ahead isn’t exactly smooth sailing. There are still plenty of challenges, like competition and making sure they can actually produce enough of these advanced chips. It’s a company to keep an eye on, for sure, but maybe don’t go all-in just yet. It’s a bit of a gamble, but one that could pay off if they play their cards right.

Frequently Asked Questions

What is Wolfspeed’s big news?

Wolfspeed just announced they’ve started making their new 200mm silicon carbide (SiC) wafers available to some customers. This is a major step because these larger wafers can help make electronics better and faster, and it shows they’re moving away from older silicon technology.

Why is silicon carbide (SiC) better than regular silicon?

Silicon carbide is a tougher material that can handle more power and heat than regular silicon. This means devices made with SiC can be more efficient, last longer, and work better, especially in things like electric cars and renewable energy systems.

How is Wolfspeed connected to AI?

Wolfspeed’s special chips are used in the power supplies for the huge computer centers that run AI. These chips help make the power more efficient and reliable, which is super important for keeping AI running smoothly.

Did Wolfspeed go bankrupt?

Yes, Wolfspeed filed for Chapter 11 bankruptcy protection. But this was a planned move to get rid of a lot of their debt. They’ve secured new funding and support from their lenders, and they expect to come out of this process stronger and with less debt.

Is Wolfspeed’s stock a good investment right now?

Wolfspeed’s stock has seen big price swings. While their new technology and financial restructuring offer potential, investing in companies like this can be risky because the technology is still new and the market can be unpredictable. It’s important to do your research.

What does Wolfspeed plan to do next?

Wolfspeed is focusing on making more of their advanced silicon carbide wafers and meeting the growing demand from industries like electric vehicles and AI. They aim to use their improved financial situation to grow their production and be a leader in this important technology.