In today’s complex financial environment, where uncertainty is the norm and information overload is a daily challenge, achieving true financial peace of mind often feels like navigating a maze blindfolded. Many people have been left confused and uninterested in managing their money by the constantly growing range of investment possibilities combined with technical language and complicated advising systems. A new generation of financial service providers is developing, driven to bring clarity, simplicity, and purpose to the forefront of investment management in response to this common disconnection. Among them, X-Clarity distinguishes itself with its clear goal to change how contemporary consumers see and go through financial planning.

Though particular information on X-Clarity’s operations stay limited because of transient website inaccessibility, the company’s branding—in line with a rising “Clarity” movement within financial services—provides significant insights into its probable philosophy and strategy. Examining what distinguishes X-Clarity reveals a client-centric, open, and very tailored solution meant to enable people to confidently seize charge of their financial destinies.

A Foundation of Transparency

X-Clarity’s concept is based on a dedication to openness—a vital reaction to decades of distrust resulting from concealed fees, complicated commissions, and opaque investment methods. Especially regarding cost, X-Clarity seems to support honest communication on all facets of the financial relationship. This probably calls for accepting a fee-only remuneration system under which clients either pay a set charge or a proportion of assets under management, and advisors have no motivation to promote certain goods.

This structure guarantees that the advisor’s interests are only those of the customer, hence removing any possible conflicts of interest that can result from commission-based models. Such openness not only fosters confidence but also enables consumers to know precisely what they are paying for—and why. In a financial world sometimes obscured by uncertainty, this clarity becomes a strong differentiator.

Apart from costs, X-Transparency Clarity’s probably reaches to risk communication and investment tactics. Clients are not only told what to invest in; they are educated on the rationale, hazards, and objectives underlying every choice, hence promoting a feeling of cooperation and mutual knowledge.

Evolving With You, Tailored Financial Advice

Every person’s financial path is different. No two customers have same requirements whether they are investing for a child’s education, planning for retirement, establishing generational wealth, or executing a business exit strategy. Understanding this, X-Clarity probably approaches financial planning quite personally, spending time to grasp every client’s objectives, lifestyle choices, values, and risk tolerance.

Rather of providing one-size-fits-all answers, the company probably creates customized financial plans and investment strategies meant to change with a client’s situation over time. X-Clarity guarantees that financial plans stay in line with life changes—be it a career change, a family growth, or unanticipated market developments—by means of regular check-ins and dynamic adjustments.

Aiming away from the “set-it-and-forget-it” mentality that has characterized much of conventional financial advice, this client-centric approach Rather, it advocates a living plan—one that changes, develops, and reacts with the client at its core.

A Fiduciary Standard Building Confidence

X-Clarity’s method has another unique feature: its probable compliance with the fiduciary standard, a legal and ethical obligation to always act in the client’s best interest. Although not all financial advisors are fiduciaries, those who are—like X-Clarity—set a higher standard for integrity and responsibility.

This implies that customers can look forward to not just tailored but also unbiased counsel. Every choice is made with the client’s wellbeing as the first concern, from suggesting investments to organizing long-term strategies. Given how financial advice is delivered, this fiduciary dedication offers vital peace of mind for consumers more informed and cautious.

A Holistic Suite of Services for Comprehensive Financial Health

X-Clarity’s value proposition likely extends well beyond traditional investment management. Its holistic approach to wealth management is designed to address every facet of a client’s financial life.

This may include:

- Retirement planning with a goal-based strategy that ensures security and sustainability.

- Education planning, helping families invest in future generations.

- Estate planning and wealth transfer guidance.

- Business advisory services for entrepreneurs seeking structured financial exits or transitions.

- Philanthropy and legacy building, ensuring that values align with long-term giving strategies.

- Equity compensation management, catering to high-earning professionals navigating stock options and restricted stock units.

This comprehensive scope ensures that clients receive not only investment advice, but also broader financial stewardship tailored to their specific situation.

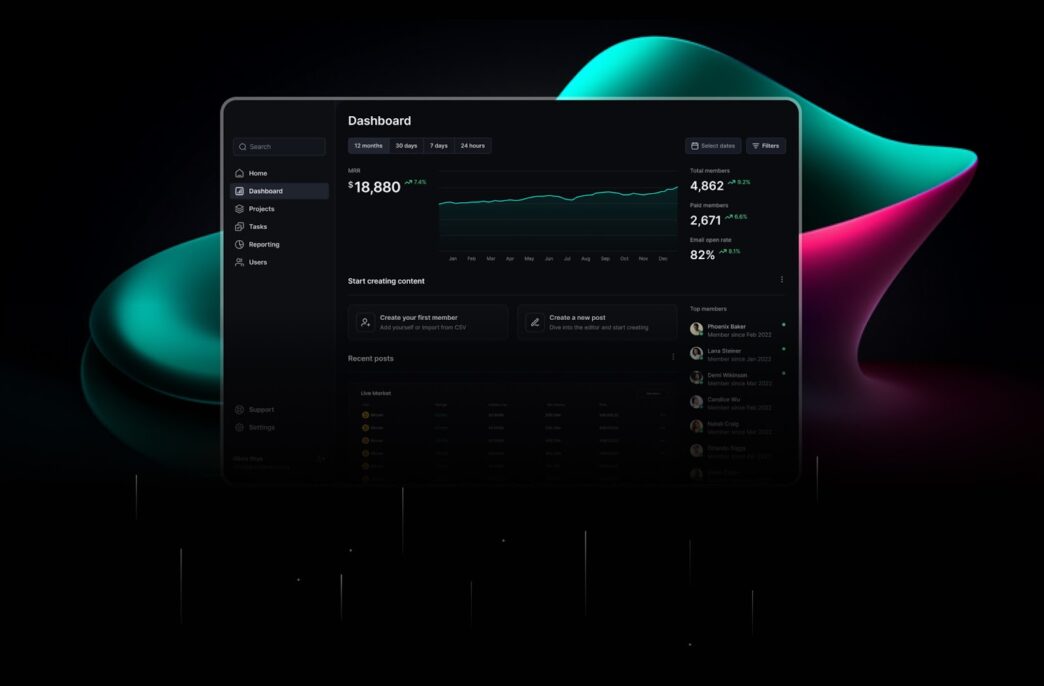

Technology That Improves, Not Replaces, Human Connection

Modern consumers want not only high-quality advice but also digital access that matches their lifestyles. X-Clarity seems to get this change and probably uses technology to provide an interactive and smooth experience.

This could include:

- Secure client portals for real-time access to accounts and documents.

- Interactive planning tools that allow clients to model different scenarios.

- Online communication channels for regular updates and meetings with advisors.

By combining tech-enabled convenience with human insight, X-Clarity seems well-positioned to serve a new generation of investors who expect clarity and connection at their fingertips.

Echoes from the Broader “Clarity” Ecosystem

Although direct testimonials for X-Clarity are few, reviews from other “Clarity” branded companies point to recurring patterns: good communication, open policies, and a client-first attitude. For example, Ameriprise-affiliated Clarity Financial Advisors rates rather well, especially for its hands-on attitude. Likewise, X-Clarity in South Africa is commended for its simple trading interface.

These instances show that, generally speaking, the “Clarity” brand has a reputation for dependability and customer empowerment. Should X-Clarity fit with these common ideals, consumers may look forward to a comparable experience defined by trust, knowledge, and proactive financial advice.

Clarity Is More Than a Name—It’s a Philosophy

X-Clarity stands out as maybe a light of simplicity and reliability in a society where the financial scene gets more complicated daily. The company’s commitment to openness, individualised planning, fiduciary responsibility, and customer empowerment seems to provide a welcome change from traditional advisory approaches.

X-Clarity sets itself as a great partner for everyone wanting to take control of their financial destiny by offering a clear and thorough road ahead rather than only financial guidance. Whether you are just beginning your wealth-building path or looking for a better, more obvious approach to control what you have created, one thing is sure: Your financial clarity starts here!

For more details, visit: http://x-clarity.com.