Keeping up with the Adani Power share price can feel like a rollercoaster sometimes, right? We’re looking at the latest numbers from both the NSE and BSE to get a clearer picture of where things stand. It’s not just about the day-to-day changes; we want to understand the bigger trends and what might be influencing the stock’s movement. So, let’s break down what’s happening with Adani Power.

Key Takeaways

- The Adani Power share price is currently around Rs 631.50, showing a slight dip from its previous close.

- Over the last three months, the stock has seen a positive movement, gaining about 13.09%, but it’s down over the past year.

- Analysts have a median target price of Rs 685.0 for Adani Power within the next 12 months, with most recommending a ‘Buy’.

- Adani Power has announced a stock split, changing the face value from Rs 10.0 to Rs 2.0, with a record date in September 2025.

- Recent financial insights show a sales de-growth of 2.28%, marking the first revenue contraction in three years, and the company has been passing profits to shareholders, though ROE has declined.

Adani Power Share Price: Current Market Snapshot

Let’s take a look at where Adani Power’s stock is trading right now. It’s always good to get a feel for the immediate market action.

Live Trading Updates

As of the latest update on September 17, 2025, around midday, Adani Power’s share price is hovering around ₹631.25. This represents a slight dip of about 0.96% from its previous closing price. The trading volume has been notable, with over 2.4 million shares changing hands so far today.

Key Price Movements

Looking at the daily trading range, Adani Power has seen its shares move between ₹640.40 and ₹666.80. This gives us a sense of the intraday volatility. It’s worth noting that the stock’s 52-week range is quite a bit wider, stretching from ₹235.85 to ₹895.85, which shows the broader swings the stock has experienced over the past year. You can check out the current stock price for more details.

Volume Analysis

Volume is a pretty important indicator for stock market watchers. High volume often suggests strong interest in a stock, whether that’s buying or selling. Today’s volume figures show a decent amount of activity, with different trading lots being reported, indicating that both retail and possibly institutional investors are engaged with the stock.

- 24,18,961 shares traded at one point.

- Another transaction block showed 2,04,150 shares.

These numbers help paint a picture of the current trading sentiment for Adani Power.

Adani Power Share Performance Over Time

Looking at how Adani Power’s stock has been doing can give you a good idea of its journey. It’s not always a straight line up, but understanding the trends helps.

Short-Term Returns

In the short term, things can be a bit choppy. For instance, over the last week, the stock might have seen a small dip, maybe around 0.50%. But then, looking at the past month, it could have bounced back, showing gains of about 8%. This kind of fluctuation is pretty common in the market, and it’s why keeping an eye on daily or weekly movements is important.

Long-Term Growth Trajectory

When we zoom out, the picture often becomes clearer. Over a three-month period, Adani Power shares have shown a decent upward movement, perhaps around 13%. However, the longer view, like the last year, might show a slight decrease, maybe around 5%. It’s interesting to see how these different timeframes tell different stories about the stock’s performance. The company’s ability to navigate market shifts is key to its long-term success. For a deeper look at its historical performance, you might want to check out Adani Power’s share price.

Historical Price Trends

Adani Power, which started back in 1996, has seen its share price move through various phases. For example, over the last three years, the stock has climbed significantly, perhaps by over 60%. Comparing this to broader market indices can also be insightful. The company’s financial health, reflected in metrics like Return on Equity (ROE), has also shown variability over the years, with some years showing very strong growth in ROE. This historical data helps paint a picture of the company’s past performance and potential future direction.

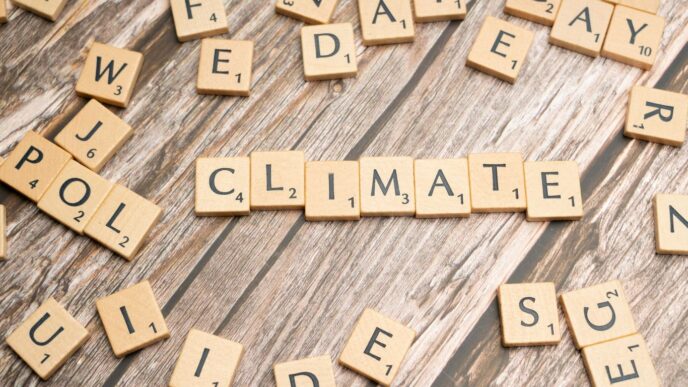

Understanding Adani Power’s Financial Health

Quarterly Earnings Review

Looking at Adani Power’s recent financial performance, the company reported a consolidated total income of Rs 14,573.70 Crore for the quarter ending June 30, 2025. This is a slight increase of 0.26% compared to the previous quarter but a decrease of 5.82% from the same quarter last year. The net profit after tax for this period stood at Rs 3,305.13 Crore. It’s worth noting that the company has seen some revenue contraction, with sales de-growing by 2.28% in the last fiscal year, marking the first such contraction in three years.

Revenue and Profitability Metrics

Adani Power’s financial health can be gauged by several key metrics. For the year ending March 31, 2025, the company spent 5.94% of its operating revenues on interest expenses and 1.4% on employee costs. While the company has shown strong profitability in recent years, there’s a trend of declining Return on Equity (ROE) over the last five years. The majority of profits from the last year were distributed as dividends to shareholders.

Here’s a look at some key financial ratios:

| Metric | FY 2021 | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|---|

| Return on Equity (%) | 26.64 | 58.79 | 69.40 | 100.67 | -6.17 |

| Interest Coverage Ratio (x) | 6.97 | 9.74 | 4.19 | 3.40 | 0.22 |

| EBITDA Margin (%) | 44.99 | 61.24 | 37.72 | 50.17 | 38.79 |

Key Financial Ratios

When we look at the broader financial picture, Adani Power’s Price to Earnings (P/E) ratio is around 19.61, and its Price to Book (P/B) ratio is approximately 4.22. The company’s Earnings Per Share (EPS) for the quarter ending June 30, 2025, was Rs 32.18. The dividend yield currently stands at 0.00%. It’s interesting to see how these figures compare to other companies in the power sector; you can find analytics on equity crowdfunding for broader market comparisons.

Analyst Outlook and Stock Recommendations

So, what are the experts saying about Adani Power these days? It’s always a good idea to see what the analysts are thinking, right? It can give you a different perspective on where the stock might be headed.

Expert Price Targets

Looking at the numbers, there are a few analysts who have put out their price targets for Adani Power. It seems like the consensus is leaning towards a potential upside, with some seeing it as a "STRONG BUY." Out of the analysts covering the stock, the breakdown looks something like this:

| Recommendation | Number of Analysts |

|---|---|

| Strong Sell | 0 |

| Sell | 0 |

| Hold | 1 |

| Buy | 2 |

| Strong Buy | 1 |

This suggests that most analysts are feeling pretty positive about the stock’s future performance.

Buy, Sell, or Hold Consensus

As you can see from the table above, the general feeling among the analysts who cover Adani Power is quite optimistic. With a majority leaning towards ‘Buy’ or ‘Strong Buy,’ it indicates confidence in the company’s prospects. However, it’s worth noting that there’s at least one analyst who currently has a ‘Hold’ recommendation. This mix is pretty common in the market, and it’s good to keep all viewpoints in mind.

Future Growth Prospects

When we look at Adani Power’s future, there are a few things that stand out. The company has seen some revenue contraction recently, which is something to watch. Also, the Return on Equity (ROE) has been declining over the past five years, and a good chunk of last year’s profits went out as dividends. On the flip side, the company’s financial health shows some solid metrics, like a decent interest coverage ratio in previous years and a good EBITDA margin. The recent stock split, changing the face value from 10.0 to 2.0, might also make the shares more accessible to a wider range of investors. It’s a bit of a mixed bag, but the overall analyst sentiment suggests they see potential for growth despite these points.

Adani Power’s Corporate Actions and Dividends

Recent Stock Splits

Adani Power has undergone a stock split, changing its face value from ₹10.0 to ₹2.0. This move was announced on August 1, 2025, with a record date set for September 22, 2025. Stock splits are often done to make shares more affordable for a wider range of investors, potentially increasing liquidity. It’s interesting to see how this impacts the share price going forward.

Dividend Payout History

Looking at dividends, Adani Power hasn’t had a history of frequent payouts. As of September 17, 2025, the company’s dividend yield stands at 0.0%. The last dividend payment date and amount are listed as null, indicating no recent distributions. This suggests the company might be reinvesting its profits back into growth opportunities.

Upcoming Board Meetings

Companies like Adani Power typically hold regular board meetings to discuss financial results and other important business matters. For instance, a board meeting was scheduled for August 4, 2025, with the purpose of reviewing quarterly results and discussing a potential stock split. Another meeting was planned for April 22, 2025, to approve audited financial results. Keeping an eye on these meeting dates can provide insights into upcoming announcements, much like how Virgin Galactic unveiled its new spaceship recently Virgin Galactic’s new spaceship.

Here’s a look at some past meeting dates and their purposes:

| Meeting Date | Announced on | Purpose |

|---|---|---|

| Sep 06, 2025 | Aug 04, 2025 | Quarterly Results & Stock Split |

| Apr 22, 2025 | Apr 14, 2025 | Audited Results |

It’s always a good idea to check the latest announcements for any changes or new information regarding these corporate events.

Shareholding Patterns and Investor Activity

When we look at who actually owns Adani Power shares, it tells a story about confidence and control. It’s not just about the price going up or down; it’s about who’s buying, who’s selling, and who’s holding on for the long haul.

Promoter Stake Details

The promoters, essentially the core group that started and manages the company, held a steady 74.96% of Adani Power shares as of June 2025. This hasn’t changed much quarter-over-quarter, which usually signals a stable hand at the helm. A small portion, about 1.81%, of these promoter shares were pledged. Pledging means the promoters have used their shares as collateral for loans, which is something investors often keep an eye on.

Institutional Investor Holdings

Foreign Institutional Investors (FIIs) and Domestic Institutional Investors (DIIs) are big players in the market. As of June 2025, FIIs held about 12.46% of Adani Power, showing a slight increase from the previous quarter. DIIs, which include mutual funds, held a smaller but also growing stake, with DIIs at 1.76% and mutual funds specifically at 1.76%. This gradual increase from institutions can be seen as a positive sign, suggesting they find the company’s prospects attractive.

Public Share Distribution

The remaining shares, around 10.82% as of June 2025, are held by the public and other entities. This category includes individual investors and other companies not classified as promoters or institutions. The slight decrease in this category from the previous quarter might indicate that some of these shares were bought by institutional investors or perhaps bought back by the company itself. It’s always good to see a diverse mix of investors, but a significant promoter stake often means strong control and commitment.

Technical Indicators for Adani Power

Looking at Adani Power’s stock through the lens of technical indicators can give us some clues about its short-term movements. These tools help traders spot patterns and potential shifts in momentum.

Moving Average Crossovers

One common signal traders watch for is when shorter-term moving averages cross over longer-term ones. For Adani Power, a recent 5-day Exponential Moving Average (EMA) crossover on the daily chart has given a bearish signal. This happened on September 16, 2025, with the 5-day EMA at 637.50. Historically, looking back over the last five years, this specific type of bearish signal has been followed by an average price decline of about 4.17% within a week. We’ve seen this pattern before, with sell signals appearing on September 11, August 26, August 21, and August 13, 2025, each followed by a short-term dip.

Another indicator, the Heikin-Ashi chart, also showed a change from green to red on September 16, 2025, suggesting a potential bearish trend. The previous close was 642.11, and the last traded price was 631.25.

Bullish and Bearish Signals

Beyond moving averages, other indicators can flash signals. The Heikin-Ashi changeover from green to red is a bearish indication. While the stock has seen positive movement since early 2005, there have been periods of negative movement, including major global events like the 2008 financial crisis and the COVID-19 pandemic.

Pivot Levels and ATR Analysis

Pivot points are calculated based on the previous day’s trading range and can act as support or resistance levels. For Adani Power, the classic pivot level is around 633.23, with resistance levels at 637.87 (R1), 644.88 (R2), and 656.53 (R3). Support levels are seen at 626.22 (S1), 621.58 (S2), and 609.93 (S3).

The Average True Range (ATR) gives us an idea of the stock’s volatility. Over the last 5 days, the ATR is around 21.00, decreasing slightly to 19.21 for 14 days and 18.15 for 28 days. This suggests that the daily price swings might be narrowing a bit.

Here’s a quick look at how Adani Power has performed against some peers:

| Name | 1 Day | 1 Week | 1 Month | 3 Months | 1 Year | 3 Years | 5 Years |

|---|---|---|---|---|---|---|---|

| Adani Power | -0.94% | -0.48% | 8.11% | 13.11% | -5.24% | 62.84% | 1606.49% |

| NTPC | 0.15% | 3.04% | -1.12% | 0.10% | -19.40% | 94.18% | 278.51% |

| JSW Energy | -0.45% | 3.59% | 1.61% | 6.81% | -28.17% | 63.25% | 811.27% |

| NLC India | -1.23% | 4.18% | 9.01% | 13.15% | -4.73% | 248.12% | 391.00% |

Wrapping Up Our Look at Adani Power

So, we’ve taken a good look at Adani Power’s stock. It’s a big player in the power generation scene, and its share price has seen some ups and downs lately, like most stocks do. We saw it drop a bit today, but over the last few months, it’s actually gone up. Analysts seem to think there’s still room for it to grow, with some giving it a buy rating. Keep in mind, though, that the company did see its sales drop a little recently, which is something to watch. Remember, this isn’t financial advice, and it’s always smart to do your own homework before making any investment decisions.

Frequently Asked Questions

What is the current price of Adani Power shares?

As of September 17, 2025, around 12:30 PM IST, Adani Power’s share price was trading at Rs 631.25. It saw a slight drop of 0.96% from its previous closing price.

How has Adani Power performed recently?

In the last three months, Adani Power shares have gone up by about 13.09%. However, over the past year, the share price has decreased by roughly 5.27%.

What is Adani Power’s market value?

Adani Power has a market value of approximately Rs 2,43,489 Crore. This places it as the third-largest company in the Power sector based on its market value.

Has Adani Power paid any dividends?

Adani Power has not paid any dividends since its start in 1996. The dividend yield is currently 0.00%.

What are analysts saying about Adani Power’s future?

Some analysts suggest a ‘Strong Buy’ for Adani Power shares. The average target price predicted by three analysts for the next year is around Rs 685.0, with a high estimate of Rs 696.0.

Are there any upcoming changes for Adani Power shares?

Yes, Adani Power has announced a stock split. The face value of shares will change from Rs 10.0 to Rs 2.0. The date for this split is set for August 1, 2025, with a record date of September 22, 2025.