Biodiesel is getting a lot of attention in 2025. It’s not just a greener fuel—it’s changing how energy markets work around the world. From stricter rules in Europe to booming demand in Asia-Pacific, the economic impact of biodiesel is showing up everywhere. Companies and governments are both trying to figure out how to make the most of this shift, but there are still plenty of challenges, like feedstock prices and new regulations. Still, with new technology and investment, biodiesel is looking like a key player in the energy transition.

Key Takeaways

- Biodiesel’s economic impact in 2025 is shaped by global policies, feedstock prices, and regional growth trends.

- Asia-Pacific and Latin America are leading market expansion, while Europe focuses on sustainability and North America balances different renewable fuels.

- Feedstock costs and availability are still the biggest hurdles for producers, making diversification and waste-based sources more important.

- New tech and integrated biorefineries are helping companies cut costs and tap into more markets, including aviation and marine fuels.

- Certification, trade rules, and policy changes remain major sources of uncertainty, but strong investment and innovation are keeping the biodiesel market resilient.

Global Market Trends Shaping the Economic Impact of Biodiesel

The biodiesel market is going through real changes right now. We’re seeing different parts of the world take very different paths, sometimes for climate reasons, sometimes for trade, but usually both. Let’s take a closer look at what’s actually going on across the globe with this fuel that’s slowly reshaping how people think about energy, transportation, and even food.

Expansion in Asia-Pacific and Latin America

There’s no denying it: Asia-Pacific and Latin America are the new hotspots for biodiesel growth. Both regions are driven by government targets, local production needs, and rising interest in clean energy. Indonesia, Malaysia, and India are rolling out mandates that keep pushing biodiesel use higher every year. In Latin America, Brazil and Argentina have found opportunity exporting to Europe and Asia, even if the politics can get messy sometimes.

- Government buy-in is the top driver of expansion in these regions.

- Latin America’s strong farm sectors power their export muscle even as exchange rates or trade disputes throw curveballs.

- Asia is blending domestic use with a growing appetite for exports, all while balancing food production demands.

- Price is always a factor, but with rising oil costs, local biodiesel makes a compelling case.

Sustainability Compliance in Europe

Europe, on the other hand, is obsessed with compliance. It’s not enough just to produce and use biodiesel—the whole process needs to meet sustainability checklists. From the feedstock (no damaging rainforests or food crops, please) to the finished product, Europe sets the bar for environmental rules. The EU’s Renewable Energy Directive, for example, sets minimum renewable energy requirements in transport, pushing up demand but also forcing changes in sourcing and reporting.

Here’s a quick look at recent changes:

| Policy | Major Requirement | Market Effect |

|---|---|---|

| RED II | Min. 14% renewable fuel in transport | Higher demand, import surge |

| ILUC Regulation | Indirect land use change limits | More waste-based imports |

- Europe is buying more waste-based biodiesel—think used cooking oil—than ever before.

- Stringent documentation rules add cost but have become non-negotiable for market access.

- There’s a slow shift away from crop-based fuels toward feedstocks like animal fats or recycled oils (see biodiesel market insights).

Balancing Biodiesel and Renewable Diesel in North America

North America, especially the US and Canada, is a tale of two fuels: traditional biodiesel and the newer, chemically refined renewable diesel (also called HVO). The US is growing both at the same time, mainly thanks to strong soybean production and a patchwork of federal and state incentives. But with more states prioritizing "drop-in" fuels that don’t require engine changes, renewable diesel is getting the investment.

- The US Renewable Fuel Standard creates steady demand for both fuels.

- Producers switch between soybean, corn oil, and used oils depending on price and policy.

- Canada is just starting to follow the US’s lead, but their market remains smaller for now.

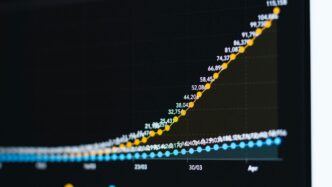

Here’s a rough snapshot of the North American market projections:

| Year | Biodiesel Market Size (USD, million) |

|---|---|

| 2021 | 7,588 |

| 2025 | 10,058 |

| 2033 | 17,673 |

- Innovation is actually centering on using more flexible, multi-feedstock refineries.

- Local supply, export potential, and advanced biorefinery integration keep the region competitive—even with price ups and downs.

From Asia’s rapid buildout to Europe’s ever-tougher standards and North America’s two-pronged approach, 2025’s global biodiesel market is anything but one-size-fits-all. Each region brings their own mix of regulation, agriculture, and ambition to the table, making for unpredictable—but genuinely interesting—market trends.

Policy Drivers and Regulatory Frameworks Influencing Biodiesel Economics

Government action pretty much sets the course for how biodiesel is produced, traded, and used today. By 2025, there’s almost a patchwork of laws and incentives pulling the industry in different directions, and if you’re a producer, you can’t afford to ignore these rules. Understanding mandates, sustainability hurdles, and the fluctuating landscape of trade and subsidies is key to making sense of the market.

Mandates and Blending Requirements

Biodiesel mandates are basically government rules that say how much biodiesel has to be mixed into regular diesel. These requirements can make or break local and global markets. For example:

- The US Renewable Fuel Standard (RFS) keeps raising the amount of biomass-based diesel needed each year.

- The European Union’s Renewable Energy Directive ramps up minimum renewable fuel content in transport.

- In Brazil, the government sets an annual minimum blend that pushes local demand.

Below is a table with a few examples for 2025:

| Country/Region | Blending Requirement (2025) | Enforcement Mechanism |

|---|---|---|

| US | 2.85+ billion gallons | Renewable Identification Numbers |

| EU | 14% transport energy | Fuel supplier penalties |

| Brazil | 14% blend (B14) | Fuel distribution monitoring |

Sustainability Criteria and Certification Burdens

Trying to keep biofuels sustainable is a big goal, but for producers, it’s complicated. Here are a few pain points:

- Producers need third-party certification (like ISCC or REDcert) to claim their exports are sustainable.

- Every region seems to have its own rules, especially Europe, where only certified waste- and residue-based fuels qualify for incentives.

- Keeping up with paperwork and audits drives up costs and, frankly, can slow business to a crawl.

If you’re exporting biodiesel to different countries, you’ll likely spend a lot of time:

- Gathering documentation for each feedstock batch.

- Juggling audits from multiple certifying agencies.

- Adjusting operations to meet ever-changing compliance rules.

Subsidies and International Trade Dynamics

Without financial help from governments, the biodiesel industry wouldn’t look anything like it does now. But those subsidies are also a double-edged sword:

- In the US, tax credits at both the federal and state levels spark investments but make profits dependent on political moods.

- Europe shifts incentives over time from promoting crop-based fuels to pushing for waste-based imports, which flips who wins and loses.

- International trade is super sensitive to rules about import duties—recent years have seen anything from anti-dumping tariffs to sudden rule changes that block or reroute big trade flows.

Just to keep things clear, here are some of the big impacts:

- Subsidies make biodiesel cheaper and more competitive with traditional diesel.

- Shifts in policy can flood some markets and dry up others overnight.

- Producers who can adapt quickly to new trade rules have the best shot at staying ahead of the pack.

Bottom line: If you’re working in biodiesel, it’s like trying to keep your balance on a shifting platform, and the rules can flip any time.

Profitability Factors and Producer Strategies in 2025

The biodiesel business in 2025 isn’t what it used to be. Companies have to be sharper than ever about where and how they make their profits. With costs jumping all over the place and technology moving fast, producers are trying everything to stay out in front. Here’s a closer look at how they’re doing it—and what’s making a difference this year.

Feedstock Diversification and Price Volatility

Feedstock is still king when it comes to costs. It usually takes up about 70–80% of total expenses for a producer, and prices can swing fast. To weather those swings, companies are:

- Sourcing from multiple crops, like soybean, palm, and used cooking oil (UCO)

- Shifting more capacity toward non-edible and waste feedstocks

- Locking in longer-term supply agreements

| Feedstock Type | Typical Cost Share (%) | Common Issues |

|---|---|---|

| Soybean Oil | 30–50 | Price volatility |

| Palm Oil | 20–40 | Sustainability debates |

| Used Cooking Oil (UCO) | 10–25 | Supply reliability |

Adapting to price changes fast is one way producers can stop a tough year from turning into a disaster.

Technological Advancements in Refineries

The newest refineries don’t look anything like the old ones. Producers are putting money into technologies, like:

- Automated process controls and digital sensors

- Advanced dry fractionation and distillation for better yields

- Flexible processing lines to move between feedstocks easily

Facilities that keep up feel less pain from energy costs and get better product every time. There’s a real gap now between plants using old versus new tech.

Integration with Oleochemical Industries

Biodiesel plants aren’t just focused on fuel anymore. A lot are lining up with the oleochemical industry—basically, anything that uses oils and fats for soaps, cosmetics, or specialty chemicals. By doing this, companies can:

- Sell by-products, like high-quality glycerine, for more cash

- Spread risks if the fuel market softens

- Aim for markets with higher prices than basic fuel alone

In short, producers in 2025 get ahead by:

- Staying flexible with feedstocks

- Upgrading their technology stack

- Teaming up with downstream partners to make the most out of every barrel

The winners are the ones who keep their costs under control and find the best value for every part of what they make.

Feedstock Availability and Sustainability Debates

Honestly, the whole discussion around where we get the oils and fats for biodiesel has become the biggest make-or-break issue for the industry in 2025. Nobody can ignore how pressing it is to figure out what we’re actually making biodiesel from—especially since both the planet and food markets are on the line.

Transition to Waste and Next-Generation Feedstocks

Over the past few years, producers have been shuffling away from just using fresh vegetable oils like soybean and palm. Instead, they’re all about so-called “advanced” feedstocks now:

- Waste cooking oil (WCO) and animal fats—these are big in Europe and North America, mainly because regulators and consumers want to lower the industry’s footprint.

- Algae: Sounds futuristic, right? It’s got crazy yield potential per acre but is pricey and complicated to scale. Labs are still working on bringing costs down so it finally makes sense for commercial use.

- Crops like Camelina or Jatropha: These aren’t food so they don’t compete for our plates, and they thrive in tough conditions where other plants won’t grow.

| Feedstock Type | Pros | Cons |

|---|---|---|

| Used Cooking Oil | Waste reuse, low cost | Collection/logistics are tough |

| Algae | Super high oil yield, scalable | Too expensive (for now) |

| Camelina/Jatropha | Non-food, low input | Limited regions, mixed yields |

Food Versus Fuel Concerns

The food vs. fuel argument keeps popping up at every conference and in every news article. Here’s what the big deal is:

- Growing crops for fuel can mean less land for food, which freaks out people worried about food prices.

- Palm and soybean oil expansions have been linked (sometimes fairly, sometimes not) to deforestation.

- Producers say they mostly use surplus or waste crops, and tech is getting better for non-food alternatives, but doubts linger.

Policymakers now often set quotas: they limit how much traditional (food-based) biodiesel can count toward renewable targets, pushing for more non-food feedstocks.

Securing Long-Term Supply Chains

It’s one thing to try new sources, but actually securing enough of them for the long haul? That’s a whole other puzzle. Biodiesel makers are juggling several challenges:

- Volatile feedstock prices—especially as food demand rises globally.

- Certification: To get access to the largest markets (like the EU), producers need proof their feedstock is sustainable, often tracked at every step—from farm or fryer to refinery.

- Logistical headaches: If you’re collecting waste oils from thousands of restaurants, it’s both time-consuming and expensive.

To keep supply steady, companies are:

- Locking in contracts with suppliers (for both crops and waste).

- Diversifying their feedstock inputs so they’re not reliant on just one market.

- Upgrading processing tech so plants can switch between different inputs depending on price and availability.

If there’s one thing clear in 2025, it’s that the debate around what goes into biodiesel isn’t going anywhere—and every shift in feedstock strategy has ripple effects for the fuel’s reputation, cost, and even global food security.

Investment and Innovation Trends Redefining the Biodiesel Market

The biodiesel landscape in 2025 is changing fast, and it’s not just about making more fuel—it’s about how smart investments and innovation are moving the market. Everyone’s after greater efficiency, more flexibility, and better margins, so companies aren’t sitting still.

Biorefinery Integration and Diversification

Enter the era of the biorefinery. Companies are moving away from single-product plants and building facilities that handle biodiesel, renewable diesel, and even biojet fuel all on the same site. The thinking is simple: if one market weakens, you still have others to keep you afloat.

- Many facilities now operate with multiple feedstocks, switching between waste oils, animal fats, or crop-based oils depending on what’s cheapest.

- By producing more than one type of renewable fuel, plants get access to a wider range of government incentives and trade partners.

- Integration makes it easier to use byproducts, like glycerin and fatty acids, for things outside of fuel—like soaps or industrial goods, boosting revenue.

| Biorefinery Output (2025 est.) | % of Facilities | Major Byproducts |

|---|---|---|

| Biodiesel only | 39% | Glycerin |

| Biodiesel + RD + SAF* | 44% | Glycerin, Biojet, Fatty acids |

| With Oleochemical Integration | 17% | Soaps, Lubricants, Additives |

| *Renewable Diesel, Sustainable Aviation Fuel |

Automation and Digitalization for Efficiency

Staying competitive means keeping costs down and running lean. Automation and digital tools are everywhere now.

- Refineries have added advanced digital monitoring, so they spot leaks and problems before they get big.

- Machine learning helps producers predict feedstock price swings so they can plan ahead or switch sources on the fly.

- Remote operations are more common, so plants need fewer people on site, which cuts labor costs.

Plants that adapt and automate are pulling ahead, while those lagging in tech are seeing slimmer profits.

Carbon Markets and Premium Opportunities

2025 brought even more buzz around carbon intensity and emissions. Why? Because the money is in the credits now:

- Producers that prove their biodiesel cuts more greenhouse gases score credits, letting them sell into premium markets like the EU or California.

- Compliance with sustainability rules (like ISCC or RSPO) means access to buyers who’ll pay extra for low-carbon, certified product.

- Some feedstocks—like used cooking oil—qualify for double-counting or higher-value credits, making them attractive despite tricky sourcing.

All this is drawing in new investors who are interested in both the financial upside and the environmental story.

In short, the biodiesel game in 2025 is about more than burning fuel—it’s about clever investment, flexible production, and riding the wave of digital and green innovation. Producers who adapt quickly don’t just stick around—they find new ways to profit.

Regional Analysis: Economic Impact of Biodiesel Across Key Markets

Understanding how biodiesel shapes economies in different areas isn’t just about numbers—it comes down to feedstock, law changes, and who’s setting the pace. Each region plays its own tune when it comes to production, market demand, and exports. Here’s how it all looks in 2025.

Growth Trajectories in North America

North America stays steady, with the U.S. leading thanks to soybean oil and continued investments in renewable diesel plants. Canada and Mexico have been catching up, but most of the money still flows from American output.

Quick Stats: North America Biodiesel Sales

| Country | 2021 Revenue (Million $) | 2025 Revenue (Million $) | CAGR (%) |

|---|---|---|---|

| U.S. | 6,081.92 | 7,990.81 | 7.06 |

| Canada | 1,009.23 | 1,416.83 | 8.85 |

| Mexico | 497.03 | 650.81 | 6.62 |

Major Shifts:

- U.S. demand for renewable diesel is almost outpacing traditional biodiesel.

- Fast adoption of feedstock-flexible refineries to handle shifting oil prices.

- Pushback on imports, especially from South America, is reshaping trade.

Europe’s Shift to Waste-Based Imports

Europe’s no stranger to big changes this year. Rapeseed was king, but now more plants run on waste oils and used cooking grease. Why? Strict laws around sustainability are forcing producers to rethink their strategies.

- Rise in certified, waste-derived biodiesel imports.

- Strong focus on environmental compliance with waste mandates.

- Policy twists make local production pricier, so imports are on the rise, especially from Asia-Pacific and South America.

Go deeper into how investment patterns differ in Europe using crowdfunding platform data.

Market Figures for Top EU Players

| Country | 2021 Revenue (Million $) | 2025 Revenue (Million $) | CAGR (%) |

|---|---|---|---|

| UK | 854.08 | 1,149.26 | 7.70 |

| Germany | 1,115.91 | 1,487.04 | 7.44 |

| France | 941.36 | 1,223.45 | 6.77 |

Asia-Pacific’s Policy-Led Expansion

Asia-Pacific’s growth is hard to ignore. Indonesia, India, and China have poured money into production and incentives. Local laws push higher blending, making these countries not just big producers but also massive consumers. Australia and Southeast Asia, meanwhile, mostly supply to global buyers.

This region sees:

- Governments enforcing blend mandates above 20% in some places

- Major investments in next-gen, multi-feedstock plants

- Fastest growth among all global regions: 2021 to 2025, China’s market almost triples

Asia-Pacific Revenue Trends

| Country | 2021 Revenue (Million $) | 2025 Revenue (Million $) | CAGR (%) |

|---|---|---|---|

| China | 2,542.09 | 3,520.44 | 8.48 |

| India | 1,958.96 | 2,714.29 | 8.50 |

| Japan | 1,348.49 | 1,835.10 | 8.01 |

What’s Driving These Changes?

- Feedstock plans: North America relies on crops, Europe wants waste, and Asia-Pacific uses both.

- Policy support: Mandates and subsidies decide which region goes fastest.

- Global trade: Exports from South America and Southeast Asia fill gaps where local supply can’t keep up.

Each area is following its own rules, but together they’re changing the game for biodiesel—sometimes competing, sometimes cooperating, but always moving the market forward.

Challenges Facing the Biodiesel Industry in 2025

The biodiesel world in 2025 isn’t all smooth sailing. I’ve seen a lot of excitement for renewable fuels, but the real-world problems just keep piling up. The top of the list? Feedstock prices swinging all over the place, expensive logistics, and a regulatory scene that’s enough to make your head spin. Here’s how these issues play out:

Feedstock Price Swings and Market Volatility

Feedstock prices—think soybean oil, palm oil, and even waste oils—aren’t exactly predictable these days. A bad harvest in South America, a sudden export ban, or trade fights? The effects go global in a heartbeat. This shocks margins for producers who can’t quickly shift gears to another raw material.

- Markets for oils and fats experience major swings, sometimes week to week.

- Biodiesel profit margins can vanish fast when feedstock prices spike.

- Trade disruptions—like sanctions, tariffs, or weather events—can make reliable sourcing a nightmare.

| Feedstock | 2024 Avg Price ($/ton) | 2025 Q3 Price ($/ton) | % Change |

|---|---|---|---|

| Soybean Oil | 1050 | 1300 | +24% |

| Used Cooking Oil | 800 | 960 | +20% |

| Palm Oil | 980 | 1125 | +15% |

High Production and Logistical Costs

Running a biodiesel plant costs more than you’d think, and the bills keep growing:

- Utilities are expensive, especially with global energy prices still high.

- Supply chains stretch for thousands of miles—hauling waste oils or crop-based feedstocks to refineries, then shipping finished biodiesel to the end user.

- Upgrades and equipment for meeting stricter traceability and sustainability standards add yet another line to the budget.

So even if the demand is there, producers can’t always crank up supply profitably. Some smaller refiners have already pulled the plug or scaled back capacity this year.

Certification Complexities and Policy Uncertainties

Don’t even get me started on paperwork. Every market—Europe, the US, Asia—demands its own eco-certifications. It’s exhausting:

- There are multiple certification systems (ISCC, RSPO, REDcert) with slightly different criteria.

- Changing rules for what feedstocks qualify as sustainable make planning hard.

- Shifting trade rules or subsidy cuts can flip the math on major investments overnight. Producers wake up to new rules, sometimes with projects already underway.

Here’s what biodiesel companies are juggling right now:

- Proving every drop of oil is traceable to an approved, sustainable source.

- Managing multi-market compliance—often for exports—juggling laws across several countries.

- Mitigating sudden subsidy or mandate changes that mess with predicted revenue streams.

So, while biodiesel is buzzier than ever in policy circles, the folks on the ground? They’re watching costs, certifications, and market signals like hawks—hoping not to get caught on the wrong side of the next curveball.

Conclusion

So, looking at where biodiesel stands in 2025, it’s clear the fuel has moved way beyond being just a backup plan for diesel. It’s now a real player in the energy market, especially as governments and companies get more serious about cutting emissions. Sure, there are still some bumps in the road—like feedstock prices bouncing around, and the rules changing from one country to the next—but the industry keeps finding ways to adapt. Producers are getting smarter, using new tech and mixing up their feedstocks to stay ahead. Plus, with more countries in Asia and Latin America jumping in, the market’s only getting bigger. At the end of the day, biodiesel is helping shape a cleaner, more flexible energy future. It’s not perfect, but it’s definitely making a difference, and it looks like it’ll keep doing so for years to come.

Frequently Asked Questions

What is biodiesel and how is it different from regular diesel?

Biodiesel is a fuel made from natural sources like vegetable oils, animal fats, or recycled cooking oil. Unlike regular diesel, which comes from petroleum, biodiesel is renewable and can be used in most diesel engines without big changes.

Why is biodiesel important for the environment?

Biodiesel helps lower pollution because it produces fewer greenhouse gases than regular diesel. It also uses waste products and plants that can be grown again, making it better for the planet.

What are the main challenges facing the biodiesel industry in 2025?

The biggest challenges include the high cost of making biodiesel, changes in the price of the materials used to make it, and complicated rules and certifications. There are also worries about using food crops for fuel instead of food.

How do governments support the growth of biodiesel?

Many governments encourage biodiesel by making laws that require fuel companies to mix in a certain amount of biodiesel, offering financial help like subsidies, and setting rules to make sure it’s made in a sustainable way.

Is biodiesel more expensive than regular diesel?

Usually, biodiesel costs more to produce than regular diesel. However, government support and new technology are helping to lower the price and make it more competitive.

What is being done to make biodiesel more sustainable?

Producers are using more waste materials, like used cooking oil and animal fats, instead of crops that could be used for food. They are also investing in better technology and ways to make the entire process cleaner and more efficient.