Office Supplies are equipment and consumable goods used in offices either by individuals involved in manual document keeping, bookkeeping, or administrative tasks and by companies, organizations, and public institutions for storage of records or information. It is important to keep an archive of records in such materials. These may include folders, file cabinets, tape, bookmarks, envelopes, and computer data. The physical forms are usually stored in boxes, racks, boxes, or cabinets.

There are different types of office supplies based on their uses. Tangible items like pens, pencils, and markers are tangible items used in daily life. But there are other important but less obvious forms of office supplies like office stationery which includes office stationery paper, envelopes, post-its, folders, cardholders, and more. Of all the categories of office supply, the most used and important is stationery. Virtually every office uses some kind of stationery in one way or another. Among the most commonly used kinds of stationery are planners, calendars, yellow pages, agendas, folders, diaries, planners, computers, typewriters, printing equipment, etc.

Most of the tangible items mentioned above are necessary for everyday use but there is certain stationery that is not necessary for office expenses. The usual office supplies include pens, pencils, markers, and highlighters. However, some companies use other specialized writing instruments like laser printers for printing company stationery and envelopes and not for other kinds of paperwork. Companies need to consider office expenses carefully because some forms of stationery are more expensive than others.

Office supplies, as the name suggests, are items used daily in offices. A pen, for example, is a must-have in every office for its utility and ease of use. It is the cheapest writing instrument and is available at any retail store. But if you find yourself buying a lot of pens because of your company’s expense on supplies, you may end up spending more than you initially thought. So make sure you are careful about buying too many pens for a given budget.

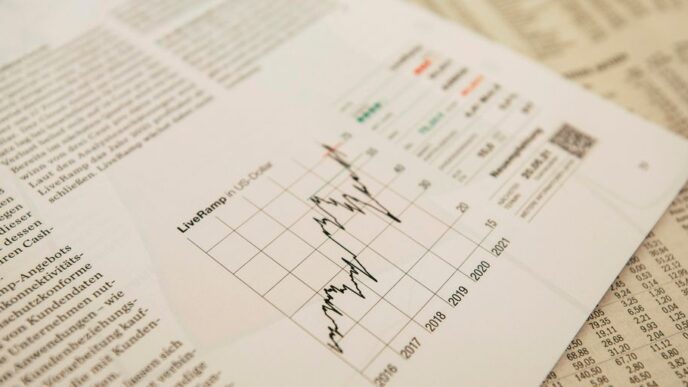

For businesses that spend a significant portion of their office expenses on supplies, having a good tax return can be crucial. It is important to track all purchases to ensure that what you bought actually covers the expenses. To this end, every business should have its own receipts and invoices so that all expenses can be properly documented. However, if the expenses are for supplies that you rarely use, it may not be feasible to keep track of your receipts and invoices. In this case, the suppliers’ address and the business tax return address of the business should be clearly indicated on the supplies’ packaging.

Every business should take note of every type of expense it incurs. This way, the owners can correctly itemize their personal and business expenses to ensure that they are entitled to a deduction on their tax returns. By doing so, they will be able to fully capitalize on the various tax deductions that are available.