The semiconductor industry is always changing, and companies are buying and merging with each other to keep up. It’s a big deal because these moves help them get better technology, reach more customers, and become stronger overall. Think of it like different companies joining forces to build the next big thing, whether it’s for your phone, your car, or even bigger systems. We’re seeing a lot of these deals happen as everyone tries to stay ahead in this fast-paced world.

Key Takeaways

- Companies are merging and acquiring others to get new technologies and expand their product lines, especially in areas like automotive and smart devices.

- Getting more manufacturing power and securing the supply chain is a major reason for recent deals, particularly with the ongoing demand for chips.

- Smaller, focused acquisitions are happening too, helping companies build specific skills for niche markets like low-power chips or edge computing.

- The semiconductor industry is seeing consolidation to speed up research and development, combining resources to innovate faster.

- Mergers and acquisitions in this sector are also about bringing in skilled people and making sure different teams can work well together after a deal.

Strategic Imperatives Driving Semiconductor Mergers and Acquisitions

The semiconductor industry is always changing, and companies are using mergers and acquisitions (M&A) to keep up and get ahead. It’s not just about getting bigger; it’s about being smart and strategic. Think of it like this: if you want to build a really advanced gadget, you don’t just grab any parts. You pick the best ones, sometimes from different suppliers, to make sure your final product is top-notch. That’s what companies are doing with M&A.

Expanding Product Portfolios Through Strategic Acquisitions

Companies are buying other companies to quickly add new products or technologies to their lineup. Instead of spending years and a ton of money developing something from scratch, they can acquire a company that already has it. This is a much faster way to get into new markets or offer a wider range of solutions to customers. For instance, a company strong in memory chips might buy a firm that makes processors to offer a more complete package for, say, data centers. It’s all about filling gaps and offering more value, which is something Padmasree Warrior, CTO of Cisco, has talked about regarding technology trends and business success. This approach helps them stay competitive and meet customer demands more effectively.

Accelerating Research and Development Via Industry Consolidation

When companies merge, they often combine their research and development (R&D) teams and resources. This pooling of talent and knowledge can speed up innovation significantly. Imagine two labs working on similar problems; when they join forces, they can share findings, avoid duplicating efforts, and tackle bigger challenges together. This consolidation can lead to breakthroughs much faster than if they worked separately. It’s a way to get more done with less wasted effort, pushing the boundaries of what’s possible in chip design and manufacturing. This is particularly important for developing technologies like AI and 5G, which require constant innovation.

Strengthening Market Presence and Operational Scale

Another big reason for M&A is to become a larger, more dominant player in the market. By combining forces, companies can increase their manufacturing capacity, improve their supply chains, and gain a bigger share of the market. This larger scale can lead to cost savings through things like bulk purchasing and more efficient operations. It also gives them more clout when dealing with suppliers and customers. Think about it: a bigger company often has more say and can negotiate better deals. This is especially true when trying to secure production capacity, a major concern in recent years. Having a stronger market presence means they can better weather economic downturns and invest more in future growth, which is key for long-term survival and success in this fast-paced industry.

Key Acquisitions Shaping the Automotive and IoT Landscape

The worlds of cars and smart devices are getting a serious tech upgrade, and a lot of that is thanks to big mergers and buyouts in the chip industry. Companies are snapping each other up to get ahead in these fast-growing areas. It’s all about making cars smarter, safer, and more connected, and making our everyday gadgets work better and use less power.

Renesas Electronics’ Focus on Automotive Sensing Solutions

Renesas has been making some smart moves, especially in the automotive sector. They picked up Steradian Semiconductors, a company that’s really good with radar tech. This is a big deal for things like self-driving cars and the systems that help drivers avoid accidents. By adding radar to their lineup, Renesas is building out a more complete package for car manufacturers who need advanced ways for vehicles to ‘see’ their surroundings. It’s not just about the main computer anymore; it’s about all the sensors working together.

Infineon’s Expansion into Automotive and IoT Markets

Infineon made a pretty significant splash when they acquired Cypress Semiconductor. This wasn’t just a small purchase; it was a major step to beef up their presence in both the automotive and the Internet of Things (IoT) spaces. Think about all the connected cars and smart home devices out there – Cypress had some really good tech for that, especially in connectivity and memory. Now, Infineon has a much stronger hand to play in supplying the chips that make these complex systems tick.

Dialog Semiconductor’s Role in Smart Device Technologies

When Renesas Electronics bought Dialog Semiconductor, it was a clear signal about where the industry is headed. Dialog was already known for its power management chips, which are super important for battery-powered gadgets like smartphones and wearables. This acquisition helps Renesas get a bigger piece of the pie in the booming IoT market. It means they can offer more integrated solutions for smart devices, making them more efficient and capable. The trend is definitely towards chips that can do more, use less power, and connect everything.

Navigating the Complexities of Global Regulatory Environments

So, when semiconductor companies decide to merge or buy another company, it’s not just about the business side of things. There’s a whole other layer of rules and regulations to deal with, and honestly, it can get pretty complicated. Different countries have their own sets of laws about this stuff, and trying to keep track of it all is a big job.

Antitrust and Geopolitical Challenges in Cross-Border Deals

One of the biggest hurdles is making sure the deal doesn’t create a monopoly or unfairly push out competitors. Think of it like this: if one company suddenly controls too much of the market, it can make it harder for new companies to start or for existing ones to compete. Regulatory bodies in places like the U.S. and Europe really watch these deals closely. They want to see proof that the merger won’t hurt competition or consumers. This means companies have to do a lot of homework, showing how their combined business will still be fair to everyone. Plus, with semiconductors being so important for national security these days, governments are paying extra attention to who owns what, especially when companies from different countries are involved. It’s not just about business anymore; it’s about technology control and international relations. This increased scrutiny means that even smaller deals, the ones that might have flown under the radar before, are now getting a closer look. It’s a shift that affects how companies approach tech M&A in general.

Ensuring Compliance with International Standards

Beyond just competition rules, there are other regulations to consider. Intellectual property, or IP, is a huge deal in the chip world. Companies have to make sure that when they merge, they aren’t just grabbing up patents in a way that stifles innovation. They need to be clear about who owns what and that everything is above board. Then there are environmental rules. Factories and manufacturing processes can have an impact, so companies need to show they’re following the environmental guidelines, no matter where they operate. It’s a lot to manage, making sure you’re playing by the rules in every country you do business in.

The Impact of Regulatory Scrutiny on Deal Success

All these regulations can really slow down a deal, or even stop it altogether. Companies have to be prepared for long investigations and be ready to make changes to their plans to satisfy regulators. Sometimes, deals get restructured, or certain parts are sold off to get approval. It’s a balancing act. You want to grow and get bigger, but you have to do it within the legal and regulatory framework. Getting this right is key to making sure the merger actually works out in the long run and doesn’t end up causing more problems than it solves.

Addressing Supply Chain Resilience Through Strategic Consolidation

The semiconductor industry, as we all know, has been through a bit of a rough patch lately with those chip shortages. It’s made everyone think about how we actually get these tiny, important pieces of tech made and delivered. Mergers and acquisitions (M&A) are one way companies are trying to make things more stable. When big companies buy smaller ones, or when two companies join forces, they often look at their whole supply chain – from getting the raw materials to shipping the final product – and try to make it work better.

Intel’s Acquisition of Tower Semiconductor for Manufacturing Capacity

So, Intel made a pretty big move by acquiring Tower Semiconductor. The main idea here was to beef up Intel’s own manufacturing capabilities, especially for chips that other companies design but need someone else to make. Think of it like a restaurant buying a farm to get fresher ingredients directly. This deal was all about getting more control over production and making sure they could meet demand, which is a big deal when everyone’s scrambling for chips. It also means Intel can offer more services to a wider range of customers, potentially smoothing out some of the bumps in the supply chain.

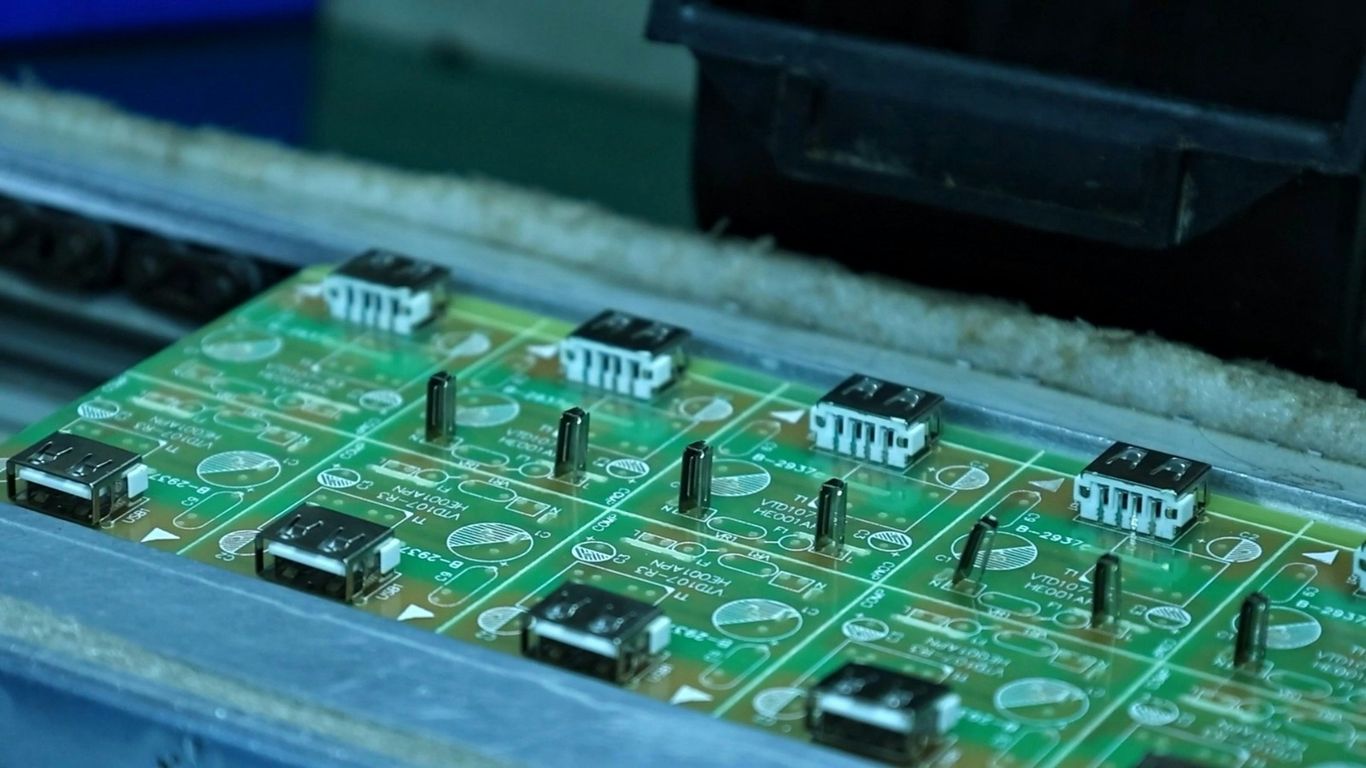

On Semiconductor’s Strategic Manufacturing Facility Acquisitions

On Semiconductor has also been busy buying up manufacturing plants. Instead of just buying another company outright, they’ve been more focused on acquiring specific facilities. This is a bit like buying a specialized tool instead of a whole workshop. It lets them add capacity where they need it most, whether that’s for power management chips or sensors, which are super important for things like electric cars and smart devices. By picking up these plants, they’re trying to secure their own production lines and reduce reliance on others, which is smart when you consider how easily things can get disrupted globally. It’s a way to build up their own strength and reliability.

Securing Production Capacity Amidst Global Chip Shortages

Ultimately, all these moves – the big mergers, the targeted facility buys – are about making the supply chain tougher. When there are fewer companies, or when companies have more control over their own factories, it can help prevent those widespread shortages we’ve seen. It’s not just about making more chips, but about making the whole process more predictable. Companies are also looking at how to manage their inventory better, maybe by having more parts on hand or working more closely with their suppliers. It’s a complex puzzle, but these M&A activities are a significant part of the strategy to build a more robust system for the future. You can find more on how companies manage their operations by looking at field service organizations.

The Rise of Specialized Acquisitions in Niche Markets

It’s not all about getting bigger for the sake of it, you know? Sometimes, the real smart moves happen when companies focus on specific areas. We’re seeing a lot more of this lately in the semiconductor world. Instead of just buying up huge companies, firms are making smaller, more targeted purchases to grab specific technologies or skills. Think of it like collecting rare trading cards instead of just buying a whole pack hoping for the best. This approach lets companies quickly get up to speed in new areas without having to build everything from scratch, which can take ages and cost a fortune.

Lattice Semiconductor, for instance, has been doing this for a while. They’ve been picking up smaller companies that are really good at low-power FPGAs. These are the kinds of chips you find in devices at the ‘edge’ – like smart sensors or cameras – and they’re super important for things like AI. By buying these specialized outfits, Lattice is building up its strength in these growing markets. It’s a smart way to stay ahead of the curve. They’ve really carved out a spot for themselves in areas like telecommunications and factory automation.

Then you have companies like Central Semiconductor. They might not be household names, but they’ve been involved in deals that focus on very specific needs, particularly for cars and industrial equipment. These kinds of acquisitions might not make huge headlines, but they are vital for making sure the right kinds of chips are available for these specialized jobs. It’s all about filling those specific gaps in the market.

Here’s a quick look at why these niche acquisitions are so important:

- Speed to Market: Companies can get new products or features out much faster by acquiring existing technology.

- Access to Talent: Often, these smaller companies have brilliant engineers with unique skills that are hard to find elsewhere.

- Reduced Risk: Focusing on a niche market can be less risky than trying to compete across the board with much larger players.

- Innovation Boost: Bringing in new ideas and technologies from outside can spark fresh innovation within the acquiring company.

It’s a different kind of strategy, but it’s definitely paying off for many. It shows that in the fast-moving tech world, sometimes the best way forward is to be precise and focused. You can see how this trend fits into the broader picture of how technology is changing, with things like advanced computer features becoming more common.

Talent Acquisition and Workforce Integration in Semiconductor Mergers

When semiconductor companies decide to join forces, it’s not just about combining balance sheets or product lines. A huge part of the puzzle, and honestly, one of the trickiest bits, is bringing the people together. You’ve got two sets of employees, often with different ways of doing things and unique skill sets, and the goal is to make them work as one cohesive unit. It’s a big undertaking, for sure.

Harmonizing Corporate Cultures Post-Acquisition

This is where things can get really interesting, or really messy. Every company has its own vibe, its own unwritten rules about how things get done. Think about it: one company might be super formal, with strict hierarchies, while another is more laid-back and collaborative. Trying to blend those can be tough. The key is to find common ground and build a new culture that respects the best parts of both. It’s not about one company dominating the other; it’s about creating something new and better. This often involves a lot of open communication, understanding what makes each culture tick, and being willing to adapt. Sometimes, you see companies create new shared values or mission statements that everyone can get behind. It’s a process that takes time and a lot of effort from leadership to make sure everyone feels included and valued.

Retaining and Integrating Diverse Talent Pools

Semiconductor work requires some seriously specialized knowledge. We’re talking about folks who are experts in chip design, advanced manufacturing processes, and all sorts of complex engineering. When a merger happens, acquiring that talent is often a major reason for the deal in the first place. The challenge then becomes keeping those skilled people on board and making sure they can share their knowledge effectively. This might mean setting up special training programs or pairing up experienced people from both companies on new projects. It’s about making sure that the combined company benefits from all the brainpower it just acquired. You don’t want to lose that critical know-how just because people felt left out or didn’t see a place for themselves in the new setup. It’s important to remember that these are the people who drive innovation, so keeping them happy and engaged is a top priority. For more on how companies manage these complexities, you can look at how firms handle legal compliance challenges.

The Strategic Importance of Workforce Synergy

Ultimately, the success of any merger in this industry really boils down to how well the people come together. If you can get everyone working towards the same goals, sharing ideas, and supporting each other, that’s when the real magic happens. It’s about creating a team that’s stronger than the sum of its parts. This synergy can lead to faster innovation, better problem-solving, and a more resilient company overall. Think about it like building a sports team: you need players with different skills, but they all have to play well together to win. In the semiconductor world, that means:

- Clear Communication: Keeping everyone informed about what’s happening and why.

- Shared Goals: Making sure everyone understands the new company’s direction.

- Mutual Respect: Valuing the contributions and backgrounds of all employees.

- Opportunities for Growth: Providing pathways for career development within the combined entity.

Getting this right means the new, larger company can really hit the ground running and tackle whatever challenges come next in the fast-paced semiconductor market.

The Influence of AI and Edge Computing on Semiconductor M&A

Artificial intelligence is really changing the game for chip companies, and you see it everywhere in mergers and acquisitions these days. It’s not just about making faster chips anymore; it’s about making chips that can actually think and process information right where the action is happening. This push towards smarter, more distributed computing is driving a lot of the deal-making we’re seeing.

Companies are actively buying up smaller firms that have figured out how to build chips specifically for AI tasks. Think about it: training these massive AI models takes a ton of processing power, and then running AI applications on devices like your phone or in a car needs specialized, efficient chips. So, you have big players snapping up companies with unique AI architectures or software that makes AI run better on silicon. It’s a way to get that specialized know-how without spending years building it from scratch. For instance, the semiconductor industry is undergoing significant consolidation in 2025, fueled by the immense demand for AI capabilities. This trend is reshaping the market landscape.

Beyond the big data centers, there’s a huge move towards

Looking Ahead

So, what does all this mean for the future? It’s pretty clear that mergers and acquisitions aren’t just a passing trend in the chip world; they’re a fundamental way companies are trying to keep up. Whether it’s grabbing new tech, getting a better handle on manufacturing, or just trying to make sure they have the right people on board, these deals are changing the game. We’ve seen how Intel is beefing up its manufacturing and how Renesas is focusing on car tech. It’s all about adapting to what customers want now and what they’ll want next, especially with things like AI and smarter cars becoming more common. Keeping an eye on these moves is key to understanding where the whole tech industry is headed.

Frequently Asked Questions

Why do chip companies buy other chip companies?

Chip companies buy others to get bigger, make more kinds of chips, or get new technology faster. It helps them sell more and be more competitive, like getting new tools for their toolbox.

How do these company sales change the chip market?

When companies join forces, there are fewer companies making chips. This can mean more power for the remaining companies, which might change prices or how quickly new ideas come out.

Does buying other companies help chip makers invent new things?

Yes, often. By combining their smart people and research, companies can often invent new chips and technologies more quickly than they could alone. It’s like putting two research teams together.

What happens to the workers when companies merge?

It can be tricky. Companies try to keep the best workers from both sides. They need to make sure everyone works well together, even if they used to work for different companies with different ways of doing things.

Are there rules that stop these company sales?

Yes, governments often look closely at these deals. They want to make sure one company doesn’t become too powerful, which could hurt customers or stop new inventions from happening. They check if the deal is fair.

How do companies make sure they have enough chips to sell?

Sometimes, companies buy factories or other companies that make chips to ensure they have enough production. This is especially important when there’s a big demand for chips, like for cars or phones.