The healthcare industry is changing fast in 2025. Things like private equity, new ways of paying for care, and digital tools are really shaping how hospitals and doctor’s offices work together. If you’re a doctor thinking about selling your practice, or just want to understand what’s happening, knowing about these mergers and acquisitions healthcare trends is super important. It’s a busy time, and being prepared can make all the difference.

Key Takeaways

- Private equity firms are buying up doctor’s offices, especially in popular specialties, to make them bigger and run them more efficiently. This can be a good chance for doctors to get money out of their practice, but they need to check the details carefully.

- How well a practice does in value-based care is now a big deal when it comes to buying or selling. If you can show you’re good at managing patient health and keeping costs down, your practice might be worth more.

- Digital health tools and AI are hot areas for mergers. Companies that make new health tech are being bought by bigger players who want to get ahead with technology.

- Many healthcare groups are joining forces or buying others to become stronger and handle unexpected problems better. This includes expanding into new areas or offering more types of services.

- There’s more government checking of healthcare deals now. It’s also really important to think about how different company cultures will mix and to do your homework before any deal happens.

Private Equity’s Growing Influence on Physician Practices

It’s no secret that private equity (PE) has been making some serious waves in the healthcare world, and 2025 is no different. We’re seeing a big jump in how much PE firms are involved with doctor’s offices and clinics. Think dermatology, orthopedics, cardiology – these areas are particularly hot right now. Why? Well, it’s a mix of things. The healthcare system is still pretty spread out, meaning there are lots of smaller practices that are ripe for consolidation. Plus, many of these specialties bring in steady money, which is always a plus for investors looking for a return. After the pandemic, some practices are still getting back on their feet financially, making a partnership or sale seem like a good idea.

Strategic Consolidation for Scale and Efficiency

One of the main reasons PE firms are buying up practices is to make them bigger and run them more smoothly. It’s like taking a bunch of small shops and turning them into one big chain. This consolidation helps in a few ways:

- Better Bargaining Power: When you have more practices under one umbrella, you can negotiate better deals with insurance companies and suppliers. It’s a numbers game, really.

- Streamlined Operations: PE firms often bring in their own management expertise to handle things like billing, scheduling, and IT. This can free up doctors and nurses to focus more on patient care instead of paperwork.

- Cost Savings: By centralizing administrative tasks and sharing resources, these larger groups can often reduce their overall operating costs.

Attractiveness of Specialty Practices to Investors

Certain medical specialties are just more appealing to investors than others. It often comes down to the predictability of revenue and the potential for growth. Practices that offer specialized, often elective, procedures tend to have more stable income streams. They might also have higher profit margins compared to more general medical services. This makes them a safer bet for PE firms that are looking for consistent returns on their investment. It’s not just about the money, though; it’s also about the potential to grow these practices by adding more locations or services.

Physician Opportunities in Private Equity Partnerships

For doctors, partnering with a PE firm can offer a way to get some cash out of their practice without completely walking away from medicine. It’s a chance for a liquidity event, meaning they can sell part of their ownership and get paid. Often, doctors stay on to run the clinical side of things, and they might even get a stake in the larger, combined company. This can provide them with:

- Access to Capital: The PE firm can provide funds for new equipment, technology upgrades, or expansion into new areas.

- Reduced Administrative Burden: As mentioned, the PE partner usually handles the business management, letting physicians focus on patient care.

- Potential for Future Growth: By being part of a larger, well-funded entity, physicians might see their practice grow and evolve in ways that wouldn’t be possible on their own.

However, it’s super important for physicians to look closely at any deal. Understanding who makes the decisions, how everyone gets paid, and what the long-term plan is can prevent headaches down the road. Making sure everyone’s goals align is key.

Value-Based Care as a Key Transaction Driver

The way healthcare providers get paid is really changing, and this is a big deal for mergers and acquisitions in 2025. We’re seeing a definite move away from just paying for services to paying for actual results and keeping people healthy. Think accountable care organizations, Medicare Advantage plans, and other models where providers share in the risk. It’s not just a nice-to-have anymore; it’s becoming standard practice. Buyers and investors are looking for organizations that are good at managing patient populations, using data well, and can handle these risk-based payment setups. This shift means that how ready a company is for value-based care is now a major factor in how much it’s worth during a deal.

Impact on Deal Valuations and Due Diligence

Because of this move to value-based care, the way deals are valued is changing. Companies that have solid systems for coordinating patient care and strong data analytics platforms are getting higher offers. Buyers are digging deeper into how well these organizations actually manage patient outcomes and control costs. It’s not enough to just offer services; you have to show you can do it efficiently and effectively.

Organizational Readiness for Risk-Based Contracting

Getting ready for risk-based contracts involves a few key things:

- Data Infrastructure: You need systems that can collect, analyze, and report on patient data accurately and efficiently. This includes tracking outcomes, costs, and patient satisfaction.

- Care Coordination: Building teams and processes that work together to manage a patient’s journey across different care settings is vital. This means breaking down old ways of doing things and getting everyone on the same page.

- Population Health Management: Developing strategies to keep entire groups of people healthy, not just treating them when they’re sick, is becoming a core capability. This often involves preventative care and managing chronic conditions.

Differentiating Through Performance and Outcomes

For healthcare organizations, this trend is a chance to stand out. If your practice or system has a proven track record of reducing hospital readmissions, cutting down on unnecessary procedures, or effectively managing long-term illnesses, you’re going to be a much more attractive target for buyers. Or, you might be in a strong position to lead a merger yourself, bringing in others who are still trying to catch up. It’s about showing real results and proving you can deliver quality care at a lower cost.

Digital Health and AI: The New Frontier for Mergers

It’s pretty wild how fast things are changing in healthcare, right? Especially with all the new tech popping up. For 2025, it looks like digital health and AI are really becoming the hot spots for mergers and acquisitions. Think about it – companies that have figured out cool new ways to use tech to help people get healthier are suddenly super attractive to bigger players. It’s not just about digitizing old processes anymore; it’s about creating genuinely new ways to care for people, making it more about the patient and less about just going to a doctor’s office.

Acquisition of Innovative Health Tech Platforms

We’re seeing a lot of movement where larger healthcare organizations, like big hospital systems or insurance companies, are buying up smaller tech startups. These startups often have unique software or clever ways to get patients involved in their own care. It’s like they’re buying a shortcut to becoming more modern and efficient. For example, some companies are getting bought because they’ve developed really good systems for managing chronic illnesses using technology, or for letting people get care at home. It’s a way for these bigger companies to quickly add new capabilities without having to build them from scratch. It’s a smart move if you want to keep up with how healthcare is changing. We’re seeing deals where companies are buying up platforms that help automate tasks or connect different health systems better, especially those that support value-based care models. It’s all about getting more bang for your buck and improving how care is delivered.

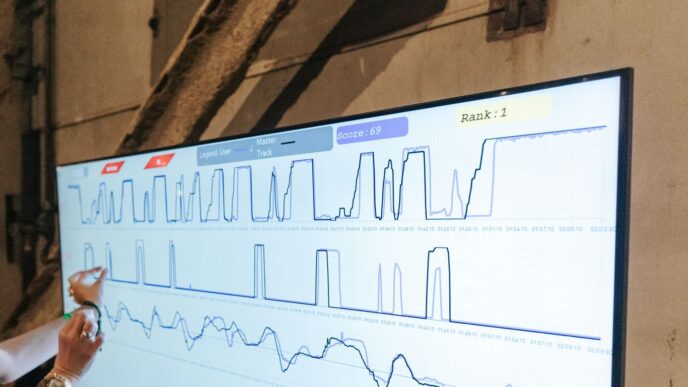

AI-Driven Diagnostics and Digital Therapeutics

Artificial intelligence is starting to play a much bigger role, too. Think about AI helping doctors spot diseases earlier or developing new treatments that are delivered digitally, like apps that help manage mental health or chronic conditions. These kinds of innovations are becoming prime targets for acquisition. Companies that can show their AI tools actually improve patient outcomes or make care more affordable are really catching investors’ eyes. It’s not just about having the tech; it’s about proving it works and can be scaled. For instance, there are deals happening where eye care companies are buying up AI platforms to combine vision care with advanced diagnostics and treatments. This shows a trend of bringing different parts of healthcare together with technology to create a more complete patient experience. It’s a big shift from just treating problems to actively preventing them and managing health proactively.

Cybersecurity as a Critical Due Diligence Factor

Now, with all this new tech and data flying around, cybersecurity has become a really big deal in these mergers. If a company has weak security, it can be a massive problem. A data breach can completely derail a deal or lead to huge costs down the road. Buyers are definitely looking closely at how well companies protect patient information. If your practice uses electronic health records, telehealth, or AI tools, expect potential buyers to ask a lot of questions about your security measures. A shaky cybersecurity setup could actually lower the value of your business or even stop a deal from happening altogether. It’s a good idea to get your cybersecurity in order before you even start thinking about selling or merging. Making sure you’re compliant with rules like HIPAA and have clear plans for what to do if there’s a breach is super important. It’s all part of making sure the deal is solid and doesn’t come back to bite you later. This focus on security is just another sign of how complex these deals are becoming, and why having good advisors is so important. You want to make sure you’re making a smart move for the future of your practice, and that includes protecting your patients’ data. It’s like getting ready for a big trip; you wouldn’t leave without checking your vehicle’s maintenance first, and in healthcare M&A, cybersecurity is that essential check.

Consolidation Strategies for Enhanced Resilience

It feels like everyone in healthcare is talking about mergers and acquisitions these days, and for good reason. Beyond just getting bigger, a lot of organizations are looking at combining forces to become tougher, you know, more resilient in this changing market. It’s not just about surviving; it’s about thriving.

Expanding Geographic Reach and Patient Populations

One of the most straightforward ways to build strength is by spreading out. Think about it: if you’re a practice in one city, merging with or acquiring a group in a neighboring town suddenly gives you access to a whole new set of patients. This isn’t just about more bodies in beds or chairs; it’s about building a broader network that can better serve a larger community. It also helps spread out risk. If one area faces an economic downturn or a specific health crisis, having a presence elsewhere can keep the whole operation stable. It’s like not putting all your eggs in one basket. Many are looking at acquiring smaller practices to achieve this wider reach.

Diversifying Services Across Care Settings

Another smart move is to offer more types of care in different places. Instead of just having a hospital, a system might buy or partner with an urgent care clinic, a home health agency, or even a specialized outpatient surgery center. This creates a more complete picture of care for patients. They can go to the urgent care for a quick fix, the hospital for something serious, and then get follow-up care at home. This integrated approach not only makes things smoother for patients but also gives the organization more ways to earn revenue and manage patient health over time. It’s about being there for patients at every step.

Horizontal and Vertical Integration Trends

We’re seeing a couple of main ways this consolidation is happening. Horizontal integration is when similar types of organizations join up, like a big hospital system buying another hospital, or a large doctor’s group acquiring smaller, independent practices. This often leads to economies of scale, meaning they can do things more cheaply because they’re doing more of them. Vertical integration, on the other hand, is when different parts of the healthcare supply chain come together. For example, a hospital might acquire a medical device supplier or a pharmacy. This can help control costs and make sure they have the resources they need when they need them. Both strategies aim to create a more robust and efficient organization that can better handle whatever comes its way.

Navigating Regulatory Scrutiny and Deal Challenges

So, dealing with mergers and acquisitions in healthcare these days? It’s not exactly a walk in the park. You’ve got regulators keeping a really close eye on things, especially when bigger players are involved. The Federal Trade Commission (FTC) and the Department of Justice (DOJ) are definitely paying attention, and they’re not shy about stepping in if they think a deal might mess with competition. This means even smaller transactions could get flagged if they seem to limit choices for patients in a specific area. It’s a good idea to get legal advice early on to figure out any antitrust risks and to build a solid case for why your deal is actually good for the market.

Increased FTC Review of Healthcare Transactions

The government is really scrutinizing healthcare deals more than before. They’re worried about big companies getting too big and potentially squeezing out smaller providers or limiting patient options. This means that if you’re looking to buy a practice or merge with another group, you need to be prepared for a longer review process. They’ll be looking at how your deal might affect prices, quality of care, and access for patients. It’s not just about the size of the deal, but also about the specific market it impacts. Understanding healthcare M&A trends for 2025 is key here, as the regulatory landscape is a big part of those trends.

Mitigating Risks of Cultural and Financial Integration

Beyond the regulatory hurdles, actually merging two organizations is a whole other ballgame. You’ve got the financial side, making sure the numbers add up and the new entity is stable. But just as important, if not more so, is the cultural fit. Think about it: different ways of doing things, different staff expectations, different patient interaction styles. If you don’t get the culture right, the whole deal can fall apart, no matter how good the finances look. Buyers are really looking at how well teams will stick around and if everyone can work together smoothly. It’s smart to think about how you’ll keep your staff happy and involved during and after the transition. Things like retention bonuses and clear communication plans can make a big difference.

Importance of Strategic Clarity and Due Diligence

When you’re looking at a deal, you really need to know exactly why you’re doing it. What’s the end goal? Is it to grow bigger, offer more services, or get into a new area? Having that clear strategy from the start helps you make better decisions throughout the whole process. And due diligence? It’s not just a formality. It’s about digging deep into everything – the finances, the operations, the legal stuff, and yes, the culture. You need to be prepared for what you find, both the good and the bad. This thorough check helps you avoid nasty surprises down the road and makes sure you’re not overpaying or taking on too much risk. It’s all about being prepared and knowing what you’re getting into before you sign on the dotted line.

Divestitures Creating New Market Opportunities

Big healthcare companies are doing some serious house-cleaning in 2025. They’re looking at their portfolios and deciding what’s really working and what’s not. This means some parts of their businesses, especially those that aren’t growing much or don’t fit the main plan, are being sold off. Think of it like decluttering your house – you get rid of things you don’t need to make space for what you do. This trend is partly because of money pressures and the general uncertainty in the market. Companies are trying to free up cash to put into areas that have more promise. It’s a way to streamline operations and get ready for a market that might keep changing.

Large Systems Shedding Non-Core Assets

Many large healthcare systems and pharmaceutical giants are actively reviewing their business units. They’re identifying and divesting assets that have limited strategic alignment or are experiencing slower growth. This isn’t just about cutting losses; it’s a strategic move to concentrate resources on core competencies and high-potential growth areas. For instance, some companies are spinning off divisions that are heavily impacted by trade policies or regulatory shifts, aiming to reduce exposure to market volatility. This portfolio optimization allows them to reinvest in innovation and areas with better long-term prospects. It’s a smart way to stay agile in a complex environment. We’re seeing this play out with companies like Becton Dickinson and Teva, who have been making significant moves to reshape their businesses by selling off certain units. This is a key part of how they’re preparing for a future that’s likely to see continued shifts in trade and reimbursement.

Regional Expansion Through Practice Acquisitions

When larger entities divest, it often opens doors for others. Smaller or regional players can step in and acquire these divested practices or business lines. This is a fantastic opportunity for them to expand their geographic footprint and patient base without having to build everything from scratch. It’s a more efficient way to grow. For example, a regional health system might acquire a group of specialty practices that a national company is selling off. This allows the regional system to enter new markets or strengthen its presence in existing ones. It’s a win-win: the seller exits an asset they no longer prioritize, and the buyer gains immediate market access and a new patient population. This kind of strategic acquisition is a common way for healthcare providers to grow their reach and service offerings. Healthcare M&A activity in Q2 2025 showed a blend of strategic growth and careful optimism, with investors focusing on high-demand specialties, indicating continued interest in specific sectors despite broader market conditions [e8b9].

Preparing Practices for Deeper Buyer Due Diligence

If you’re a practice owner thinking about selling, or if you’re a buyer looking at divested assets, it’s important to know that due diligence is getting more thorough. Sellers need to have their house in order. This means having clear financial records, well-documented operational processes, and a solid understanding of their market position. Buyers are digging deeper to make sure they understand all the risks and potential. They want to see evidence of strong patient outcomes, efficient operations, and a clear path for future growth. For sellers, this means being proactive. Get your financials organized, understand your key performance indicators, and be ready to answer tough questions. It’s not just about the numbers; buyers are also looking at the culture of the practice and how well it might integrate with their own. Being prepared for this level of scrutiny can make the difference between a smooth sale and a deal that falls apart. It’s about showing that your practice is a sound investment, ready for its next chapter with a new owner.

Looking Ahead

So, as we wrap up our look at healthcare mergers and acquisitions for 2025, it’s clear things are really shifting. Private equity is still a major player, especially when it comes to doctor’s offices, and the move towards paying for good patient outcomes rather than just doing procedures is changing how deals are made. Digital health and AI are also big areas where companies are looking to buy or partner up. It’s a complex time, for sure, with new rules and economic factors to consider. But for those who can plan carefully and get good advice, there are definitely opportunities to grow and improve how we deliver care. It’s not just about getting bigger; it’s about getting smarter and more connected in the healthcare world.

Frequently Asked Questions

Why are big companies, like private equity firms, buying up doctor’s offices?

Private equity firms are buying doctor’s offices to make them bigger and run them more smoothly. They see certain doctor’s offices, especially those that focus on specific areas like skin or bone health, as good investments. These firms can offer doctors a way to get money for their practice while still being involved in patient care.

How does the way we pay for healthcare affect buying and selling practices?

The healthcare system is moving towards paying doctors based on how well they take care of patients, not just how many services they provide. This means that when companies buy or merge with practices, they look closely at how good the practice is at managing patient health and keeping costs down. Practices that do well in this area are more valuable.

What role do technology and AI play in healthcare mergers?

Technology and artificial intelligence (AI) are becoming very important. Companies are buying tech businesses that help with things like diagnosing illnesses or providing digital treatments. AI can help doctors find problems earlier and offer new ways to treat patients. It’s also crucial to make sure these new technologies are secure from hackers.

Why are healthcare organizations merging or buying other companies?

Organizations are joining forces to become stronger and more prepared for challenges. This can mean reaching more patients in different areas, offering a wider range of services like clinics or home care, and having more power when dealing with insurance companies. They might buy similar businesses (horizontal) or businesses that support their services (vertical).

Are there any rules or challenges when healthcare companies merge?

Yes, government agencies like the FTC are watching healthcare mergers more closely to prevent too much control in one area. It can also be hard to combine different company cultures and finances smoothly. Having a clear plan and doing thorough research beforehand is very important to avoid problems.

How do companies selling off parts of their business create new chances for others?

Sometimes, large healthcare systems sell off parts of their business that aren’t their main focus. This creates opportunities for other companies, like smaller groups of doctors, to buy these parts and grow. If you’re thinking of selling your practice, make sure it’s in good shape because buyers will be looking very carefully at everything.