So, you’re looking at bonds and trying to figure out what all these numbers mean? It can get a bit confusing, especially when you hear people talking about the yield curve and different maturities. Today, we’re going to break down what the 3 year yield is all about and why it matters to investors. Think of it as a snapshot of what the market thinks interest rates will do in the near future. It’s not super complicated once you see how it fits into the bigger picture.

Key Takeaways

- Bond yield basically tells you the return you get on your investment each year.

- The yield curve shows how yields change for bonds with different lengths of time until they mature.

- A normal yield curve means longer-term bonds usually pay more than short-term ones.

- The 3 year yield is a specific point on this curve, showing what investors expect for a 3-year investment.

- Changes in the yield curve, including the 3 year yield, can give clues about where the economy might be headed.

Understanding Bond Yields

Bonds are a pretty common part of investing, often brought up for the income and stability they can add to a portfolio. But sometimes, people get a bit worried when bond yields start going up. So, let’s break down what yield actually means for investors.

What Does Yield Mean for Investors?

At its core, a bond’s yield is the return you can expect to get each year from that bond, considering the price you paid for it and the interest payments it makes. Think of it as the overall return you’re getting on your investment over the time left until the bond is paid back. For the company or government that issued the bond, the yield is basically the cost of borrowing money. If a government issues a three-year bond and the yield is 0.25%, it means they’re paying 0.25% each year to borrow money for those three years.

When a bond is first sold, it’s in the ‘primary market.’ The price you pay then depends on things like the interest rate it offers, how long until it’s paid back, and what similar bonds are going for. This initial price helps figure out the starting yield. After that, bonds can be traded between investors in the ‘secondary market,’ and their prices, along with their yields, can change based on what’s happening in the market.

Coupon Yield Versus Current Yield

When you talk about bond yields, there are a few terms you’ll hear. The first is the coupon yield, which is also called the coupon rate. This is the fixed interest rate set when the bond is first issued, and it doesn’t change throughout the bond’s life. For example, a $1,000 bond with a 5% coupon rate will pay $50 in interest each year, no matter what.

Then there’s the current yield. This is calculated by taking the bond’s annual interest payment (the coupon payment) and dividing it by the bond’s current price in the market. So, if that same $1,000 bond paying $50 a year is now trading for $1,030 in the market, its current yield would be a bit lower than 5%. Current yield is more relevant if you’re thinking about selling the bond before it matures. If you buy a bond at its face value and hold it until it’s paid back, your current yield at the end will be the same as the coupon yield.

Here’s a quick look:

| Term | Calculation |

|---|---|

| Coupon Yield | Annual Interest Payment / Face Value |

| Current Yield | Annual Interest Payment / Current Market Price |

Yield to Maturity Explained

Coupon yield and current yield are good starting points, but they don’t tell the whole story. They don’t account for things like reinvesting the interest payments you receive or what happens if the bond is paid back earlier than expected. For a more complete picture of the return you can expect if you hold the bond until it matures, you need to look at Yield to Maturity (YTM).

YTM takes into account the bond’s current market price, its face value, its coupon interest rate, and the time left until it matures. It essentially calculates the total return you’d get if you held the bond all the way to its maturity date and reinvested all the coupon payments at the same YTM rate. It’s a more complex calculation, but it gives a better estimate of the bond’s overall profitability over its entire life.

The Yield Curve Explained

So, what exactly is this yield curve everyone talks about? Think of it as a snapshot of interest rates across different timeframes for bonds that are pretty much the same in terms of risk. Usually, we’re talking about U.S. Treasury bonds because, well, the government is generally seen as a safe bet, meaning they’re unlikely to default on their debt. This makes them a good benchmark for understanding the broader interest rate environment.

Visualizing Interest Rates and Maturities

A yield curve is basically a line graph. It plots the interest rate, or yield, you’d get for lending money to the government for different lengths of time. You’ll see points on the graph for short-term Treasury bills (like 3-month or 1-year) and then longer-term Treasury notes and bonds (like 10-year or 30-year). The line connecting these points shows how yields change as the maturity date gets further away. The shape of this line tells us a lot about what investors expect for the economy and future interest rates.

The Term Structure of Interest Rates

This relationship between the yield on a bond and how long until it matures is called the "term structure of interest rates." It’s not just about today’s rates; it reflects what investors anticipate for interest rates in the future. If investors expect rates to go up, they’ll usually demand a higher yield for locking their money up for a longer period. Conversely, if they think rates might fall, longer-term bonds might offer lower yields because they’re seen as more stable.

U.S. Treasury Yield Curve as a Benchmark

Why are U.S. Treasuries so important here? Because they’re considered "risk-free" in terms of default. This means their yields aren’t really influenced by worries about whether the borrower can pay back the loan. Instead, their yields are primarily driven by expectations about inflation, economic growth, and the Federal Reserve’s monetary policy. This makes the U.S. Treasury yield curve a go-to indicator for understanding the overall cost of borrowing in the economy, influencing everything from mortgage rates to corporate borrowing costs. You can check out the daily rates on the U.S. Department of the Treasury’s website.

Interpreting the Yield Curve’s Shape

The shape of the yield curve tells us a lot about what investors think is going to happen with the economy and interest rates down the road. It’s basically a snapshot of borrowing costs for the government across different time frames, from short-term Treasury bills to long-term Treasury bonds. When we look at this line, we can see three main patterns.

The Normal Upward-Sloping Curve

This is what most people expect to see most of the time. In a normal yield curve, longer-term bonds pay a higher interest rate, or yield, than shorter-term bonds. Think of it like this: if you’re lending your money out for a longer period, you want to be compensated more for the extra risk and the fact that your money is tied up for longer. This shape usually pops up when the economy is doing okay, maybe even growing, and people expect interest rates to stay the same or go up a bit in the future. It suggests a healthy economic outlook. For example, a two-year Treasury might yield 1%, while a ten-year Treasury could offer 2.5%. This difference is what we call the slope.

Understanding the Inverted Yield Curve

An inverted yield curve is the opposite – short-term bonds have higher yields than long-term bonds. So, the line slopes downward. This is often seen as a warning sign. It can mean that investors are worried about the economy slowing down or even heading into a recession. They might expect interest rates to fall in the future because the central bank will likely cut rates to try and boost the economy. When this happens, investors might pile into longer-term bonds, pushing their prices up and their yields down. Historically, an inverted yield curve has sometimes preceded economic downturns. For instance, you might see a two-year bond yielding 5% while a ten-year bond yields only 4.5%.

Characteristics of a Flat Yield Curve

A flat yield curve means that short-term and long-term bonds are offering pretty much the same yield. There isn’t much difference between them. This can happen when the market is unsure about the future direction of the economy or interest rates. It might be a sign that the economy is transitioning from one state to another, perhaps from growth to a slowdown, or vice versa. Sometimes, a flat curve can also appear when interest rates are already quite low. You might see yields like 6% for a two-year bond, 6.1% for a five-year, and 6% for a ten-year. It’s a bit of a mixed signal, suggesting uncertainty about what’s coming next. This shape can be a bit tricky for investors trying to figure out the best investment strategies.

The Significance of the 3 Year Yield

The 3 Year Yield in Context

The 3-year Treasury yield sits in a pretty interesting spot on the yield curve. It’s not as short-term as, say, a 3-month Treasury bill, but it’s also not as long-term as a 10-year or 30-year bond. This middle ground gives it a unique perspective on what the market thinks about the economy’s near-to-medium term future. Think of it as a snapshot of interest rate expectations for the next few years. When you look at the yield curve, you’re seeing how much extra return investors demand for tying up their money for longer periods. The 3-year yield is a key data point in understanding that trade-off.

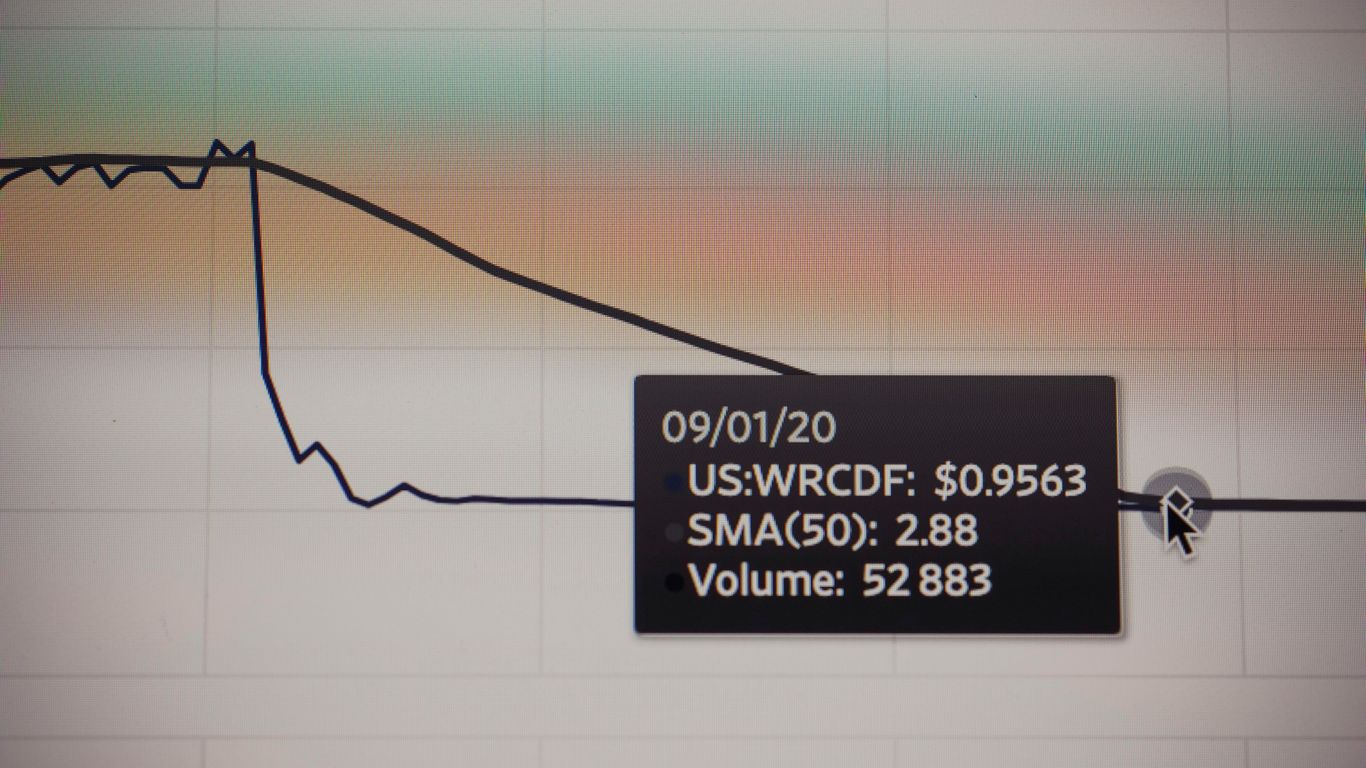

Comparing Yields Across Maturities

It’s really helpful to see how the 3-year yield stacks up against other maturities. For instance, if the 3-year yield is 2.5% and the 10-year yield is 3.0%, that’s a pretty standard, upward-sloping curve. It suggests investors expect things to grow steadily. But what if the 3-year yield was higher than the 10-year yield? That’s an inverted yield curve, and it often signals worries about the economy slowing down. Here’s a quick look at how yields might compare:

| Maturity | Example Yield |

|---|---|

| 3 Year | 2.8% |

| 5 Year | 3.1% |

| 10 Year | 3.3% |

| 30 Year | 3.7% |

This comparison helps us see the market’s appetite for risk and its outlook on future interest rates. A bigger jump in yield from the 3-year to the 10-year might mean investors are pretty confident about the economy’s path. A smaller jump, or even a dip, tells a different story.

How the 3 Year Yield Reflects Market Expectations

So, what exactly is the 3-year yield telling us? Well, it’s a pretty good indicator of where investors think short-term interest rates will be in about three years. If the market anticipates the central bank will raise rates to combat inflation, the 3-year yield will likely climb. Conversely, if investors expect rate cuts due to a weakening economy, that yield might fall. It’s like a thermometer for economic sentiment. For example, if you’re thinking about taking out a mortgage, the rate you get might be influenced by these intermediate-term yields, as banks often price loans based on various points on the yield curve. It’s a dynamic number, constantly reacting to new economic data and policy announcements.

Factors Influencing Bond Yields

The Inverse Relationship Between Price and Yield

So, you’ve got a bond, right? It pays a set amount of interest, called a coupon, for its entire life. That coupon payment doesn’t change. But the price you can sell that bond for in the market? That can change a lot. And here’s the kicker: when market interest rates go up, the price of your existing bond usually goes down. Why? Because new bonds being issued will offer that higher interest rate, making your older, lower-paying bond less attractive. To sell it, you’d have to lower the price. Conversely, if market rates fall, your bond with its higher coupon becomes more desirable, and its price can go up. This means bond prices and yields move in opposite directions.

Let’s say you have a bond with a $100 face value that pays 2% interest annually. That’s $2 a year. If market interest rates for similar bonds are also 2%, your bond will likely trade at par, $100. But if market rates jump to 3%, new bonds will pay $3 a year. Your 2% bond is now less appealing. To sell it, you might have to offer it for less than $100, maybe $95. Now, if you bought that bond for $95 and it still pays $2 a year, your actual yield is higher than 2% because you paid less for it.

Market Climate and Investor Demand

Think of the bond market like any other market – supply and demand really matter. When lots of investors want to buy bonds (high demand), and there aren’t that many available (low supply), prices tend to go up, and yields go down. People are willing to accept a lower return because the security of the bond is so appealing, or maybe they expect interest rates to fall further. On the flip side, if investors are nervous or prefer other investments like stocks, demand for bonds might drop. If governments or companies need to borrow more money, they issue more bonds, increasing the supply. More supply and less demand usually push bond prices down and yields up. What’s driving this demand? It’s often about what investors think will happen with the economy and interest rates in the future. If they expect rates to rise, they might hold off on buying bonds now, waiting for better yields later.

Impact of Interest Rate Changes on Yields

This is a big one. Central banks, like the Federal Reserve, have a major influence here. When they decide to raise interest rates, it directly impacts the yields on new bonds. As we talked about, this makes existing bonds with lower coupon payments less valuable, so their prices drop, and their yields rise to become competitive. It’s a bit of a balancing act. While rising rates can mean short-term losses for existing bondholders if they need to sell, they also mean that any new money you invest in bonds will earn a higher return going forward. Over the long haul, this can actually be a good thing for your overall investment growth. It’s like planting a tree; it might take a while to see the full benefits, but the future harvest can be much richer.

Using the Yield Curve for Investment Decisions

So, you’ve got a handle on what the yield curve is and why it matters. Now, how do you actually use this information to make smarter investment choices? Think of the yield curve as a kind of economic weather report. Its shape can give you clues about what might be coming down the road, economically speaking.

Predicting Economic Trends

The shape of the yield curve can be a pretty good indicator of future economic activity. For instance, a normal, upward-sloping curve, where longer-term bonds offer higher yields than shorter-term ones, generally suggests that investors expect the economy to grow. This is because growth usually comes with inflation, and investors want to be compensated for that risk over longer periods. On the flip side, an inverted yield curve, where short-term yields are higher than long-term yields, often signals that investors are anticipating an economic slowdown or even a recession. They might be moving their money into longer-term bonds, thinking that interest rates will fall in the future, which drives up the prices of those longer bonds and lowers their yields.

Navigating Different Interest Rate Environments

Understanding the yield curve helps you figure out where interest rates might be headed, and that impacts all sorts of investments. If you see a steepening curve, meaning the gap between short-term and long-term yields is widening, it might suggest rising inflation and interest rates. In this scenario, you might want to be cautious with long-term bonds, as their prices could fall if rates go up. Conversely, if the curve is flattening or inverting, it could mean interest rates are expected to fall or stay low. This might make shorter-term bonds or floating-rate instruments more attractive. It’s all about adjusting your strategy based on what the market seems to be pricing in for the future. You can even use tools to analyze deals in different markets, like equity crowdfunding analytics.

Strategies Like Riding the Curve

One strategy investors sometimes use is called "riding the curve." This works best when interest rates are stable. The idea is to buy a bond that’s, say, a 5-year maturity. As time passes, that bond gets closer to maturity, and its yield typically falls (assuming the curve stays the same). Because bond prices move inversely to yields, the price of your bond goes up as its yield falls. You then sell the bond before it matures, hopefully pocketing a profit from that price increase. It’s a bit like catching a wave – you’re trying to profit from the bond’s movement along the yield curve. Here’s a simplified look at how yields might appear across different maturities:

| Maturity | Yield |

|---|---|

| 2 Year | 1.0% |

| 5 Year | 1.8% |

| 10 Year | 2.5% |

| 20 Year | 3.5% |

Remember, this is just one way to use yield curve information, and it comes with its own risks. It’s always a good idea to consider your own financial goals and risk tolerance before making any investment decisions.

Wrapping It Up

So, we’ve looked at what the 3-year yield means and why it matters. It’s not just some number floating around; it gives us a peek into what investors expect for interest rates and the economy in the near future. Whether it’s going up, down, or staying flat, it tells a story. Keep an eye on it, and remember it’s just one piece of the bigger financial puzzle. Understanding these basic concepts can really help you make smarter choices with your money.

Frequently Asked Questions

What exactly is bond yield?

Think of yield as the yearly profit you get from your bond investment. It’s usually shown as a percentage of the bond’s price. So, if you have a bond that pays you $50 a year and its price is $1,000, its yield is 5%.

What’s the difference between coupon yield and current yield?

The coupon yield is the fixed interest rate set when the bond is first sold, and it never changes. Current yield, however, changes based on the bond’s current price in the market. If the price goes up, the current yield goes down, and vice versa.

What does ‘yield to maturity’ mean?

Yield to maturity is a way to figure out the total amount of money you’ll get if you hold onto a bond until it officially matures. It includes all the interest payments you’ll receive, plus any increase or decrease in the bond’s price.

What is a yield curve?

A yield curve is like a snapshot that shows the interest rates (or yields) for bonds that have the same quality but different times until they mature. It’s a line graph where you can see how yields change as the time to maturity gets longer.

What does the shape of the yield curve tell us?

The shape gives clues about the economy. A normal curve slopes upward, meaning longer-term bonds pay more, which usually happens when the economy is growing. An inverted curve slopes downward, with short-term bonds paying more, often signaling a possible recession. A flat curve means there’s not much difference in pay between short and long terms, suggesting economic uncertainty.

How can investors use the 3-year yield?

The 3-year yield is a useful point on the yield curve. By comparing it to yields on bonds with shorter or longer times to maturity, investors can get a better sense of what the market expects for interest rates and the economy in the near to medium future. It helps them make smarter choices about where to put their money.