Starting a business in 2025 feels like a wild ride, doesn’t it? There’s so much happening, from new tech popping up to how people shop changing. It’s easy to get lost in all the noise, but understanding the real startup industry statistics is key. We’re going to look at what’s actually going on, what’s making businesses grow, and where things might be headed. Think of this as a quick rundown of the numbers and trends that matter most for anyone thinking about launching something new or growing what they already have.

Key Takeaways

- Small businesses are a huge part of the world’s economy, making up most companies and providing lots of jobs.

- Technology, especially AI and online selling, is really changing how startups work and grow.

- Getting money for startups is still a big deal, with venture capital playing a major role, but seed funding is also important.

- Some places are becoming big centers for startups, with Asia Pacific and North America showing strong growth and innovation.

- While many startups don’t make it, learning from failures and adapting is how businesses can become more resilient.

Startup Industry Statistics: A Global Overview

The startup scene in 2025 is buzzing, and it’s pretty wild to think about how many new businesses pop up every single day. Globally, we’re talking about hundreds of millions of entrepreneurs out there, all trying to make their mark. It’s not just about having a cool idea; it’s about building something that lasts. Small businesses, in particular, are really the engine room for a lot of economies. They create jobs and bring new things to the table, which is pretty important when you look at the bigger economic picture.

Global Entrepreneurial Landscape

The sheer number of people starting businesses is staggering. We’ve got an estimated 582 million entrepreneurs worldwide right now. Think about that – that’s a lot of people with ideas and the drive to make them happen. These small businesses aren’t just a small part of the economy either; they make up about 90% of all companies globally and are responsible for half of all jobs. That’s a huge impact from what are often considered the ‘little guys’. The number of companies forming each year is also on the rise, showing a steady increase in people taking the leap.

Small Businesses as Economic Pillars

It’s clear that small businesses are the backbone of global economies. In 2025, more than 60% of these businesses are planning to expand, which shows a lot of confidence in the market. The market value for small businesses is projected to keep growing significantly over the next decade. This growth isn’t just about size; it’s about their contribution to GDP and employment. They are the ones often introducing new products and services that larger companies might not focus on. It’s really interesting to see how they keep things moving forward.

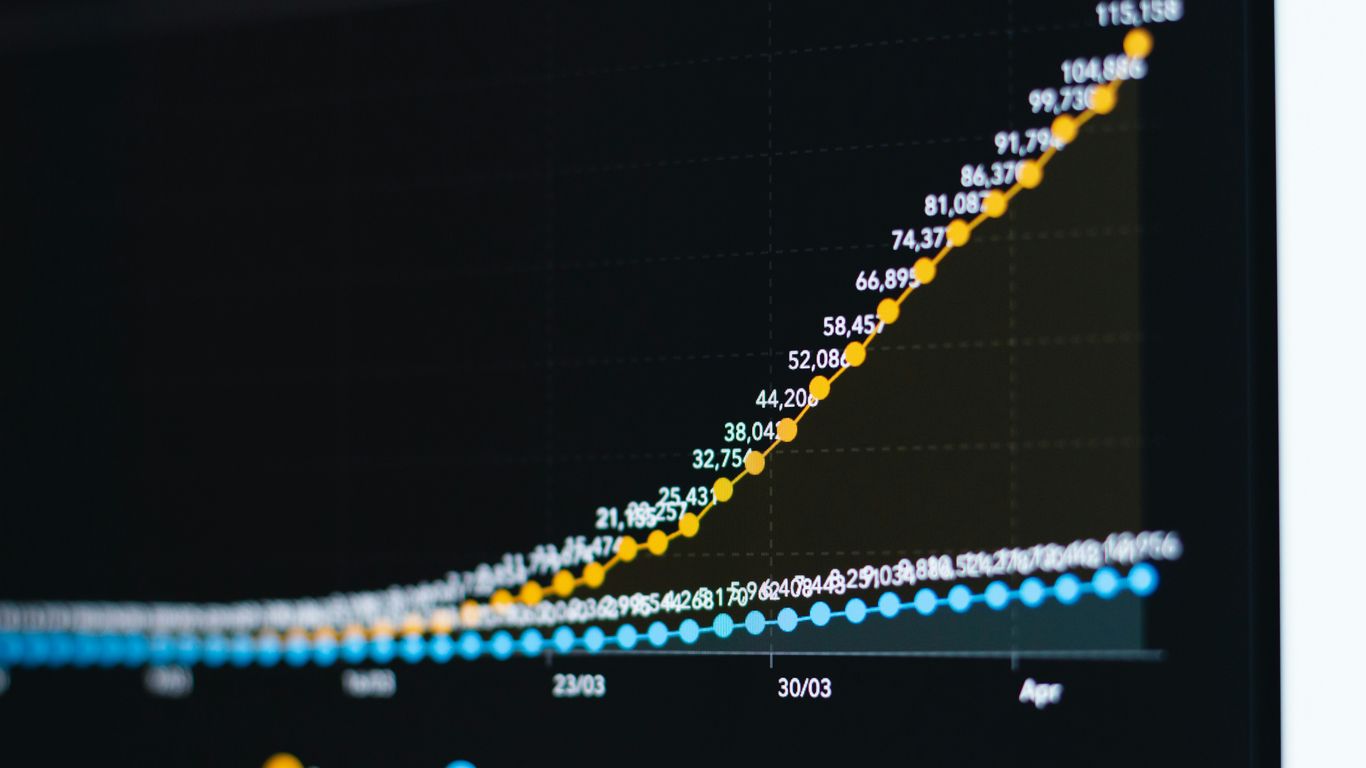

Startup Formation and Growth Rates

When we look at how many startups actually make it, the numbers can be a bit sobering. While the entrepreneurial spirit is strong, the reality is that a significant portion of startups don’t last long. Around 21% fail in the first year, and that number climbs to 50% by year five. However, for those that do succeed, the growth can be explosive. Investors are pouring billions into promising ventures, especially in tech sectors like AI and fintech. This funding is what helps startups get off the ground and scale up, aiming to become the next big thing. It’s a high-risk, high-reward environment, and understanding these dynamics is key for anyone looking to get involved, whether as a founder or an investor. For a look at some of the tech trends driving this, you can check out insights from leaders like Padmasree Warrior on key technology trends.

Key Trends Driving Startup Success in 2025

Alright, let’s talk about what’s really making startups tick in 2025. It feels like every week there’s some new tech or a different way of doing business, and it can be a lot to keep up with. But if you’re looking to get ahead, or even just understand what’s happening, there are a few big themes that keep popping up. These aren’t just buzzwords; they’re the actual forces shaping how companies get started and how they grow.

Artificial Intelligence and Automation Adoption

It’s pretty clear that AI isn’t just for the big tech giants anymore. Startups are finding all sorts of ways to use it, from making customer service chatbots smarter to automating repetitive tasks that used to eat up so much time. Think about it: if a computer can handle data entry or schedule meetings, your team can focus on the actual creative work or talking to customers. This isn’t about replacing people, but about making everyone more productive. We’re seeing AI pop up in everything from marketing tools to product development, helping companies make better decisions faster.

- Streamlining Operations: AI can automate tasks like data analysis, report generation, and even initial customer outreach.

- Personalized Customer Experiences: Using AI to tailor product recommendations or support interactions based on user behavior.

- Product Innovation: Developing AI-powered features that offer unique value to customers.

E-commerce and Social Commerce Expansion

Online shopping isn’t new, but the way people buy things online is always changing. E-commerce continues to be huge, but what’s really gaining traction is social commerce – basically, buying things directly through social media platforms. It’s super convenient because you don’t even have to leave the app you’re already using. For startups, this means thinking about how to make their products discoverable and purchasable right where people are spending their time online. It’s about meeting customers where they are, making the buying process as smooth as possible.

- Direct-to-Consumer (DTC) Growth: Brands selling directly to customers online, cutting out middlemen.

- Live Shopping Events: Real-time product demonstrations and sales hosted on social media or dedicated platforms.

- Influencer Marketing Integration: Collaborating with influencers to drive sales through their social channels.

Sustainability and Ethical Consumerism

People are paying more attention to where their products come from and how they’re made. There’s a growing demand for businesses that are not only profitable but also good for the planet and fair to people. This means startups are looking at eco-friendly materials, ethical sourcing, and transparent business practices. It’s not just about being green; it’s about building trust with customers who care about these issues. Companies that can show they have a purpose beyond just making money often find they have a more loyal customer base.

| Area of Focus | Startup Approach in 2025 |

|---|---|

| Environmental Impact | Using recycled materials, reducing carbon footprint, waste reduction |

| Ethical Sourcing | Ensuring fair labor practices and responsible supply chains |

| Transparency | Open communication about business operations and impact |

| Social Responsibility | Contributing to community initiatives or social causes |

Navigating Startup Funding and Valuations

Getting money for your new business can feel like a puzzle, right? It’s not just about having a great idea; it’s about convincing others to believe in it enough to put their cash down. We’re seeing some interesting shifts in how startups are getting funded and what they’re worth.

Venture Capital Investment Trends

Venture capital (VC) is still a big deal for many startups, especially those looking to grow fast. In 2025, a lot of that money is flowing into areas like AI. It’s estimated that AI startups alone grabbed nearly $90 billion in VC funding, making up a good chunk of all the money invested. This shows investors are really betting on new tech. But it’s not just AI; other sectors like fintech and green tech are also attracting significant attention. VCs are often looking for companies that have already shown some traction and are ready to scale up, though even then, there’s a considerable risk involved, with many investments not panning out.

Seed Funding Dynamics

Before you get to the big VC rounds, there’s the crucial seed funding stage. This is often the first real money a startup gets, usually from angel investors or early-stage VC funds. The average valuation for a seed-stage startup in the US is around $7.5 million. This initial funding is vital for getting the product off the ground, building a team, and figuring out the market. Many founders start by bootstrapping, meaning they use their own money, but seed funding is often the next step to accelerate growth.

Unicorn Startup Valuations and Growth

We hear a lot about

Startup Ecosystems and Regional Dynamics

The landscape for startups isn’t uniform; it’s a patchwork of vibrant hubs and emerging centers, each with its own flavor and strengths. Understanding these regional differences is key for any entrepreneur looking to grow or expand. It’s not just about where you are, but how that location impacts your access to talent, funding, and even customer bases. The concentration of resources and support networks in established hubs can significantly accelerate a startup’s journey.

Prominent Global Startup Hubs

Certain cities have become synonymous with startup success, acting as magnets for talent and investment. These locations often boast a dense network of venture capitalists, experienced mentors, and a culture that embraces innovation. Think of places like Silicon Valley, of course, but also London, Tel Aviv, and Berlin, each offering a unique blend of industry focus and support.

- Access to Funding: Established hubs typically have a higher density of angel investors and venture capital firms.

- Talent Pool: Proximity to universities and a history of tech innovation attract skilled workers.

- Networking Opportunities: Concentrated industry events and co-working spaces facilitate connections.

Asia Pacific’s Rapid Growth

The Asia Pacific region is a powerhouse of startup activity, showing remarkable growth in recent years. Countries like Singapore, India, and South Korea are rapidly developing their ecosystems, driven by strong government support, a large and growing consumer market, and increasing digital adoption. This region presents a dynamic environment for startups, especially those focused on e-commerce, fintech, and mobile technologies. For a deeper look at these trends, the Global Startup Ecosystem Report 2025 provides extensive data.

North America’s Innovation Focus

North America, particularly the United States and Canada, continues to be a leader in startup innovation. Beyond the well-known tech centers, there’s a growing trend of startups emerging in secondary cities, fueled by lower operating costs and a focus on specific industries like biotech, AI, and clean energy. The region benefits from a mature venture capital market and a culture that encourages risk-taking and rapid iteration. This focus on cutting-edge technology means North America remains a key area to watch for groundbreaking new ventures.

Understanding Startup Failure and Resilience

It’s a tough world out there for new businesses. You hear the stories, and honestly, the statistics aren’t exactly encouraging. Many people think starting a business is all about a great idea and a bit of luck, but the reality is much more complex. Most startups don’t make it past their first few years. It’s a hard truth, but understanding why can help you avoid the common pitfalls.

Common Reasons for Startup Failure

So, what goes wrong? It’s rarely just one thing, but a few major culprits pop up repeatedly. Running out of money is a big one, often because they couldn’t secure more funding or their initial cash just disappeared too fast. Another huge factor is simply not having a product or service that people actually want or need. You can have the best tech integration in the world, but if no one buys it, what’s the point?

Here are some of the top reasons businesses falter:

- No Market Need: The idea just doesn’t solve a real problem for enough people.

- Ran Out of Cash: Poor financial management or inability to raise more funds.

- Not the Right Team: Lacking the necessary skills or having internal conflicts.

- Get Outcompeted: Competitors offer something better, cheaper, or faster.

- Pricing/Cost Issues: The product is too expensive, or the cost to produce it is too high.

- Poor Product: The product itself is buggy, difficult to use, or doesn’t deliver on its promise.

Startup Survival Rates by Year

It’s a bit grim, but knowing the timeline can help set expectations. The first year is the most precarious. After that, things can get a little more stable, but the risk never fully disappears. Many businesses that fail do so between years two and five.

| Year | Failure Rate |

|---|---|

| Year 1 | ~21% |

| Year 2 | ~30% |

| Year 5 | ~50% |

| Year 10 | ~70% |

Strategies for Mitigating Risk

Okay, so it’s not all doom and gloom. There are ways to increase your chances. It starts with really understanding your market before you even build anything. Talk to potential customers, get feedback, and be ready to pivot if your initial assumptions are wrong. Having a solid financial plan and keeping a close eye on your cash flow is also super important. Don’t be afraid to seek advice from mentors or experienced professionals; they’ve likely been through similar challenges. Building a strong, adaptable team and focusing on delivering real value to your customers are key. Remember, even experienced entrepreneurs with past failures have a better shot at success the next time around, so learning from mistakes is part of the process. Making sure your business has a clear business model is a good start.

Emerging Industries and Business Models

It’s pretty wild how fast things change, right? What was cutting-edge last year might be old news by now. For startups in 2025, figuring out where the real action is happening is key. We’re seeing some seriously interesting sectors pop up and grow, often because of new tech or just different ways people want to buy stuff.

Fastest-Growing Small Business Sectors

So, what’s actually booming? It’s not just one thing. A lot of it has to do with what people need now and how we’re trying to be better for the planet. Here’s a quick look at some of the top areas:

| Sector | Key Trend |

|---|---|

| Solar & Renewable Energy | Huge job growth, massive market size. |

| E-commerce & DTC Brands | Sales expected to keep climbing. |

| Health & Wellness | Especially home care, demand is up. |

| Consulting (Business/IT) | A go-to for new businesses. |

| Cybersecurity & Data Protection | Essential for almost everyone now. |

Rise of Micro-Consulting and Digital Platforms

Forget those huge consulting firms for a minute. What’s really taking off are smaller, specialized consultants and online platforms that connect people with specific skills. Think of someone who’s a whiz at optimizing social media ads for local bakeries, or a platform that matches freelance graphic designers with small businesses needing logos. These setups are often lean, agile, and can adapt quickly. They don’t need massive offices or huge teams. It’s all about niche expertise and being accessible online. This model really cuts down on overhead and lets people focus on what they do best, serving clients who need that exact skill set without a lot of fuss.

Fintech and Cleantech Investment Opportunities

When we talk about where the money is flowing, two big areas stand out: Fintech and Cleantech. Fintech, or financial technology, is changing how we handle money, from easier payments to new ways of investing. Startups here are making financial services more accessible and efficient for everyone. On the other hand, Cleantech is all about solutions for our planet. This includes everything from better battery storage for solar power to new ways to reduce waste. Investors are really looking at these sectors because they address major global needs and have the potential for significant growth. Both are complex fields, but the opportunities for innovation and investment are huge right now.

The Evolving Workforce and Operational Models

The way we work and run businesses is changing, and startups are right at the forefront of this shift. It’s not just about having a good idea anymore; it’s about how you build and manage your team and your operations to keep up with the pace.

Remote Work Adoption in Startups

Remote work isn’t just a perk; it’s become a standard operating procedure for many startups. This move away from traditional office spaces has opened up a wider talent pool, allowing companies to hire the best people regardless of their location. Think about it: you’re no longer limited to candidates within commuting distance. This also means startups can save a lot on office rent and overhead, which is a big deal when you’re just starting out. However, keeping everyone connected and maintaining a strong company culture when people are spread out requires deliberate effort. Tools for communication and collaboration are key, and finding ways to build team cohesion without being in the same room is something many companies are still figuring out. The tech job market, for instance, is seeing a significant increase in demand for professionals who can manage and thrive in these distributed environments, alongside a growing emphasis on diversity within the workforce [63c1].

Impact of AI on Workforce Productivity

Artificial intelligence is starting to really change how productive people can be. AI tools can automate repetitive tasks, analyze large amounts of data quickly, and even help with creative processes. This means employees can spend more time on the complex, strategic parts of their jobs that really need a human touch. For startups, this can mean getting more done with smaller teams, which is a huge advantage. However, it also means workers need to learn how to use these new tools effectively. There’s a learning curve, and companies need to invest in training to make sure their teams can actually benefit from AI, rather than just being overwhelmed by it. The goal is to use AI to augment human capabilities, not replace them entirely.

Building Diverse and High-Performing Teams

Creating a team that’s both diverse and performs well is a major focus for successful startups. Diversity isn’t just about checking boxes; it brings different perspectives, experiences, and problem-solving approaches to the table. This variety can lead to more innovative solutions and a better understanding of a wider customer base. Building this kind of team involves looking beyond traditional hiring channels and actively seeking out candidates from various backgrounds. It also means creating an inclusive environment where everyone feels valued and heard. When you combine a diverse group of people with clear goals, good communication, and the right tools, you get a team that can really achieve great things. It’s about creating a culture where everyone contributes their best work.

Wrapping It Up: What’s Next for Startups in 2025?

So, looking at all these numbers, it’s pretty clear that the startup world in 2025 is still a really active place. We’re seeing a lot of growth, especially in areas like tech, sustainability, and online sales. Things like AI and remote work are changing how businesses operate, and it seems like a lot of entrepreneurs are ready for it. While not every idea takes off – we know that 90% of startups don’t make it – the ones that do can really make a big impact. It’s a mix of big dreams and hard work, and it looks like the trend is towards more businesses focusing on what customers actually need and how to do it in a smarter, often digital, way. Keep an eye on these trends; they’re shaping the future of how we work and buy things.

Frequently Asked Questions

What are the main things helping startups do well in 2025?

Startups are getting a big boost from new technology like Artificial Intelligence (AI) and automation, making things run smoother. Also, selling online and through social media is growing fast. Plus, people really care about the planet and doing good, so businesses that are eco-friendly and fair are doing great.

Why do so many new businesses not make it?

A lot of startups don’t succeed because they don’t really understand what customers want, or they run out of money. Sometimes, the team isn’t quite right for the job. It’s tough out there, and many businesses struggle to find their footing.

Where are the best places for startups to grow?

Right now, Asia is seeing super fast growth for new companies, especially in tech. North America is also a big deal for new ideas and has lots of money available for startups. These places have strong support systems for entrepreneurs.

How much money do startups usually get when they first start?

When a startup is just beginning, it often gets around $2.2 million in what’s called ‘seed funding’ in the US. This money is super important to get the product made, check if people like it, and hire the first few workers.

Are more companies working from home now?

Yes, definitely! More than half of startups are letting their employees work from home. This started happening a lot more because of the pandemic. It helps companies save money on office space and lets them hire talented people from anywhere in the world.

What kind of businesses are growing the fastest right now?

Businesses that deal with solar and clean energy are booming. Online stores and brands that sell directly to customers are also doing really well. Plus, anything related to health and wellness, like home care, is seeing a lot of growth. Consulting and online clothing shops are also popular.