Thinking about where to put your money can feel like a big decision, right? You hear about venture capital and hedge funds, and they sound important, but what’s really the difference? It’s easy to get them mixed up because both deal with big money and investments, but they operate pretty differently. This article will break down venture capital vs hedge fund, looking at what they do, how they work, and who they’re for, so you can get a clearer picture.

Key Takeaways

- Venture capital firms gather money from various investors to put into promising businesses, hoping for big returns.

- Venture capitalists pick companies based on their strong points and how much people want what they offer.

- VC firms make money from management fees and a share of profits, while also helping new businesses grow, create jobs, and boost the economy.

- Hedge funds use a wider range of trading methods and often have shorter investment periods compared to venture capital.

- Both venture capital and hedge funds have different rules they have to follow and different ways they pay their managers.

Understanding Venture Capital vs Hedge Fund

When you’re looking at where to put your money, two big players often come up: venture capital (VC) and hedge funds. They sound similar, maybe, but they’re really quite different in what they do and how they operate. It’s like comparing a farmer who grows new crops to a trader who buys and sells existing goods on a big market. Both are involved with money and growth, but their methods and goals are worlds apart.

The Core Purpose of Venture Capital

Venture capital is all about getting new companies off the ground. Think of those tech startups you hear about, the ones with big ideas but not much else to start. VC firms give these companies money, usually in exchange for a piece of ownership, called equity. This isn’t like a bank loan where you have to pay it back with interest on a schedule. Instead, VCs are betting on the company growing big and becoming valuable. They’re looking for that next big thing, the company that could change an industry. It’s a long game, and they often invest in companies that aren’t making any profit yet, sometimes for years. They’re essentially partners in the growth story, providing not just cash but often advice and connections too. The goal is for the company to eventually be sold or go public, making the VC firm and its investors a lot of money. It’s a way to fuel innovation and create new businesses that might not get funding anywhere else. You can find out more about the role of venture capitalists in business growth.

Hedge Funds: A Different Investment Paradigm

Hedge funds, on the other hand, are more like sophisticated investment shops that play in the big leagues of public markets. They take money from wealthy individuals and institutions and then use a wide variety of strategies to try and make returns. This can involve buying stocks, selling stocks they don’t own (short selling), using borrowed money (leverage), and trading all sorts of financial products. Their main aim is to make money regardless of whether the market is going up or down, hence the ‘hedge’ part – they try to protect themselves from losses. They’re often much more active traders than VCs, looking for short-term opportunities as well as long-term plays. It’s a very different approach to making money compared to the patient, growth-focused strategy of venture capital.

Key Differences in Investment Focus

So, what really sets them apart? It boils down to a few main things:

- What they invest in: VCs focus on private, early-stage companies with high growth potential. Hedge funds typically invest in publicly traded securities like stocks and bonds, but can also dabble in private markets, commodities, and currencies.

- How they make money: VCs make money when the companies they invest in become successful and are eventually sold or go public. Hedge funds aim to generate returns through various trading strategies, often trying to profit from market inefficiencies or trends.

- Risk and Reward: VC is generally considered higher risk because many startups fail, but the potential rewards can be enormous if one succeeds. Hedge funds can also be high risk, depending on their strategy, but they often aim for more consistent, albeit potentially lower, returns than a successful VC investment.

- Liquidity: Money invested in VC is usually locked up for many years, as it takes time for startups to grow and be sold. Hedge fund investments can be more liquid, though there are often restrictions on when investors can pull their money out.

Investment Strategies and Risk Profiles

Venture Capital’s Growth-Oriented Approach

Venture capital (VC) is all about putting money into new companies, the ones that have big ideas and the potential to grow a lot. VCs aren’t just handing over cash; they’re looking for businesses that can really change things. They spend a lot of time figuring out which companies have the best shot. This means looking closely at the market, who the competitors are, and if the people running the company seem like they can actually pull it off. They also check out the product or technology to make sure it’s solid.

VCs often invest in stages, putting in more money as the company hits certain goals. It’s a long game, and they’re patient. They want to see these companies become leaders in their fields. The main goal is to help these young businesses grow so much that they become worth a lot more money later on.

Hedge Funds’ Diverse Trading Tactics

Hedge funds, on the other hand, are a bit different. They use a wider range of methods to make money, and they can be pretty flexible. Think of them as more active traders. They might bet on stocks going up or down, deal with currencies, or even invest in things like commodities. They’re not necessarily focused on building up a single company over many years like VCs are.

Instead, hedge fund managers are constantly looking for opportunities in the market, trying to profit from price changes or other market movements. They can use borrowed money to make bigger bets, which can lead to bigger gains but also bigger losses. It’s a more complex and often faster-paced approach to investing.

Risk Management in Venture Capital

VCs have to be smart about the risks they take. Since they’re investing in new companies, there’s a good chance some of them won’t make it. To handle this, they spread their investments around. They might invest in companies at different stages of development, in different industries, or even in different parts of the world. This way, if one company fails, it doesn’t wipe out their whole fund.

They also manage risk by:

- Diversifying: Spreading money across many different companies and industries.

- Staging Investments: Putting money in gradually as the company proves itself.

- Over-Commitment: Sometimes, they commit to investing more money than they initially plan, just in case a promising company needs extra help.

- Due Diligence: Doing thorough research before investing to catch potential problems early.

Risk Mitigation in Hedge Fund Operations

Hedge funds also have ways to manage their risks, though it can be trickier because they often use more complex strategies. They might use what’s called hedging, which is like taking out insurance on their investments to protect against big losses. They also keep a close eye on market trends and adjust their investments quickly if things look like they might go south.

Some common ways hedge funds try to keep risk in check include:

- Hedging Strategies: Using financial tools to offset potential losses.

- Stop-Loss Orders: Automatically selling an investment if it drops to a certain price.

- Position Sizing: Not putting too much money into any single investment.

- Scenario Analysis: Thinking about what could happen in different market situations and planning accordingly.

The Role of Investors and Fund Structure

When you’re looking at venture capital (VC) versus hedge funds, understanding who puts money into these funds and how they’re set up is pretty important. It’s not just about the flashy returns; it’s about the people and the mechanics behind the scenes.

Who Invests in Venture Capital Firms?

Venture capital firms attract a specific type of investor, often those looking for significant growth potential, even if it means taking on more risk. These investors are the lifeblood of VC, providing the capital that fuels startups and emerging companies. Think of large institutions like pension funds, university endowments, and foundations. High-net-worth individuals and family offices also frequently participate. These investors are drawn to VC because it offers a chance to invest in innovative companies before they become widely known, potentially leading to outsized returns. They’re essentially betting on future market leaders. It’s a long-term game, and these investors understand that.

Typical Investors in Hedge Funds

Hedge funds, on the other hand, tend to attract a similar, but perhaps slightly broader, investor base. Again, you’ll find institutional investors like pension funds and endowments. However, hedge funds are also very popular with accredited individual investors and funds of funds. The appeal here is often the potential for uncorrelated returns – meaning their performance might not move in lockstep with the broader stock market. Hedge funds use a wider variety of strategies, from long-short equity to global macro, which can appeal to investors seeking diversification or specific market exposures. The ability to potentially profit in both rising and falling markets is a big draw for many.

The Structure of Venture Capital Firms

VC firms typically operate as limited partnerships. This structure involves two main parties: the general partner (GP) and the limited partners (LPs). The GP is the VC firm itself, responsible for finding and managing investments. They make the day-to-day decisions. The LPs are the investors who provide the bulk of the capital. They are passive investors, meaning they don’t get involved in the operational decisions of the fund. The VC firm, or GP, raises money from these LPs for a specific fund, which then invests in a portfolio of companies over a set period, often around 10 years. This structure is designed to align the interests of the managers with those of the investors, with the GP typically earning a management fee and a share of the profits (carried interest) if the fund performs well. It’s a model that has been around for a while and is well-understood in the investment world, though specific details can vary, and understanding the nuances is key for anyone considering investing in a VC fund.

Anatomy of a Hedge Fund

Hedge funds also commonly use a partnership structure, but their operational setup can be more varied. Like VC, they have a fund manager (often the GP) who makes investment decisions and investors (LPs). However, hedge funds are known for their flexibility. They can employ a wide range of investment strategies and often have shorter lock-up periods compared to VC. The management fee is standard, but the performance fee, often referred to as the ‘2 and 20’ model (2% management fee and 20% of profits), is a hallmark. This fee structure is designed to heavily reward the fund manager for generating strong returns. Some funds might have different fee arrangements, like tiered fees for larger investors or fee caps, to protect their clients. The key difference often lies in the active trading and the diverse strategies employed, which require a different kind of operational infrastructure and risk management compared to the long-term, company-building focus of venture capital.

Lifecycle and Liquidity of Investments

When you put money into venture capital (VC) or a hedge fund, it’s not like putting it in a regular savings account where you can just pull it out whenever. These investments have their own timelines and rules about when and how you can get your money back.

The Venture Capital Investment Lifecycle

VC investments are all about growth, and that takes time. Think of it like planting a seed and waiting for it to grow into a tree. The money you invest goes through several phases as the startup company develops. It usually starts with a seed round, then moves through Series A, B, and C funding rounds, and might even go through expansion or mezzanine stages. Each stage involves different levels of risk and potential reward. It’s a long game, and you’re essentially betting on the company’s future success.

Liquidity and Exit Strategies in VC

Because VC investments are in private companies, they’re not very liquid. You can’t just sell your stake on a public stock exchange. Getting your money back usually happens through an "exit event." This could be:

- Initial Public Offering (IPO): The company goes public, and you can sell your shares on the stock market.

- Acquisition: Another company buys the startup you invested in.

- Secondary Sale: You sell your stake to another investor.

These exits can take many years, often 5 to 10 years or even longer. It means your capital is tied up for a significant period. For investors looking for quick access to their funds, VC isn’t the best fit. Understanding these timelines is key, especially if you’re looking at platforms that offer access to private markets, like equity crowdfunding analytics.

Hedge Fund Investment Horizon and Liquidity

Hedge funds, on the other hand, can be a bit more flexible, but it really depends on the specific fund and its strategy. Some hedge funds might invest in assets that are traded daily, offering more frequent opportunities to redeem your investment. Others might take on longer-term, less liquid positions.

Generally, hedge funds have lock-up periods, meaning you can’t withdraw your money for a certain amount of time after you invest. After that, you might only be able to redeem your investment at specific intervals, like quarterly or annually. There can also be gates, which limit the amount of money that can be withdrawn during a redemption period if too many investors want their money out at once. So, while they might offer more liquidity than VC, it’s still not the same as a bank account. You need to check the fund’s specific terms and conditions.

Fee Structures and Compensation Models

Venture Capital Fee Structures Explained

When you invest in a venture capital (VC) fund, you’re not just handing over cash; you’re entering into an agreement where the fund managers get paid for their work. It’s usually a two-part system. First, there’s the management fee. This is a yearly percentage, typically around 2%, taken from the total amount of money the fund has to invest, known as committed capital. Think of it as covering the lights, the rent, and the salaries for the people finding and working with those promising startups. It’s a pretty steady income for the VC firm, regardless of how well the investments are doing in that specific year.

Then there’s the really exciting part for the managers: carried interest, often called "carry." This is where they get a cut of the profits, usually 20%, but only after the investors have gotten their initial investment back, plus a bit more, often called a "hurdle rate." So, if a VC fund invests $100 million and makes $300 million, the investors get their $100 million back first. Then, the remaining $200 million is split, with the investors getting $140 million (70%) and the VC managers getting $60 million (30% of the profit). Wait, I said 20% carry. Let me recheck that. Ah, yes, the 20% is of the profit, so in this example, 20% of $200 million is $40 million. The investors get $160 million and the managers get $40 million. This structure is designed to align the managers’ interests with the investors’ – they only make big money if the fund does well. It’s a big incentive to pick winners and help them grow.

Hedge Funds’ Fee Models: The ‘2 and 20’

Hedge funds often use a similar fee structure, famously known as "2 and 20." This means a 2% annual management fee based on the assets under management (AUM), and a 20% performance fee on profits. However, hedge funds are a bit more flexible. You might see variations like "1 and 30" (1% management, 30% performance) or even "0 and 40" if a fund is really confident in its ability to generate returns.

What’s interesting is how that performance fee works. Unlike VC’s carried interest, which is usually tied to the entire fund’s performance over its life, hedge fund performance fees are often calculated annually. A key concept here is the "high-water mark." Imagine a hedge fund’s value goes up, and the manager earns a performance fee. Then, the market dips, and the fund loses some value. The high-water mark means the manager can’t charge another performance fee until the fund’s value not only recovers to its previous peak but also grows beyond it. This protects investors from paying performance fees on the same gains multiple times. It’s a way to ensure managers are truly adding new value. Some funds might also use a "hurdle rate," similar to VC, where profits below a certain percentage don’t trigger the performance fee. This whole setup is about making sure the managers are rewarded for actual, sustained success, not just lucky market movements. It’s a delicate balance, and understanding these details is pretty important for anyone looking to invest. For instance, if you’re looking at technology investments, you’ll want to understand how these fees might impact your returns, especially with the evolving regulatory landscape for technology firms.

Performance Fees and Carried Interest

So, let’s break down performance fees and carried interest a bit more, because they’re the real drivers of compensation for fund managers. Carried interest, as we touched on with VC, is essentially the managers’ share of the profits. It’s typically a fixed percentage, like 20%, of the profits generated by the fund. The crucial part is that it’s usually realized only when the fund liquidates its investments or sells them. This long-term perspective encourages VC managers to focus on growing the companies they invest in over several years.

Performance fees in hedge funds, on the other hand, are often more dynamic. They can be calculated more frequently, like annually, and are subject to that high-water mark we discussed. This means if a fund has a bad year and loses money, the manager has to make up those losses before they can earn any performance fees on future gains. This is a significant difference from carried interest, which is typically calculated on the overall profit of the fund at the end of its life.

Here’s a quick comparison:

- Carried Interest (VC):

- Percentage of overall fund profits.

- Typically realized at the end of the fund’s life.

- Incentivizes long-term company growth.

- Performance Fees (Hedge Funds):

- Percentage of annual profits (often).

- Subject to high-water marks.

- Can be triggered more frequently.

Both structures aim to align manager and investor interests, but they do so with different timing and mechanics, reflecting the distinct investment strategies of venture capital and hedge funds.

Regulatory Landscape and Legal Considerations

Regulatory Impact on Venture Capital

When you’re looking at venture capital (VC), the rules can feel a bit different depending on where you are. In the U.S., a lot of this comes down to state laws, but federal rules play a part too. For instance, some states have put specific laws in place that talk about how VC funds should be set up, how they’re run, and what they can invest in. It’s not a one-size-fits-all situation. Federal rules, like the Volcker Rule, have also been tweaked. The 2020 version, for example, made it easier for banks to invest in VC funds by creating an exemption for them. This can really help VC firms get the money they need. It’s a complex web, and staying on top of it is key for anyone involved.

Legal Cases Shaping Venture Capital

Beyond the actual laws, court cases give us a good look at how VC funds actually work and what issues can pop up. While not always directly about regulations, cases like Dagres v. Commissioner of Internal Revenue or In re Trados Inc. Shareholder Litigation shed light on the inner workings. They often discuss the roles of the different players, like the limited partners who put up the cash and the general partners who manage the money, and how management companies fit into the picture. Understanding these cases helps you grasp the financial setup and the business side of VC, which is pretty important context.

Regulatory Frameworks for Hedge Funds

Hedge funds operate under a different set of rules, and it’s a bit more involved. For investors, especially big ones like institutions, understanding these rules is a big deal. You need to know if you qualify to invest, and that often means meeting certain financial thresholds. For example, under the Investment Company Act of 1940, a "qualified purchaser" is someone with a significant amount of investments. For individuals, it’s $5 million, but for institutions, it jumps to $25 million. These numbers can change, so you always have to be paying attention. Doing your homework, or due diligence, isn’t just about the fund’s performance; it’s also about checking their regulatory history. Plus, there are all sorts of forms you might need to file, like Form D or Form ADV, and not doing so can lead to trouble. It’s a lot to keep track of, but it’s how you stay on the right side of the law and get access to these kinds of investments. Many investors work with lawyers to make sure they’re following all the rules, which is a smart move when dealing with complex financial markets. You can find more information on how these regulations affect private equity investments on pages like this one.

Impact on Market and Economic Growth

Venture Capital as a Catalyst for Innovation

Venture capital plays a big role in getting new ideas off the ground. Think of it as the fuel for innovation. VC firms invest in startups, often those with groundbreaking technology or business models that could change how things are done. This funding allows these young companies to research, develop, and bring their products or services to market. Without this early-stage capital, many brilliant ideas might never see the light of day. It’s not just about the money, though; VCs also bring valuable advice and connections, helping these companies grow faster and smarter. This injection of capital and expertise can lead to entirely new industries or significantly disrupt existing ones. For instance, the rise of personal computing and the internet wouldn’t have happened at the same pace without VC backing.

How Venture Capital Reshapes Industries

When venture capital flows into a sector, it often shakes things up. Companies that get VC funding are usually trying to do something different, something better. They might introduce a new way to deliver a service, a more efficient manufacturing process, or a product that solves a problem people didn’t even know they had. This competition forces established companies to adapt or risk becoming obsolete. It’s a constant cycle of improvement driven by the pursuit of growth and market share. We see this happening across many fields, from software and biotech to renewable energy. The impact goes beyond just the companies themselves; it creates jobs, drives technological advancement, and can even influence consumer behavior and expectations. It’s a powerful force for economic change, pushing the boundaries of what’s possible and driving economic expansion.

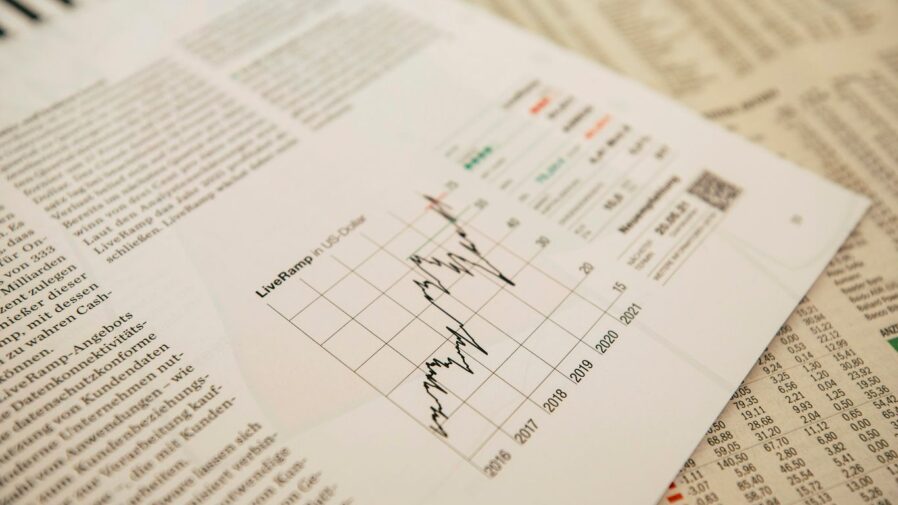

Hedge Funds’ Influence on Market Dynamics

Hedge funds, while different from VCs, also have a significant impact on markets, though often in shorter timeframes. They use a wide range of strategies, including going long and short, using derivatives, and employing significant leverage. This activity can increase market liquidity, meaning it’s easier to buy and sell assets. However, their strategies can also introduce volatility. When many hedge funds make similar bets, it can amplify market movements. They are also active participants in various asset classes, from stocks and bonds to commodities and currencies. Their trading decisions can influence asset prices and, by extension, broader market sentiment. While VCs focus on building companies, hedge funds often focus on exploiting market inefficiencies and price discrepancies. Their influence is more about the flow of capital and price discovery in the short to medium term.

Wrapping It Up: VC vs. Hedge Funds

So, we’ve looked at how venture capital and hedge funds operate. VC is all about backing new, growing companies, often for the long haul, in exchange for ownership. It’s a way to fuel innovation and potentially see big growth, though it comes with its own set of risks and a specific process for startups to follow. Hedge funds, on the other hand, are more about flexible trading strategies across various markets, aiming for returns in shorter timeframes. They have different fee setups and offer investors more freedom to move money in and out. For anyone looking to invest, understanding these core differences in how they find deals, manage money, and what they aim to achieve is key to deciding where your capital might best fit.

Frequently Asked Questions

What exactly is venture capital and how is it different from a bank loan?

Venture capital, or VC, is like special money given to new companies that are expected to grow a lot. Unlike a bank loan where you have to pay the money back with interest on a schedule, VC money is given in exchange for a piece of the company, called ownership or stock. This helps young companies focus on growing without the stress of immediate loan payments.

Who typically puts money into venture capital funds?

Venture capital funds usually get their money from people who are already wealthy, like rich individuals, and from big organizations such as insurance companies and retirement funds. These investors are hoping to make a lot of money back from the successful companies the VC fund invests in.

How do venture capitalists decide which companies to invest in?

Venture capitalists are like talent scouts for businesses. They look for companies with strong leaders, cool new products, and a good chance to become much bigger. They check things like how good the company’s idea is compared to others, how capable the team is, and if lots of people will want to buy what the company makes.

What is the typical timeline for a venture capital investment?

When a venture capital firm invests in a company, it’s usually a long-term commitment. They often hold onto their investment for several years, helping the company grow and improve. Eventually, they aim to sell their share for a profit, which is called an ‘exit strategy’.

How do venture capital firms make money?

VC firms make money in a couple of ways. They charge a yearly fee to manage the fund, usually around 2% of the total money they manage. They also take a share of the profits when the companies they invested in become successful and are sold, which is often about 20% of the profits.

How does venture capital help the economy?

Venture capital is a big help to the economy because it gives money to new and exciting companies that might have really innovative ideas. These companies can then grow, create new jobs, and develop new technologies that can change entire industries and make things better for everyone.