Well, the August 2025 job report is out, and it’s showing us a labor market that’s really slowing down. It feels like things have just kind of stopped moving, you know? Most of the numbers aren’t really changing much, and the trend lines are looking a bit fuzzy, making it tough to guess what’s next. We saw job growth numbers that were way lower than folks expected, and past months got revised down quite a bit. This report gives us a lot to think about when it comes to the economy.

Key Takeaways

- Job growth in July was much lower than predicted, with only 73,000 new jobs added.

- Previous months’ job numbers were revised down significantly, showing a weaker trend.

- The unemployment rate went up a little, partly because fewer people are looking for work.

- Consumer confidence has dipped, suggesting people might spend less.

- Businesses are hiring less and cutting back on inventory, preparing for slower demand.

August 2025 Job Report: A Stalled Labor Market

Well, it looks like the job market decided to take a breather this August, and not in a good way. Things feel like they’ve just kind of… stopped moving. Most of the numbers we look at are stuck in neutral, which makes it really hard to figure out what’s coming next. It’s like trying to predict the weather when the forecast is just “mildly confusing.”

Key Takeaways from the Latest Job Report

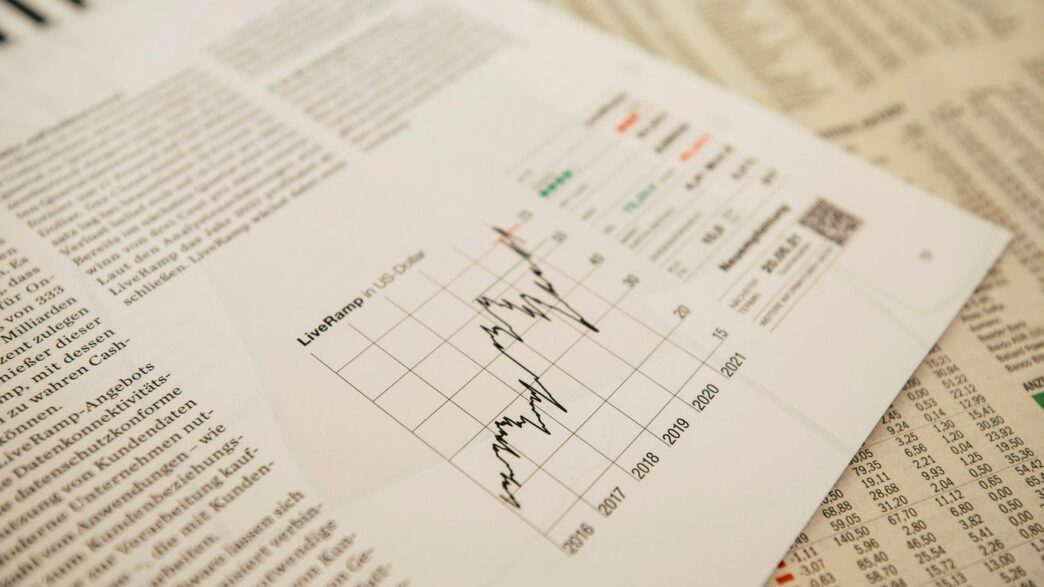

The big story this month is how much the numbers from previous months got revised downwards. Last month, we saw about 73,000 new jobs added. That’s not great, but it’s not a disaster on its own. What is concerning is that the job numbers for May and June were slashed by a combined 258,000. June’s job growth, in particular, was the weakest we’ve seen in over four years. This brings the three-month average down to a mere 35,000 jobs, a pace we haven’t seen since 2020. It’s a clear sign that the rapid hiring we got used to is really slowing down.

Understanding the Nuances of Job Creation Figures

It’s important to remember that monthly job creation numbers can be a bit wobbly. They often get revised later, and sometimes those revisions can paint a misleading picture. For instance, the revisions we saw this month are pretty significant. They suggest that the economy added far fewer jobs in the spring than initially reported. This makes it tough to get a clear read on the labor market’s actual health. We’re seeing a shift from a market that felt really strong to one that’s showing more signs of being fragile. It makes you wonder if this slowdown is just a temporary pause, maybe due to things like tariffs or people delaying hiring decisions, or if it’s something more long-term.

Revisions Paint a Picture of Slowing Growth

Let’s look at the numbers:

- July Job Growth: 73,000 (Revised May & June: -258,000 combined)

- Unemployment Rate: 4.2% (Up from 4.1%)

- Labor Force Participation Rate: 62.2% (Down from 62.4%)

- Job Openings: 7.4 million (Down from 7.8 million)

- Hires: 5.4 million (Down from 5.6 million)

- Quits: 3.1 million (Down from 3.3 million)

These figures, especially the downward revisions and the drop in participation, suggest that the economy is definitely losing steam. It’s not the kind of news that gets you excited about the future, but it’s important to see what’s really happening. We’re seeing fewer people looking for work, and fewer jobs being filled. It’s a different landscape than we’ve seen in a while, and it’s making companies think twice about their next moves. It’s a bit like when Virgin Galactic unveiled its new spaceship; it’s a big step, but it also means a lot of planning and careful execution is needed for what comes next in space travel [68d5].

Economic Indicators Signal a Cooling Economy

It’s becoming pretty clear that the economy is taking its foot off the gas. We’re seeing a bunch of signs pointing to a slowdown, and it’s not just one isolated thing. It’s a pattern that’s showing up across different parts of the economy, from what people are buying to how businesses are managing their stock.

Consumer Sentiment and Spending Trends

Folks seem to be feeling a bit more cautious lately. Consumer spending, which is a huge driver of economic activity, has started to ease up. It’s not a collapse or anything, but it’s definitely not the robust growth we saw earlier. People are thinking twice about big purchases, and that’s rippling through to businesses. It’s like everyone’s collectively decided to hold onto their wallets a little tighter for now. This shift in consumer behavior is a pretty big deal when you consider how much of our economy relies on people spending money.

Business Hiring and Inventory Adjustments

Businesses are definitely noticing this cooling trend. Many companies are pulling back on their hiring plans, which makes sense when they anticipate slower sales. We’re also seeing businesses draw down their inventories more quickly. This means they’re selling off what they have on hand rather than ordering a lot of new stock. It’s a sign that they’re preparing for a period of lower demand. This careful approach to inventory management is a classic move when the economic outlook is uncertain. It helps them avoid getting stuck with too much product if sales don’t pick up as expected. It’s a bit like how people are rethinking car ownership, with more folks opting for shared rides, which changes how manufacturers plan their production making transportation more affordable than ever before.

Impact of Tariffs on Inflation and Income

On top of everything else, the recent tariffs are adding another layer of complexity. While the details are still a bit fuzzy, it looks like these tariffs will likely push prices up for some goods. This means higher inflation, which can really eat into people’s paychecks. When your money doesn’t go as far, you tend to spend less, which, you guessed it, further cools the economy. It’s a bit of a tricky situation because while tariffs are meant to protect domestic industries, they can also create these ripple effects that slow down overall economic growth. We’re watching closely to see how these play out over the rest of the year.

Labor Market Dynamics: What the Job Report Reveals

So, what’s actually happening with jobs right now? It feels like things have just… stopped moving. Forget the usual back-and-forth of heating up or cooling down; most of the numbers are just sitting there. It’s hard to get a clear picture of where things are headed.

Unemployment Rate and Labor Force Participation

The unemployment rate nudged up a bit to 4.2% in August, from 4.1% the month before. It’s not a huge jump, but it’s definitely higher than the really low numbers we saw last year. What’s interesting is that this rise isn’t because a ton more people are looking for jobs. Instead, the labor force participation rate – that’s the percentage of people working or looking for work – actually dropped a little, down to 62.2%. This means fewer people are in the mix, which can make the unemployment rate look a bit different than it might otherwise.

Job Openings and Hiring Rates

Job openings continued to fall, hitting 7.4 million. This is the tenth month in a row that the number has been below 8 million. We saw fewer openings in places like healthcare and food services, which is a change. Hires also went down slightly. The rate at which people are getting hired is pretty much where it was back in 2014, when the economy was still recovering from the big recession. It’s not a bad rate, but it’s certainly not the fast-paced hiring we’ve seen in more recent years.

Worker Confidence and Quits

When people quit their jobs, it usually means they feel pretty good about finding another one. In August, the number of people quitting their jobs went down a bit, to 3.1 million. This number has been pretty steady, and honestly, pretty low, for a while now. It suggests that workers aren’t feeling as confident about jumping ship to a new job as they might have been previously. The overall number of people leaving their jobs, for any reason, stayed the same. This steady, low quit rate is a sign that workers might be holding onto their current positions more tightly.

Navigating the Evolving Job Market for Businesses

So, the job market is definitely shifting gears, right? After a few years of businesses scrambling to hire anyone they could, things are starting to calm down. It’s not quite the wild west of hiring anymore. This August 2025 report shows job gains have slowed, and there are more people looking for work compared to open positions. This is actually good news for many small businesses that were struggling to find staff.

Adapting to Moderate Compensation Cost Growth

Remember those crazy wage hikes from 2022 and 2023? They’re mostly behind us. We’re seeing payroll and benefits costs grow at a much more normal rate, around 4% annually, which is pretty much where we were before the pandemic. So, you can plan your budgets a bit more predictably now. It’s not about fighting for every employee with huge salary offers anymore. This return to more moderate compensation growth means businesses can focus on sustainable hiring practices.

Prioritizing Cash Flow Amidst Uncertainty

With borrowing costs still pretty high – think 7% to 15% – and all sorts of economic questions floating around, keeping a close eye on your cash flow is super important. It’s wise to aim for break-even and try to avoid taking on more debt if you can. Having a solid cash reserve will really help your business handle any unexpected bumps, like changes in trade policies or tariffs. It’s all about building that financial cushion.

Leveraging Benefits for Competitive Advantage

Even though the hiring market is cooling, offering good benefits is still a smart move. The data shows that well-thought-out benefit packages actually help companies hire better people and can even boost how well employees perform. Instead of just seeing benefits as an expense, think of them as an investment in your team’s productivity. This is especially true as your company grows and you start thinking about things like health insurance, which can make a big difference in attracting and keeping good employees. Companies that focus on employee well-being often see better results, much like how technology is changing how we approach business goals Padmasree Warrior, CTO of Cisco, highlights key technology trends.

Here’s a quick rundown of what to consider:

- Plan for steady cost increases: Budget for annual increases in total compensation costs around 3.5% to 4%.

- Manage cash flow closely: Focus on maintaining healthy cash reserves and minimize debt.

- Use benefits wisely: Design benefit packages to attract and retain talent, viewing them as productivity investments.

The Federal Reserve’s Stance and Market Expectations

So, what’s the Federal Reserve up to, and what does it mean for us? It’s a bit of a mixed bag out there. The job market, as we’ve seen, is definitely cooling off. Payroll growth wasn’t as strong as expected in July, and some earlier numbers got revised down, which tells us things are slowing. This slowdown isn’t just in jobs, either. Consumer spending is easing up, and businesses are getting ready for less demand, cutting back on hiring and inventories. Plus, those new tariffs could push inflation higher later this year, potentially squeezing people’s incomes and slowing down the economy even more.

Anticipated Interest Rate Adjustments

Given all this, many economists think the Fed might cut interest rates soon, maybe even in September. Markets are pretty much betting on it too. The Fed has been cautious about lowering rates after raising them to fight inflation. Their target rate is currently around 4.5%, which is still pretty high compared to before the pandemic. This higher rate environment has made borrowing more expensive for businesses, with rates for term loans and SBA loans being significantly higher than just a few years ago. It really changes how businesses need to manage their money.

Bond Market Opportunities

With interest rates where they are, some people are looking at bonds. If you’re thinking about where to put your money, there might be some good opportunities in certain bond markets over the next few years. Bonds can be a way to protect your investments and find specific chances to make money. It’s a different picture than a few years ago, for sure.

US Dollar Performance Outlook

As for the U.S. dollar, it might stay strong for a little while because people often turn to the dollar when things feel uncertain. But looking further out, we might see it weaken a bit. This is because other countries might start doing different things with their own interest rates and economies, which can affect the dollar’s value. It’s all part of the bigger economic picture we’re watching closely, especially with the latest economic data coming out.

Small Business Strategies in a Rebalanced Labor Market

The job market is definitely feeling different these days. After a few years where it felt like you had to grab any warm body you could find, things have cooled off a bit. This shift, sometimes called the "Great Rebalancing," actually gives small businesses a chance to be smarter about who they bring on board. It’s not about desperation hiring anymore; it’s about finding the right fit for your team.

Selective Hiring in a Normalized Market

Remember those times when there were way more job openings than people looking for work? That’s mostly behind us. Now, there are about as many unemployed workers as there are open jobs. This means you can take your time and really look at candidates. Instead of just filling a spot quickly, focus on finding people whose skills and personality match your company culture. This careful approach can save a lot of headaches down the road.

Customer Retention Over Acquisition

With the economy feeling a bit uncertain, and borrowing costs still pretty high, it makes sense to focus on keeping the customers you already have. It’s often less expensive to keep a customer happy than it is to find a new one. Think about ways to improve your customer service, maybe offer loyalty programs, or just check in more often. Happy, returning customers are the bedrock of a stable business, especially when new growth feels a bit slower.

Diversifying Revenue Streams

It’s always a good idea for small businesses not to put all their eggs in one basket. If your main income comes from just one product or service, consider what else you could offer. Maybe there’s a complementary service you could add, or a different market you could tap into. This doesn’t mean a huge overhaul; it could be as simple as bundling existing products or offering a new, related service. Having multiple ways to bring in money makes your business much more resilient when one area slows down. For some tips on keeping your tech up-to-date to support these changes, you might find advice on optimizing computer speed helpful.

Wrapping It Up: What August 2025’s Jobs Report Means

So, looking at the August 2025 job numbers, it’s pretty clear the economy isn’t exactly roaring ahead right now. Most signs point to things slowing down, with job growth numbers being weaker than expected and revisions showing fewer jobs were added in previous months than we thought. This cooling trend is showing up in other areas too, like consumer spending easing a bit. Businesses are also starting to be more careful about hiring, which is a big change from the hiring frenzy of recent years. For small businesses, this means it’s a good time to focus on keeping the customers you have, managing your money carefully, and being more selective when you do need to hire. The economy feels a bit uncertain, especially with new tariffs potentially making things more expensive. It’s not a time for panic, but it is a time to be smart and adaptable.

Frequently Asked Questions

What does the August 2025 job report say about the job market?

The job market in August 2025 seems to be slowing down. Job growth numbers were lower than expected, and past job numbers were also lowered. This means fewer new jobs are being created compared to earlier in the year.

Why did the unemployment rate go up a little?

The unemployment rate went up slightly because fewer people were looking for jobs. Even though there were fewer jobs available, the number of people wanting jobs also decreased, which made the unemployment rate tick up a bit.

Are businesses still hiring a lot?

Businesses are hiring, but not as much as before. The number of job openings has gone down, and it’s becoming a bit easier for companies to find workers. This is good news for businesses that had trouble hiring in the past.

How are tariffs affecting the economy and jobs?

New tariffs, which are taxes on imported goods, could make prices go up for some things. This might mean people have less money to spend, which could slow down the economy and affect job growth.

What should small businesses do in this changing job market?

Small businesses should focus on keeping their current customers happy and be more careful about who they hire. It’s also a good idea to manage their money wisely and not take on too much debt because the economy is cooling down.

What is the Federal Reserve likely to do next?

Because the economy is cooling, many people expect the Federal Reserve might lower interest rates soon. This could make borrowing money cheaper for businesses and individuals.