Australia is really starting to make some noise in the world of computer chips. It’s not just about making them, though; it’s about smart design and using special kinds of materials. The government is putting money into this, and there’s a big push to get more local companies involved. We’re seeing some cool advancements, especially in areas like defense and new technologies. But, like any growing industry, there are definitely some hurdles to jump over, particularly when it comes to finding the right people to do the work.

Key Takeaways

- Australia’s semiconductor industry is getting a boost from government funding, focusing on chip design and compound semiconductors.

- The market is expected to grow significantly, driven by tech advancements and government support, impacting Australia’s GDP and jobs.

- Key players are emerging in specialized areas like long-range IoT chips, power management, and lasers, showing Australia’s niche strengths.

- A major challenge is the shortage of skilled workers, especially electricians, which needs to be addressed through expanded training programs.

- Obstacles like high investment costs and supply chain reliance are being tackled through strategic focus and national coordination.

Australia’s Strategic Semiconductor Landscape

Australia is really starting to make some noise in the semiconductor world, and it’s not just about making chips, but about being smart about where we play. The government’s been putting money into this, seeing it as a big deal for our future, especially for things like defense and new tech.

Government Investment in Chip Manufacturing

The feds and state governments are putting their money where their mouth is, backing projects that help us build and test chips right here. Think of it as laying the groundwork for a whole new industry. The National Reconstruction Fund is a big part of this, with billions set aside for manufacturing, including the bits and pieces that go into making advanced electronics. It’s not just about building factories, though; it’s about getting the right equipment and making sure we can actually produce things.

Focus on Compound Semiconductors and Design

Instead of trying to go head-to-head with the massive chip makers on everything, Australia is getting clever. We’re really leaning into compound semiconductors and chip design. These are the specialized bits that go into things like advanced communication systems and power electronics. It’s a smart move because it plays to our strengths in research and development, and it means we can create high-value products without needing the same kind of massive scale as the big players.

Technology Transfer and Defense Initiatives

There’s a big push to make sure that the technology we develop stays secure and benefits Australia. This means working with trusted partners, especially on defense projects. The idea is to build our own capabilities, but also to share knowledge with countries we have strong ties with, like the US and the UK. It’s all about making sure our defense systems are up-to-date and that we have a reliable supply of critical components, which is pretty important for national security.

Market Growth and Economic Impact

The Australian semiconductor sector is really starting to pick up steam. We’re looking at some pretty solid growth projections for 2025 and beyond. It’s not just about making chips; it’s about how this industry fits into the bigger economic picture for the country.

Projected Market Size and Growth Rate

Right now, the Australian semiconductor industry is estimated to be worth around USD 24.46 billion. The numbers suggest it’s going to keep growing, with a projected compound annual growth rate of about 6.50% between 2025 and 2033. This isn’t just a small bump; it points to a significant expansion, largely thanks to things like more AI being used and general tech improvements across the board. It’s a good sign for anyone involved.

Key Drivers of Market Expansion

So, what’s pushing this growth? A few things stand out. For starters, the automotive sector, especially with electric vehicles (EVs) and their fancy driver-assistance systems, is a big deal. EVs are taking up a larger slice of the global car market, and they need a lot of chips. Plus, cloud spending in the Asia Pacific region is set to more than double in the next five years, which means more demand for the infrastructure that supports it. And, of course, AI is a massive factor, not just in how chips are used, but also in making the chip design process itself faster and cheaper. The increasing demand for AI technologies is also making companies think more about sustainability in how they manufacture chips.

Contribution to National GDP and Employment

When an industry like this grows, it naturally has a positive effect on the national economy. We’re talking about more high-skilled jobs, not just in manufacturing but also in research and development. Building out this semiconductor ecosystem helps make supply chains more secure, meaning less reliance on imports, which is good for national security too. Industries that use these components, like medical devices and energy, also get a boost from having reliable, local sources. It’s about building a stronger, more self-sufficient economy overall, and you can find more information on market entry and expansion strategies at IMARC Group.

Government Support and Funding Mechanisms

Australia’s governments, both federal and state, are stepping up to support the semiconductor industry. It’s not just about big promises; there are actual programs and money being put into play. Think of it as planting seeds for future growth. The federal government, through initiatives like the National Reconstruction Fund (NRF), is directing capital towards manufacturing, including areas like power electronics and advanced systems that rely on chips. The NRF Corporation, set up in August 2025, can invest significant amounts through various financial means.

On the state level, New South Wales is making a move with its Semiconductor Sector Service Bureau (S3B). This bureau is designed to help companies with things like chip design and prototyping. They offer support such as subsidized software and help with multi-project wafer runs, which can really lower the barrier to entry for smaller companies and researchers. It’s a practical way to get more players involved in the chip game.

These investments are important because building out a semiconductor capability isn’t cheap. It requires substantial capital, especially for things like pilot facilities and specialized equipment. The goal is to build up local manufacturing and integrate Australia more smoothly into global supply chains. It’s a long-term play, and sustained government policy and investment are key, much like what we’ve seen in places like Singapore which has a significant semiconductor sector.

Here’s a look at some of the funding avenues:

- Federal Government Investments: Allocations for chip production lines, testing infrastructure, and equipment upgrades are part of the national strategy.

- National Reconstruction Fund Initiatives: The NRF can invest up to AUD 15 billion across priority areas, including value-added manufacturing relevant to semiconductors.

- New South Wales Semiconductor Sector Service Bureau: This initiative provides subsidized software, multi-project wafer runs, and engineering assistance to support design and prototyping.

The government’s commitment is a vital step in building Australia’s capacity in this critical technology. It’s about creating a more robust and self-reliant future for the nation’s tech sector, potentially impacting everything from defense systems to consumer electronics. You can find more information on how new technologies are shaping the future of PCs at Advanced Micro Devices.

Australian Semiconductor Innovators and Niches

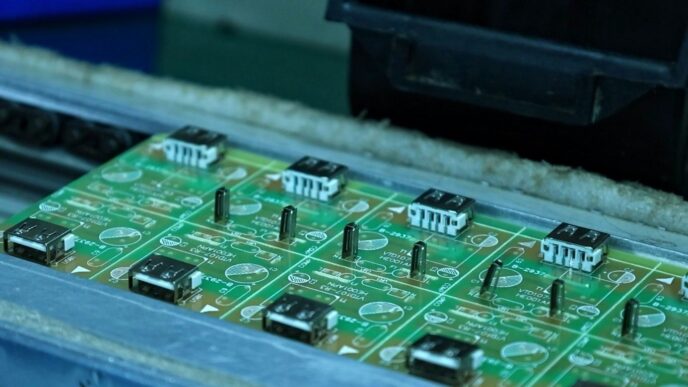

It’s easy to think of semiconductors as just those tiny chips you find in phones and computers, and honestly, most of the really advanced manufacturing happens overseas, like in Taiwan. But Australia has its own quiet strengths in this area, focusing on specific parts of the chip world where we can really make a mark. We’re not trying to out-produce the giants; instead, we’re looking at the clever design work and specialized applications.

Leading Australian Semiconductor Companies

Australia has some really interesting companies doing good work in the chip space. Take Morse Micro, for example. They’re based in Sydney and are making Wi-Fi chips that are designed for the Internet of Things (IoT) – think long-range, low-power connections. Their MM8108 chip even won some awards this year for being a top IoT technology. Then there’s Silanna Semiconductor, out of Brisbane. They focus on chips that manage power and radio frequencies, and they’ve been putting out new products like their SL2002 FirePower laser-driver IC. BluGlass, located in Silverwater, is doing some cool stuff with gallium nitride (GaN) lasers and photonics. They actually set a world record for a type of laser output recently and are seeing orders come in, even from India’s Ministry of Defence. And in Adelaide, Hendon Semiconductors is making hybrid thick-film circuits, which are important for things like healthcare and defense.

Strengths in Niche Market Segments

What’s really interesting is where these Australian companies are finding their footing. They’re not trying to make every kind of chip. Instead, they’re good at:

- Connectivity: Developing chips for things like long-range, low-power Wi-Fi.

- Power Electronics: Creating chips that efficiently manage electricity, which is key for electric vehicles and renewable energy.

- Photonics: Working with light to create chips, which has applications in areas like advanced sensors and communication.

- Specialized Assemblies: Building secure and reliable circuits for sensitive industries like defense and medical devices.

These are areas where Australia’s existing skills in systems engineering and research can really shine. It’s about finding those specific needs that the big manufacturers might not focus on as much.

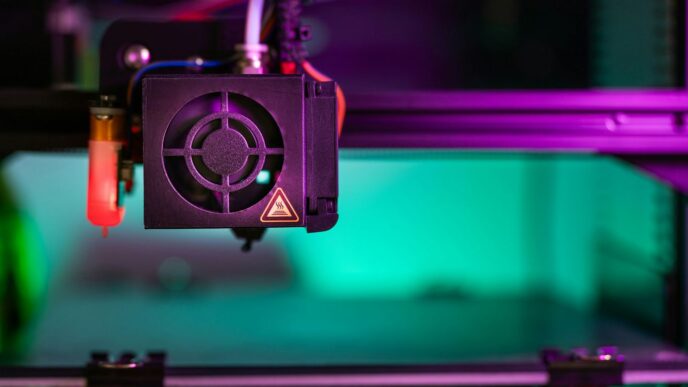

Emerging Technologies in Fabrication

Looking ahead, there’s a lot of buzz around new ways of making chips. CSIRO engineers, for instance, have been experimenting with quantum-AI techniques to make chip production faster and more accurate. We’re also seeing local companies that make manufacturing equipment start to build machine learning into their systems for testing and inspection. This could really speed things up. Companies like Diraq are even looking at quantum technology, working with local design firms to create new kinds of semiconductor solutions for super-cold environments. It’s these kinds of forward-thinking projects that show Australia’s potential to contribute to the next wave of semiconductor innovation, even if it’s in very specialized areas.

Addressing Talent Shortages and Workforce Development

It’s no secret that the semiconductor industry is booming, but getting enough skilled people to actually build and design these chips is turning into a real headache. We’re seeing a massive global demand for talent, and Australia is definitely feeling the pinch. The race for industry talent is intensifying, and it’s a key concern across the entire semiconductor value chain. Without enough qualified workers, future growth plans could really stall out.

The Growing Demand for Skilled Electricians

While we often think of chip designers and engineers, the need for skilled tradespeople, like electricians, is also sky-high. These are the folks who keep the complex machinery in fabrication plants running smoothly. Think about the specialized equipment needed for cleanrooms or the intricate wiring for testing facilities – it all requires a solid understanding of electrical systems. As new facilities are planned and existing ones are upgraded, the demand for electricians with specific industry knowledge is only going to climb. It’s not just about plugging things in; it’s about understanding the precise requirements of sensitive manufacturing environments.

Challenges in Securing Specialized Expertise

Beyond the general need for trades, there’s a significant gap when it comes to highly specialized roles. We’re talking about people with deep knowledge in areas like device physics, maintaining the incredibly complex tools used in fabrication, or ensuring high-reliability manufacturing processes. These aren’t skills you pick up overnight. The Australian Strategic Policy Institute has pointed out that this lack of specialized workforce is a major bottleneck for the sector. It’s tough to find people who can handle the intricate details of semiconductor manufacturing, especially when other tech sectors are also competing for the same limited pool of talent. This scarcity can lead to costly project delays and makes it harder to scale up operations effectively. Finding people with the right background is tough, and even tougher when you need them to understand specific Australian defense needs or harsh-environment electronics.

Scaling Up Training and Talent Pipelines

So, what’s the plan? We need to seriously ramp up our training programs. This means more university courses focused on semiconductor engineering, but also vocational training for those essential trades. Partnerships between industry and educational institutions are key here. Companies are already working with local colleges to attract students to relevant fields, which is a good start. We also need to look at reskilling programs for existing workers and attracting talent from overseas for those highly specialized roles. The goal is to build a robust talent pipeline that can support the industry’s growth for years to come. It’s about creating clear career paths, from apprenticeships right through to advanced research roles, making sure Australia has the skilled people it needs to compete on the global stage. This includes looking at how we can support SMEs in engineering and prototyping, as they often need multi-million-dollar funding to get their projects from design to manufacturing, a process that can take years. Building these capabilities requires a coordinated national effort, involving universities, companies, and governments at all levels to develop a semiconductor strategy.

Overcoming Industry Obstacles

Building a semiconductor industry in Australia isn’t exactly a walk in the park. There are some pretty big hurdles we need to get over if we want this to really take off. It’s not like setting up a small business; this is complex stuff with serious financial and skill requirements.

Scale and Capital Investment Requirements

Let’s be real, building a cutting-edge chip factory, the kind that can compete globally, costs an absolute fortune. We’re talking billions, maybe even tens of billions, of dollars. Australia just doesn’t have the same kind of capital readily available as some of the bigger players overseas. This means we probably can’t aim to be a mass producer of every type of chip. Instead, we need to be smart and focus on areas where we can actually make a difference, maybe starting with smaller, specialized production runs. The government has acknowledged these costs, and it’s clear that significant financial backing and a very specific plan will be needed to even get pilot projects off the ground, let alone full-scale manufacturing. It’s a tough pill to swallow, but we have to be realistic about the scale of investment needed.

Supply Chain Vulnerabilities and Component Reliance

Another big issue is that we don’t make a lot of the really basic stuff needed for chip production right here. Think about things like special chemicals, or the masks used to pattern the chips, or even certain gases. We rely on getting these from other countries. This makes us vulnerable. If there’s a problem with shipping, or if another country decides to hold onto their supplies, our production can grind to a halt. This is especially worrying when you consider the global economic situation. We need to figure out how to secure these supplies, maybe through long-term deals with suppliers, but that also ties up more money. It’s a tricky balance between needing these components and the cost of making sure we always have them.

The Need for National Coordination and Policy

To really tackle these challenges, everyone needs to be on the same page. We need a clear, unified strategy from the government, not just a bunch of separate initiatives. This means federal and state governments working together, along with universities and the companies themselves. Having clear policies and incentives will encourage more investment and make it easier for businesses to take risks. It’s about creating a supportive environment where innovation can happen. We also need to think about how we can use existing national resources, like those related to quantum technology, to help boost our semiconductor efforts. Building up our own capabilities is key to becoming more self-reliant in a world where global supply chains can be unpredictable. It’s a big job, but getting this coordination right is probably the most important step we can take. It’s a chance to build something lasting, and maybe even get some of our own tech out there, like the new iPager that just came out [0b8c].

Australia’s Opportunity in Specialized Segments

So, while Australia might not be looking to build massive chip factories like some of the global giants – that’s a whole different ballgame with huge costs – there are definitely areas where the country can really make its mark. It’s more about finding those clever niches where Australian know-how can shine.

Defense-Grade and Harsh-Environment Electronics

Think about electronics that need to work no matter what – extreme temperatures, radiation, you name it. The Australian government is putting money into making sure we have our own capabilities for defense stuff, which is pretty smart. This means there’s a steady demand for things like secure assemblies, radio frequency modules, and components that can handle tough conditions. It’s a good way for smaller Australian manufacturers to get involved and build up their skills, kind of like what’s happening with upgrades in places like Hendon.

Advancements in Power and Photonics

Then there’s the whole area of power electronics and photonics. Gallium Nitride (GaN) lasers and power devices are a big deal globally, and Australian companies like BluGlass are showing that it’s possible to develop this cutting-edge tech here and sell it overseas. It’s about creating specialized chips that can handle high power efficiently, which is important for everything from electric vehicles to renewable energy systems. This is a space where Australian innovation can really compete on the world stage.

AI-Enabled Manufacturing Services

Another interesting angle is using artificial intelligence in the manufacturing process itself. Imagine using machine learning to spot tiny defects in chips or to make sure the manufacturing process is running as smoothly as possible. Australian companies that make manufacturing equipment or integrate these systems can stand out by adding AI capabilities. Programs from places like CSIRO, and even demonstrations involving quantum computing and AI planned for 2025, could lead to new services for both Australian and regional customers. This is about making manufacturing smarter and more precise, which is a big plus for the semiconductor packaging industry in Australia.

Basically, the focus is on high-assurance, low-volume production for specific customers in defense, energy, and space. It’s less about mass production and more about precision and reliability, playing to Australia’s strengths in systems engineering and specialized design.

Strategic Ripple Effects and Future Outlook

Building out Australia’s semiconductor capabilities isn’t just about making chips; it’s about setting off a chain reaction of good things for the economy and national security. Think more high-paying jobs in research, making stuff, and putting systems together. Plus, it shores up our supply chains, meaning we don’t have to rely so much on other countries for these vital parts. Industries like medical tech, automation, and energy will get a boost from having trusted, local sources for their components. It’s a real win-win.

Economic and Security Gains from Ecosystem Development

When you build up a local semiconductor industry, it’s like planting seeds for future growth. You get skilled jobs, sure, but you also get a more secure supply chain. This means industries that need reliable parts, like defense or even advanced medical equipment, can count on Australian-made components. It reduces our vulnerability to global disruptions and strengthens our position in a world where tech is everything. It’s about building resilience and self-sufficiency.

Leveraging Quantum and National Infrastructure

Australia has some serious potential in areas like quantum computing and advanced national infrastructure projects. These fields often need highly specialized chips that can handle extreme conditions or perform complex calculations. By focusing on these niche areas, Australian companies can carve out a significant global market share. Imagine chips designed for harsh environments or those that power the next generation of quantum computers; that’s where Australia can really shine. We’re seeing early signs of this with companies looking at specialized packaging and services to support the growing tech needs in the Asia Pacific region, which could really boost our role in the global tech supply chain. It’s about finding our unique spot and excelling there.

Building Self-Reliance in Global Supply Chains

In today’s world, relying too heavily on single sources for critical components is a risky game. Australia’s move into semiconductors is a strategic play to build more self-reliance. This means not only making chips here but also developing the whole ecosystem around it – from design to packaging. It’s about creating a robust, domestic capability that can weather global storms and ensure we have access to the technology we need, when we need it. This approach can also attract investment and partnerships, further solidifying our place in the international tech landscape. It’s a long-term vision for a more secure and independent future, and it’s something that companies like Cisco, with their focus on innovation in areas like mobile tech and security, understand the importance of key technology trends.

Looking Ahead: Australia’s Semiconductor Future

So, where does this all leave Australia’s semiconductor scene as we move into 2025? It’s clear the country is making moves, focusing on smart areas like chip design and specialized manufacturing, rather than trying to out-fab the giants. Government backing is there, with money flowing into new facilities and research. We’re seeing some really cool homegrown companies doing impressive work in niche markets, from long-range IoT chips to advanced lasers. But let’s be real, there are big hurdles. We’re talking about the massive cost of building factories and, perhaps more importantly, a serious shortage of skilled people. Getting enough engineers and technicians trained up is going to be key. If Australia can keep up the momentum, focus on its strengths, and find ways to attract and keep talent, it could carve out a significant spot for itself in the global tech picture, especially in areas important for defense and new technologies. It’s a challenging road, but the potential rewards are pretty big.

Frequently Asked Questions

What is Australia doing to build its own chip-making industry?

Australia is putting money into chip making and design. The government is investing in new factories and focusing on special types of chips, like those used in defense and for things that need to work in tough conditions. They’re also working with countries like the US and UK to share technology.

How big is the semiconductor market in Australia expected to get?

The market for chips and related services in Australia is growing. It was worth about $13.88 billion in 2024 and is predicted to reach around $24.46 billion by 2033. This growth is happening because more people are buying electronics, and new technologies like AI and the Internet of Things need lots of chips.

What kind of jobs will be needed in Australia’s chip industry?

As the chip industry grows, there will be a bigger need for skilled workers, especially electricians who can work in factories and with complex equipment. There’s also a shortage of engineers who know a lot about how chips are made and how to fix the machines that make them.

What are some Australian companies doing in the chip world?

Some Australian companies are doing well in specific areas. Morse Micro makes chips for long-range Wi-Fi for smart devices. Silanna Semiconductor creates chips that help manage power in electronics. BluGlass makes special lasers used in technology, and they’ve even sold some to India’s defense department.

What are the biggest challenges for Australia’s chip industry?

Building chip factories costs a lot of money, which is hard for Australia to match with bigger countries. It’s also tough to find enough workers with the right skills. Plus, Australia has to import many important materials needed to make chips, which can cause problems if those supplies get interrupted.

Where does Australia have the best chance to succeed in the chip market?

Australia can do well in special areas where it doesn’t need to make chips in huge amounts. This includes making chips for defense that can work in harsh environments, creating advanced power chips and light-based chips (photonics), and using AI to help design and check the quality of chips during manufacturing.