The Fintech Meetup 2025 recently wrapped up, and it was quite the event for anyone in the financial technology world. I went hoping to get a feel for where things are headed, and honestly, it delivered. There was a lot of talk about new tech, how companies are connecting, and what the future might hold. It felt like a big gathering of smart people all trying to figure out the next big thing in finance.

Key Takeaways

- Fintech Meetup 2025 was a major event for networking and seeing new financial tech.

- Discussions focused on new ways to handle payments and digital banking.

- The event helped create many business connections, with over 20,000 B2B conversations happening.

- Leaders shared thoughts on making financial services more accessible globally and improving digital banking.

- There’s a positive outlook in fintech, even with economic worries, especially around B2B payments.

Fintech Meetup 2025: A Hub of Innovation and Networking

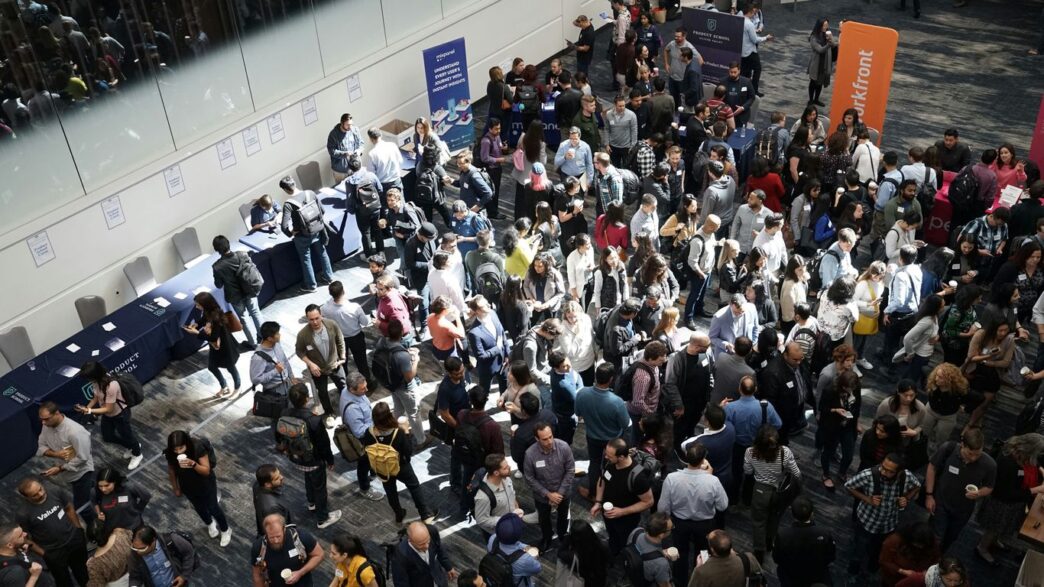

Fintech Meetup 2025 really kicked off with a bang, bringing together a massive crowd of people all focused on the future of finance. The energy from the moment registration opened was something else. It felt like everyone was ready to connect and see what’s new in the industry.

High-Energy Start to the Event

The first day was packed. Thousands of fintech pros showed up, and you could just feel the buzz in the air. It was all about making connections, finding new partners, and getting a look at the latest tech. The welcome reception that evening was a great way to wrap up the day, letting people chat and build on those initial connections.

Showcasing Latest Financial Technology Innovations

Walking through the expo hall was like stepping into the future. So many companies were showing off their newest ideas, from payment systems to digital banking tools. It was a chance to see firsthand the tech that’s changing how we handle money. The event really highlighted how fast things are moving in financial technology.

Fostering New Business Opportunities

Beyond just seeing new tech, the event was a massive networking opportunity. They managed to set up over 20,000 B2B conversations, which is pretty wild. This really helped people find new business partners and explore ways to grow. It wasn’t just about talking; it was about making deals happen and setting up future collaborations. If you’re looking to make valuable connections, checking out the Hosted Meetings program is a smart move.

Key Themes and Discussions at Fintech Meetup 2025

Fintech Meetup 2025 really zeroed in on what’s moving the needle in financial services right now. It wasn’t just a bunch of buzzwords; people were talking about practical applications and future directions.

The Future of Payments Innovation

This was a big one. There was a lot of talk about how payments are changing, especially with instant payment systems. Companies are looking for ways to make transactions faster and smoother, not just for consumers but for businesses too. It feels like we’re on the edge of some major shifts in how money moves around.

Digital Banking Strategies and Challenges

We heard from some big names about how they’re tackling digital banking. It’s clear that customer experience is key, but there are also hurdles to overcome, like keeping up with new tech and regulations. The discussions highlighted the need for banks to be agile and customer-focused to stay competitive. It’s all about making banking easier and more accessible.

Expanding Embedded Financial Services

This topic really got people thinking. Embedded finance, where financial services are integrated into non-financial platforms, is growing fast. Think about getting a loan directly when you’re buying something online, or insurance offered at the point of sale. It’s about making financial tools available right when and where people need them. This trend is changing how businesses interact with their customers and opens up new avenues for partnerships. You can find more on payment innovation at Fintech Meetup Cyprus.

Driving Growth Through Strategic Fintech Connections

Fintech Meetup 2025 really hammered home how important it is to build the right connections in this fast-moving industry. It wasn’t just about showing off new tech; it was about making deals happen and finding partners. The event facilitated over 20,000 B2B fintech conversations, which is a pretty wild number when you think about it. That’s a lot of potential collaborations getting started.

It was great to see the Startup Pitch Finale winners announced – Utsav Shah from Kaaj and Edwin Handschuh from 1Konto took home the top spots. These kinds of competitions are super important for giving new companies a leg up and showing everyone what’s next. The real value, though, comes from strengthening those relationships within the fintech industry.

Here’s a quick look at how the event helped make those connections:

- Structured Networking: Thousands of pre-scheduled meetings took place, creating a focused environment for business development.

- Open Innovation: J.P. Morgan Payments made a big move to give developers more access to their systems through APIs. This kind of openness is what helps the whole fintech ecosystem grow.

- Relationship Banking: Ally Financial highlighted the need for banks and fintechs to build deeper, ongoing relationships, moving beyond simple transactions.

Events like this are a fantastic way to see the industry in action and find opportunities. If you’re looking to get your brand noticed at these kinds of gatherings, there are specialized agencies that can help with everything from marketing to lead generation, making sure your presence counts long after the event is over. You can find more information on upcoming fintech events in 2025 here.

Insights from Fintech Leaders and Visionaries

Fintech Meetup 2025 was a fantastic place to hear directly from the people shaping the future of finance. It wasn’t just about new tech; it was about the big ideas behind it. Shivani Siroya, CEO of Tala, gave a really inspiring talk about how new technologies are making financial services more accessible globally. It’s clear that expanding financial access is a major goal for many in the industry.

We also heard from leaders like Michael Rhodes of Ally Financial and Nigel Morris of QED Investors. They shared their thoughts on digital banking, talking about the challenges and what it takes to create good customer experiences. It’s not easy, but they’re finding ways to make banking smoother for everyone.

Here are some of the key themes that came up:

- Financial Access and Global Growth: How can we bring more people into the financial system? This was a big question, with speakers highlighting technology’s role.

- Digital Banking Experiences: What makes a digital bank great? The focus is on user-friendly design and meeting customer needs.

- Institutional Investing Trends: What are the big players looking at? Discussions touched on where smart money is going in the fintech space.

It was also interesting to hear about the focus on B2B payments. According to PitchBook data, these types of fintech companies got more than half of the venture capital funding in 2024. This shows where a lot of the business innovation is happening right now. For brands looking to make their mark, understanding these trends is key, and agencies can help with content marketing for fintech to get your message out there.

The Evolving Landscape of Lending at Fintech Meetup 2025

Fintech Meetup 2025 really put a spotlight on how lending is changing, and honestly, it’s happening fast. Gone are the days when a simple credit score was the only thing that mattered. Lenders are now looking at a much wider picture to figure out who’s a good bet.

Disrupting Traditional Lending Models

It was clear from the talks that old ways of doing things just aren’t cutting it anymore. Small businesses, in particular, are seeing new options for getting capital. Instead of just relying on bank statements, lenders are digging into things like how often a business pays its bills or even how its customers behave. This means more companies that might have been overlooked before could now get the funding they need. It’s about making lending fairer and more accessible.

AI-Powered Automation in Finance

Artificial intelligence isn’t just a buzzword anymore; it’s actively being used to make lending smoother. Think about the loan application process – AI can speed up checking documents, spot potential fraud, and even help decide if a loan should be approved. This not only makes things quicker for everyone but also frees up people to focus on more complex tasks. The goal is to create a better experience for borrowers and open up new lending avenues.

Alternative Data for Smarter Risk Profiling

This was a big one. Lenders are increasingly using what’s called ‘alternative data’ to get a clearer view of risk. This could be anything from how a business manages its cash flow to its payment history with suppliers. By looking at these different data points, lenders can make more informed decisions. It’s a way to be more inclusive and help businesses build their creditworthiness. We’re seeing a move towards systems that can adapt to new data sources, which is pretty exciting for making better financial decisions.

Post-Event Engagement and Brand Visibility

So, Fintech Meetup 2025 wrapped up, and while the connections made and ideas shared are fantastic, the real work often starts afterward. How do you keep that momentum going and make sure your brand stays top-of-mind?

It’s all about smart follow-up and making your presence felt even after you’ve left the venue. Think of it like this: the event is the spark, but your post-event strategy is the fuel that keeps the fire burning.

Here’s a breakdown of how to make that happen:

- Content Marketing: Don’t let those great discussions just fade away. Turn insights from panels or your own company’s participation into blog posts, social media updates, or even short video clips. This keeps your audience informed and positions you as a knowledgeable player in the fintech space. We saw a lot of focus on content marketing for fintech at the event, and it really works to keep people engaged.

- Email Campaigns: You likely collected a good number of leads or made new contacts. A well-timed email campaign can nurture these relationships. Share event highlights, offer exclusive content, or invite contacts to a follow-up webinar. It’s a direct line to people who have already shown interest.

- Social Media Amplification: Keep the conversation going online. Share photos from the event, thank speakers and attendees, and recap key takeaways. Using event hashtags helps people find your content and continue the dialogue. It’s a great way to boost your social media presence.

Maximizing Brand Impact at Industry Events

Making your brand stand out at a busy event like Fintech Meetup is tough. It’s not just about having a booth; it’s about creating an experience. This means thinking about:

- Pre-Event Buzz: Getting people excited before they even arrive. This could be through targeted social media ads, email announcements about your participation, or even offering early access to content.

- On-Site Engagement: Beyond just handing out flyers, think about interactive elements. Maybe a live demo, a Q&A session at your booth, or even a small networking event you host.

- Post-Event Follow-Through: This is where the real value is often secured. Did you promise a whitepaper? Send it. Did you schedule a follow-up call? Make sure it happens. Consistency is key to building trust.

Digital Lead Generation Solutions

Events are great for meeting people, but turning those meetings into actual business requires a solid lead generation strategy. This involves:

- Clear Calls to Action: Make it obvious what you want people to do next, whether it’s visiting your website, signing up for a demo, or downloading a resource.

- CRM Integration: Ensure all the contacts you make are quickly and accurately entered into your customer relationship management system for efficient follow-up.

- Tracking and Analysis: Understand which activities generated the most valuable leads. This data helps you refine your approach for future events. It’s about working smarter, not just harder, to connect with the right people.

A Palpable Sense of Optimism in Fintech

Even with all the talk about economic ups and downs, you could really feel a positive vibe at Fintech Meetup 2025. It seems like folks in the fintech world are looking ahead with a lot of hope, which is pretty refreshing. Companies that focus on staying compliant while still pushing new ideas are the ones that will really stand out.

Navigating Economic Uncertainty with Enthusiasm

Despite some worries about the economy, the mood at the event was definitely upbeat. People seemed genuinely excited about the direction fintech is heading. It feels like many fintech companies are on a good track, and while there might be some market bumps ahead, the overall feeling is one of growth and opportunity. It’s like everyone’s ready to build on the progress made over the last few years.

B2B Payments as a Focal Point

There was a clear shift in focus towards business-to-business (B2B) payments this year. Instead of just consumer-focused solutions, a lot of the conversation centered on how fintech can solve payment problems for businesses. This makes sense when you look at the numbers; a big chunk of investment in fintech is going into companies that handle B2B transactions. It shows where the real action is happening for many fintech innovators.

Real-Time Payments as an Untapped Opportunity

It’s kind of surprising, but real-time payments in the U.S. still have a ton of room to grow. Many businesses are still using payment methods that haven’t changed much in years. This means there’s a big chance for companies to create faster, more efficient ways to handle payments. Lots of tech companies and startups are already working on these kinds of solutions, and it was clear at the meetup that this is a major area for future development. It’s a chance to really change how money moves for businesses, and maybe even help teams find new roles more easily with platforms like Elevator.

Here’s a quick look at what was discussed:

- Focus on B2B: The majority of fintech investment is going into business-focused payment solutions.

- Efficiency Gains: Companies are looking for ways to speed up payment processes.

- Growth Potential: Real-time payments are seen as a significant area for expansion.

It really felt like a moment where the industry is looking forward, ready to tackle challenges and grab new chances. The energy was high, and the focus on practical solutions for businesses was a big theme.

Wrapping Up Fintech Meetup 2025

So, Fintech Meetup 2025 wrapped up, and it was quite the event. Lots of people showed up, and the energy was definitely there. We saw some really interesting talks about where finance is headed, especially with all the new tech coming out. It felt like a good place to make connections and get a feel for what’s next in the industry. If you missed it, don’t worry, there are always more events like this. Keep an eye out for the next big thing in fintech – it’s always just around the corner.

Frequently Asked Questions

What is Fintech Meetup 2025 all about?

Fintech Meetup 2025 was a big event where people in the money technology world got together. It was a place to learn about new ideas, meet other professionals, and find chances to grow businesses. Think of it as a big party for money tech!

What kind of new money tech was shown?

The event showed off the newest tools and ideas in financial technology. This included things like faster ways to pay, new ways to do online banking, and services that let businesses offer financial tools to their customers.

How did the event help businesses connect?

It was designed to help businesses meet and make deals. Over 20,000 meetings happened, helping people find partners and new customers. There was also a competition where new companies pitched their ideas to win.

Who were some of the main speakers?

Some really important people from big companies like J.P. Morgan, Ally Financial, and Stripe shared their thoughts. They talked about how to make online banking better and how new technology is helping more people around the world get access to financial services.

What was new in the lending section?

The event highlighted how lending is changing. Companies are using smart technology, like artificial intelligence (AI), and looking at more than just credit scores to decide who gets loans. This helps make lending fairer and more available.

Was there a good feeling at the event?

Yes, even with some worries about the economy, most people felt hopeful about the future of fintech. They were excited about how businesses pay each other and saw real-time payments as a big chance for growth.