So, you’re looking at investing and keep hearing about the 2-year yield? It’s one of those terms that sounds a bit technical, but honestly, it’s pretty straightforward once you break it down. Think of it as a quick snapshot of what the market thinks about short-term interest rates and the economy’s health. It’s not just for the big players; understanding this number can actually help you make smarter choices with your own money. Let’s get into what it really means and why you should pay attention.

Key Takeaways

- The 2-year yield shows the return you get from a U.S. government bond that matures in two years. It’s basically what the market expects for short-term interest rates.

- This yield moves opposite to the bond’s price: when the price goes up, the yield goes down, and vice versa. It’s all about supply and demand for these government IOUs.

- The Federal Reserve’s decisions on interest rates and what people expect inflation to do are big drivers of the 2-year yield. Economic news matters a lot here.

- Looking at the 2-year yield compared to longer-term yields (like the 10-year) helps paint a picture of the economy. If short-term yields are higher than long-term ones, it can sometimes signal trouble ahead.

- For investors, the 2-year yield is a useful tool for managing risk, especially when things get shaky in the stock market, as these bonds are seen as very safe.

Understanding the 2-Year Treasury Yield

So, what exactly is this 2-year Treasury yield everyone talks about? Simply put, it’s the annual return you can expect if you buy a U.S. Treasury note that matures in two years and hold onto it until it’s paid back. Think of it as the government paying you interest for borrowing your money for a short period. Because the U.S. government is generally considered a very reliable borrower, these notes are seen as one of the safer places to put your money. The 2-year yield is a snapshot of what the market thinks about short-term interest rates and the economy right now.

What the 2-Year Yield Represents

This yield isn’t just a number; it tells us a lot about market expectations. It reflects how investors feel about the economy’s immediate future, including potential changes in interest rates set by the Federal Reserve and how much prices might go up (inflation). It’s like a thermometer for the short-term economic outlook. When the yield is high, it often means investors expect interest rates to rise or inflation to be a bit higher in the near future. Conversely, a lower yield might suggest the opposite.

How the 2-Year Treasury Yield Is Calculated

Calculating the yield isn’t overly complicated. It’s based on two main things: the bond’s fixed interest payment, called the coupon rate, and its current price in the market. The government sets the coupon rate when it first issues the bond. But the price? That changes daily based on how much people want to buy or sell it. The yield is essentially the annual interest payment divided by the bond’s current market price. So, if a bond pays $40 a year in interest and its price is $1,000, the yield is 4%. But if that same bond’s price goes up to $1,050, the yield drops because that fixed $40 is now a smaller percentage of the higher price. It’s an inverse relationship: as the price goes up, the yield goes down, and vice versa. You can see an example of a specific Treasury note’s details, including its price and yield, on pages like this Treasury Note data.

The Relationship Between Price and Yield

This price-yield connection is pretty important to grasp. When demand for these 2-year notes increases, their price gets pushed up. As the price climbs, the fixed interest payments become a smaller portion of that higher price, which naturally lowers the yield. It’s a bit like buying something on sale – you get more for your money, and in the bond world, that translates to a lower yield. The opposite happens too; if fewer people want to buy these notes, the price will fall, and the yield will rise to make them more attractive to buyers. This dynamic is constantly at play in the market.

Factors Influencing the 2-Year Yield

So, what makes the 2-year Treasury yield move up and down? It’s not just one thing, but a mix of big economic forces. Think of it like a weather report for the economy – lots of different elements play a part.

Federal Reserve Policies and Interest Rates

The Federal Reserve, or the Fed as most people call it, has a pretty big say in where short-term rates go. Their main tool is the federal funds rate, which is basically the target rate for overnight lending between banks. When the Fed decides to hike this rate, it usually pushes up yields on short-term government debt, like the 2-year Treasury. Why? Well, borrowing money becomes more expensive across the board, so investors want a higher return on their government bonds to make it worthwhile. This often happens when the Fed thinks the economy is getting a bit too hot or inflation is climbing too fast. They’re trying to cool things down.

On the flip side, if the Fed cuts rates, it’s usually to give the economy a boost by making borrowing cheaper. This tends to pull down short-term yields. Less cost to borrow means investors don’t need as much compensation for holding those short-term government IOUs.

Inflation Expectations and Economic Data

What people think will happen with prices down the road really matters. If everyone expects inflation to go up, the purchasing power of your money shrinks faster. So, to keep you interested in buying a 2-year Treasury, the yield has to be higher to make up for that expected loss in value. It’s like needing more money today to buy the same amount of stuff tomorrow.

Conversely, if inflation is expected to stay low or even fall, yields tend to drop. People are more willing to accept a lower return because their money won’t lose as much value over time. The 2-year yield often adjusts to match these inflation outlooks.

Economic reports also play a huge role. Things like:

- Gross Domestic Product (GDP) Growth: When the economy is growing strongly, it can signal potential inflation, leading the Fed to consider rate hikes, which pushes yields up. A healthy economy generally means higher yields.

- Unemployment Rates: Low unemployment often means a strong economy, which again might prompt the Fed to raise rates to keep inflation in check, thus increasing the 2-year yield. High unemployment, however, might lead the Fed to cut rates to stimulate jobs, lowering yields.

- Consumer Spending: Strong consumer spending can indicate a robust economy, potentially leading to higher inflation expectations and, consequently, higher yields.

Geopolitical Events and Market Volatility

Big global events, like political instability in major regions or unexpected international crises, can shake up markets. When things get uncertain, investors often look for safer places to put their money. U.S. Treasury bonds, especially short-term ones, are seen as very safe. This increased demand can push bond prices up and, as we’ve seen, push yields down. It’s a bit of a flight to safety. Conversely, if global markets are stable and investors are feeling confident, they might move money out of safe havens and into riskier assets, which can reduce demand for Treasuries and cause yields to rise.

The 2-Year Yield in the Broader Market

So, the 2-year Treasury yield isn’t just some number floating around; it actually tells us a lot about what people think is going to happen with the economy and interest rates in the near future. It’s like a snapshot of the market’s short-term expectations.

Comparing Yields Across Maturities

When we talk about the "yield curve," we’re basically looking at the yields of Treasury bonds with different lengths of time until they mature. The 2-year yield is a key part of this picture. Usually, longer-term bonds pay more interest (have higher yields) than shorter-term ones. This makes sense because you’re tying up your money for longer, and there’s more uncertainty over that period. Think of it like this:

- Normal Yield Curve: Short-term yields are lower than long-term yields. This usually means people expect the economy to grow steadily.

- Flat Yield Curve: Short-term and long-term yields are pretty much the same. This can happen when the economy is transitioning, and there’s some uncertainty about what’s next.

- Inverted Yield Curve: Short-term yields are higher than long-term yields. This is often seen as a warning sign that people expect the economy to slow down, maybe even head into a recession.

Interpreting the Yield Curve

The shape of the yield curve, with the 2-year yield playing a big role, gives us clues. While the 10-year yield might reflect longer-term economic outlooks, the 2-year yield is more sensitive to what the Federal Reserve might do with interest rates soon. If the Fed is expected to raise rates, the 2-year yield will likely go up. If they’re expected to cut rates, it’ll probably go down. It’s a good way to see what the market thinks about immediate monetary policy.

The 2-Year Yield as an Economic Barometer

Because it’s so tied to short-term interest rate expectations and the Fed’s actions, the 2-year yield is a pretty good indicator of the economy’s immediate health. When the 2-year yield is climbing, it often means the market anticipates stronger economic growth and potentially higher inflation, which could lead to interest rate hikes. On the flip side, a falling 2-year yield might suggest worries about economic slowdown or lower inflation. It’s one of the first places many investors look to get a feel for the economic winds. For those looking to analyze market trends, tools like those offered by HelpTheCrowd can provide valuable data.

Investor Strategies and the 2-Year Yield

So, how do folks actually use the 2-year Treasury yield in their investment plans? It’s not just some number floating around; it actually tells us a lot about what the market thinks is coming up.

Risk Management and Diversification

When things get a bit shaky in the stock market, a lot of people look to Treasury notes, and the 2-year is a popular choice. Since they’re backed by the U.S. government, they’re seen as super safe. If you’re worried about your other investments taking a hit, putting some money into 2-year Treasuries can be a way to keep your overall portfolio steadier. It’s like having a safety net.

Fixed-Income Investment Approaches

For those focused on bonds, the 2-year yield is a big deal. If interest rates are expected to go up, buying shorter-term bonds like the 2-year note makes sense. Why? Because when it matures, you can reinvest that money at the new, higher rates. It’s a way to adapt to a changing rate environment. For example, looking at data from late 2024, yields were around 4.30%, which gave investors a decent return for a short commitment. If rates were expected to drop, you might lock in a longer-term bond to secure that rate for longer. It really depends on what the market’s predicting.

Utilizing Yield Spreads for Opportunities

This is where it gets a bit more interesting. Investors often look at the difference, or spread, between yields on Treasuries of different lengths. Comparing the 2-year yield to, say, the 10-year yield can tell you a lot about economic expectations. If the spread is widening, meaning the 10-year yield is much higher than the 2-year, it often suggests people are feeling good about the economy’s long-term prospects. But if that spread narrows, or even flips (the 2-year yield is higher than the 10-year), that’s often seen as a warning sign for a potential economic slowdown. It’s a way to read the market’s mind, in a way. You can track these differences to spot potential shifts and adjust your strategy accordingly. For instance, understanding the relationship between different maturities is key when considering fixed income strategies.

Historical Performance and Trends

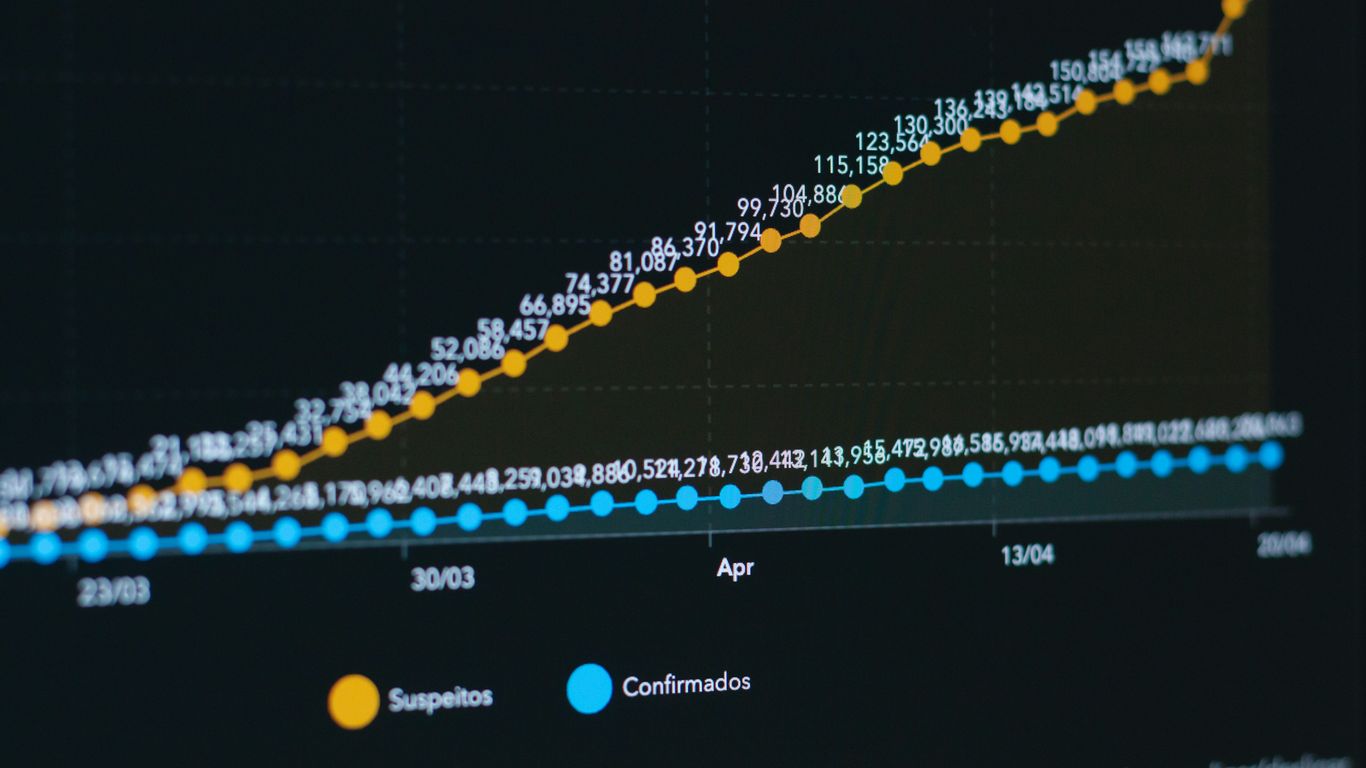

The 2-year Treasury yield hasn’t exactly been a straight line; it’s more like a rollercoaster ride reflecting economic ups and downs. Looking back, we’ve seen some pretty wild swings. Back in the early 1980s, for instance, the yield was sky-high, topping 15%. This happened because the Federal Reserve was really pushing interest rates up to get a handle on double-digit inflation. Fast forward to after the 2008 financial crisis, and things were the opposite. The Fed dropped rates to almost nothing, using things like quantitative easing to try and get the economy moving again. This brought the 2-year yield way down.

More recently, the COVID-19 pandemic sent yields to historic lows, dipping to around 0.10% in 2020. But as the economy started to bounce back and inflation became a concern, those yields began to climb again. It really shows how sensitive this yield is to what’s happening both here and around the world.

Key Historical Yield Movements

- Early 1980s: Yields exceeded 15% due to aggressive Fed rate hikes to combat high inflation.

- Post-2008 Financial Crisis: Yields dropped to near-zero as the Fed implemented stimulus measures.

- 2020 (COVID-19 Pandemic): Yields hit historic lows around 0.10%.

- Late 2024: Yields hovered around 4.30%, influenced by inflation and Fed policy.

Impact of Economic Cycles and Crises

Economic cycles and major events have a big impact on where the 2-year yield lands. During periods of strong economic growth and rising inflation, you’ll typically see yields go up. This is because investors expect the Fed to raise interest rates to cool things down. Conversely, during recessions or times of financial stress, like the 2008 crisis or the pandemic, yields tend to fall. Investors often move their money into safer assets like Treasury bonds, pushing prices up and yields down. This flight to safety is a common reaction when markets get shaky. For example, global tensions can cause a similar effect, making U.S. Treasury securities more attractive. It’s a bit like people wanting to hold onto their cash when they’re not sure what’s coming next.

Recent Trends and Future Forecasts

As of late 2024, the 2-year Treasury yield has been trading around the 4.30% mark. This level reflects a mix of ongoing inflation concerns and the Federal Reserve’s efforts to manage interest rates. Strong job numbers and steady consumer spending have helped keep yields up. However, there’s still a lot of uncertainty about global financial conditions and what the Fed might do next, which keeps things moving.

Looking ahead, forecasts for the 2-year yield are a bit mixed. Some market watchers think yields might settle down as inflation hopefully cools off. Others believe the Fed might keep rates higher for longer if inflation proves stubborn. What happens with the U.S. economy and the broader global financial picture will really shape where this yield goes in the coming months. It’s a dynamic situation, and keeping an eye on economic data is key. For those interested in the latest developments in aerospace, you might find Virgin Galactic’s new spaceship unveiling interesting space tourism ambitions.

Here’s a look at how yields have behaved in different economic environments:

| Economic Condition | Typical 2-Year Yield Trend |

|---|---|

| High Inflation / Growth | Increasing |

| Recession / Uncertainty | Decreasing |

| Stable Economy / Moderate | Stable or Slightly Rising |

Economic Implications of Yield Changes

Changes in the 2-year Treasury yield ripple through the economy in a few key ways. It’s not just numbers on a screen; it affects how much things cost and how people spend their money.

Impact on Borrowing Costs

When the 2-year yield goes up, borrowing money generally gets more expensive. Think about it: if the government has to pay more to borrow for two years, other lenders will likely follow suit. This means interest rates on things like car loans, credit cards, and even adjustable-rate mortgages can climb. For families, this can mean less money left over each month after paying interest, which might lead them to cut back on spending. Businesses also feel the pinch. Higher borrowing costs can make them think twice about taking out loans for new equipment or expanding their operations. This slowdown in spending and investment is a major consequence of rising short-term yields.

Government Debt Management

The government itself is a big borrower, and the 2-year yield directly impacts how much it costs to manage the national debt. When yields are higher, the government has to pay more interest on newly issued Treasury bills and notes. This can put a strain on the federal budget, potentially meaning less money for other programs or services. Conversely, when yields are lower, the government saves money on interest payments, which can give it more flexibility in its spending and fiscal planning.

Consumer Spending and Investment

Consumer behavior is closely tied to these yield movements. If people expect interest rates to stay low or even fall, they might feel more confident spending and investing. They might take out that car loan or invest in the stock market. However, if the 2-year yield is climbing, signaling potentially higher rates ahead, consumers might become more cautious. They might save more and spend less, waiting to see what happens. This shift in consumer sentiment can have a noticeable effect on overall economic activity. Businesses watch consumer spending closely, and if it slows down, they might also pull back on their own investments and hiring plans.

Tracking and Analyzing the 2-Year Yield

So, you want to keep tabs on the 2-year Treasury yield? It’s not as complicated as it might sound, and honestly, it’s pretty important for understanding where the economy might be headed. Think of it like checking the weather forecast, but for your money.

Essential Tools and Resources

There are a bunch of places you can go to see what the 2-year yield is doing. Websites like CNBC or MarketWatch are good for quick, up-to-the-minute numbers. If you want to dig a bit deeper and see historical data, the Federal Reserve Economic Data (FRED) website is a goldmine. You can find all sorts of charts and historical records there. It’s a great way to see how the yield has moved over time. For direct purchases, TreasuryDirect is the official government site.

Interpreting Data and Charts

When you look at the numbers, pay attention to a few things. Obviously, the current yield is key. But also look at how much it’s changed recently and how it stacks up against yields for other Treasury maturities, like the 10-year or 30-year. This comparison helps you understand the shape of the yield curve, which can tell you a lot about what investors expect for the economy. For example, if short-term yields are higher than long-term ones, that’s often seen as a sign that people are worried about a slowdown. It’s all about putting the pieces together.

Educational Platforms for Investors

If you’re new to this, don’t worry. There are plenty of resources out there to help you get up to speed. Websites like Investopedia offer clear explanations of financial terms and concepts. Understanding these basics can really help you make better investment choices. It’s like learning the rules of a game before you play. You can also find interactive tools that let you play around with different scenarios, which is a pretty neat way to learn. For instance, seeing how product tagging in videos works can be a useful analogy for understanding how different financial data points connect, as seen with platforms like Smartzer.

Here’s a quick look at how yields can compare:

| Maturity | Example Yield (Late 2024) |

|---|---|

| 2-Year Treasury | ~4.30% |

| 10-Year Treasury | ~4.00% |

| 30-Year Treasury | ~4.20% |

Remember, these numbers change daily, so always check the latest figures.

Wrapping It Up

So, we’ve looked at what the 2-year Treasury yield is all about and why it matters for folks investing their money. It’s not just some number that pops up on a screen; it actually tells us a lot about what people think might happen with interest rates and the economy down the road. Keeping an eye on it, and how it compares to other yields, can give you a better sense of where things might be headed. Whether you’re just starting out or have been investing for a while, understanding this yield is a good step toward making more informed choices for your own financial journey.

Frequently Asked Questions

What exactly is the 2-year Treasury yield?

Think of the 2-year Treasury yield as the yearly profit you get from lending money to the U.S. government for two years. It’s like a promise from the government to pay you back with interest. This yield tells you how much you’re earning based on the current price of that government loan.

How is the 2-year yield figured out?

It’s calculated based on the interest rate the government promises to pay (called the coupon rate) and the price the bond is selling for in the market. If more people want to buy these bonds, the price goes up, and the yield goes down. If fewer people want them, the price drops, and the yield goes up. It’s a bit like a seesaw.

Why should investors care about the 2-year yield?

This yield is a big clue about what investors think will happen with the economy and interest rates in the near future. It helps people decide where to put their money, especially when it comes to safer investments like government bonds.

How does the 2-year yield compare to longer-term bonds?

Usually, lending money for a longer time means you expect a higher profit. So, the 2-year yield is typically lower than, say, the 10-year yield. But if the 2-year yield becomes higher than the 10-year yield, it can be a sign that people are worried about the economy slowing down.

What makes the 2-year yield change?

Several things can move this yield. The Federal Reserve’s decisions on interest rates are a major factor. Also, how much people expect prices to go up (inflation) and big world events can cause it to shift.

Can I invest in these 2-year Treasury bonds?

Yes, you can! You can buy them directly from the U.S. Treasury through a website called TreasuryDirect, or you can buy them through a bank or a brokerage account. You can either hold onto them until they mature or sell them to someone else before that.